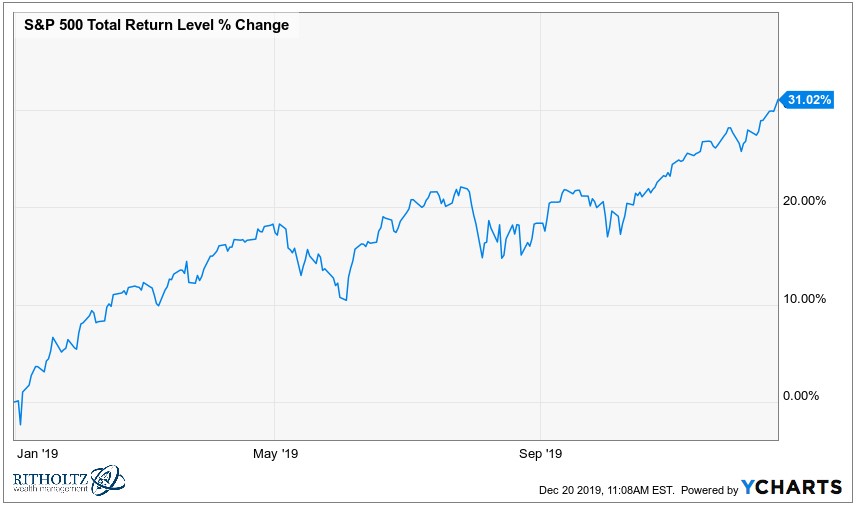

The S&P 500 is now up more than 30% this year:

There are still a couple of weeks to go in the year, but barring a catastrophe, the stock market will finish 2019 with double-digit gains for the 8th time out of the last 11 years. The question inquiring market minds would like to know is this: what does 2019’s big gain mean for the market in 2020?

The easy answer is nothing but we can still look back at history to see how often big gains are followed up by even more big gains (or losses).

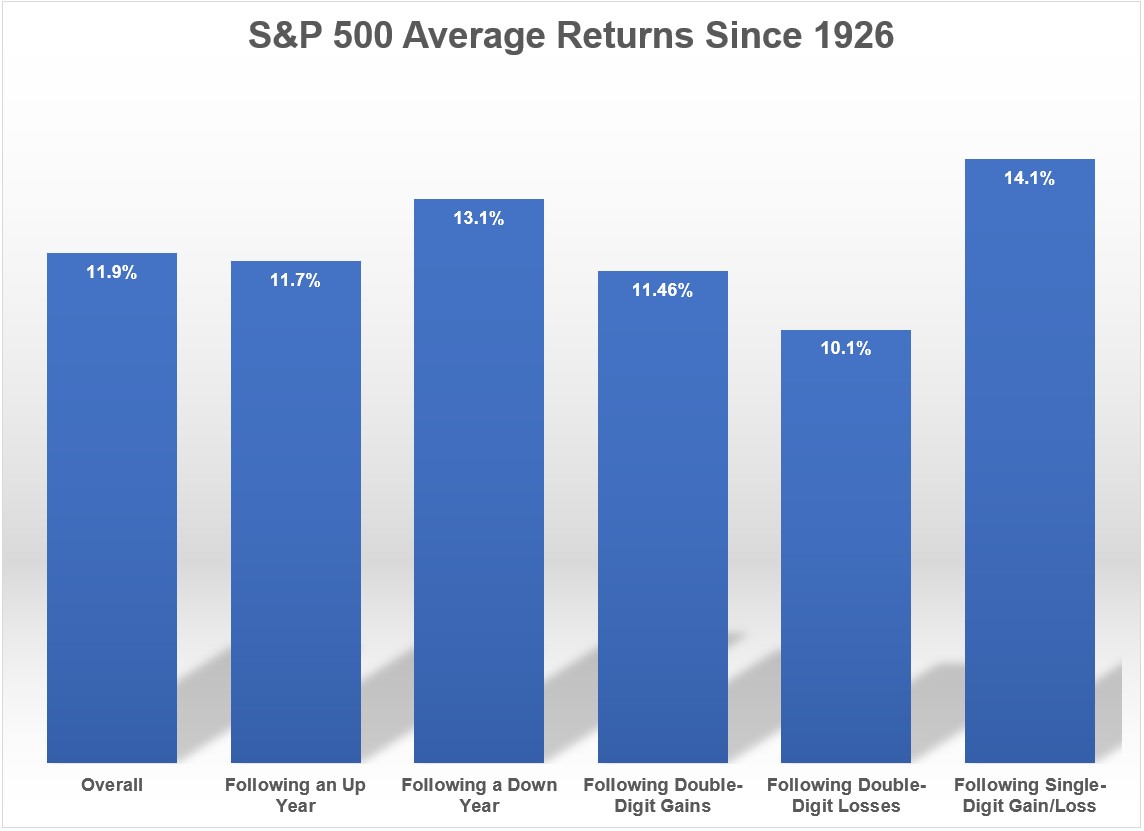

Since 1926, U.S. stocks have been up double-digits 54 times (not including 2019). The average return in the year following a double-digit gain was 11.5%.1 The year following those double-digit gains saw positive returns 39 times (72% of the time) and negative returns 15 times (28% of the time).

Of those 54 times stocks showed a double-digit gain in the prior year, 29 times they were up double-digits again the next year. So more than half the time stocks are up double-digits in one year, they’ve been up double-digits again the next year. There have been only three years on record where stocks were down double-digits in the year following a double-digit gain (1936 -35%, 1965 -10% and 1972 -15%).

I also went through the average returns following a number of other scenarios and noticed the results were fairly similar no matter what happened the year before:

The stock market has generally gone up over time so the average returns following almost any type of market environment have been positive, on average. This doesn’t mean stocks are guaranteed to go up every year but historically, roughly 3 out of every 4 years have seen gains going back 95 years or so.

So what’s going to happen next year?

I have no idea but historical odds have shown stocks are either up double-digits or down double-digits 70% of the time. That’s pretty decent odds.

Michael and I discussed what double-digit returns mean for the market on Animal Spirits this week. I also get relatively animated (for me) about how worthless year-end price targets, we discuss knowing what you don’t know and how wealth managers are impacting market valuations:

Subscribe to the Animal Spirits playlist to watch more of our videos every week.

Further Reading:

The Danger of One Year Performance Numbers

Now here’s what I’ve been reading this week:

- Using algorithms and Instagram to eat for free in NYC (Chris Buetti)

- The man who saved New York City (Big Picture)

- Climbing the wealth ladder (Dollars and Data)

- The joy of having kids (Paul Graham)

- The ultimate 2020 market playbook (Bps and Pieces)

- Intangible returns (Prag Cap)

1For all of you median people, that number was also 11.5%.