On this week’s Animal Spirits we discussed dividend yields in various stock markets around the globe and how they provide a silver lining during a stock sell-off:

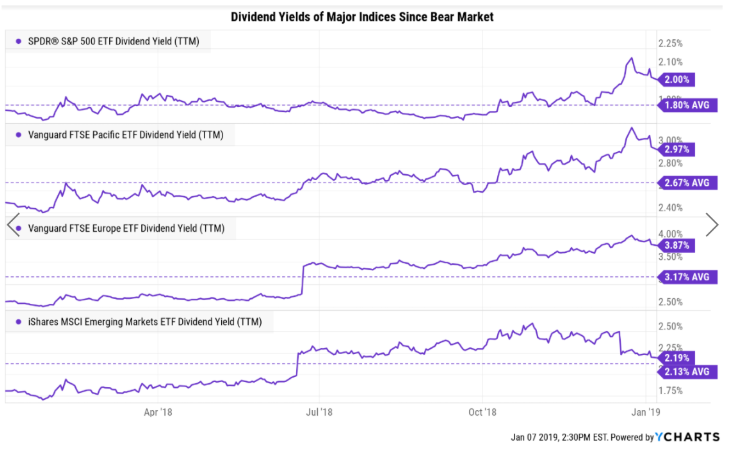

Here’s the chart we referred to on the show:

Stocks have popped around 10% or so since the massacre on Christmas Eve but this is a nice illustration of the upside involved in bear markets. When prices fall, yields go up.

That means any new money you’re putting to work in the stock market is being invested at higher yields than you would have received earlier this year. The same principle applies when you rebalance your portfolio into some of the recent pain.

It may not feel like it but this is actually a good thing for most investors.

When all of the short-term market talk centers on individual stocks and daily moves it’s easy to overlook simple things like cash flows through dividend payments. And while dividend yields are lower in the U.S. than they were in the past1, the growth in dividends over time is an underappreciated force in long-term compounding.

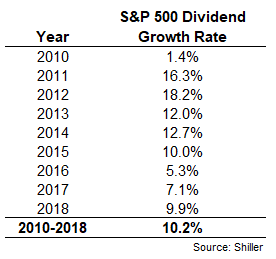

Take a look at the annual growth rate in dividends on the S&P 500 every year going back to 2010:

So while the S&P 500 was down more than 4% in 2018, dividends were actually up almost 10%. And dividends have more or less tracked the stock market’s growth in this time as well. The S&P 500 is up 11.6% annually on a total return basis from 2010 to 2018, not much higher than the 10.2% annual growth rate in dividends.

In a world awash in low-yielding fixed income assets, this is a phenomenal growth rate in income for investors looking for yield. It can’t stay this high forever, but dividend growth has outpaced the rate of inflation historically.

Obviously, dividend payments are not the same thing as interest payments on bonds and dividends certainly can, and likely will, fall during a recession. But where else could you possibly find 10% annual growth on your income payments like this?

Sometimes people forget that putting money into the stock market gives you an ownership stake in actual businesses that produce regular cash flow which they pay out to their investors.

When stocks go down, yields tend to go up. But even when stocks go up, dividends are rising right along with them.

Further Reading:

Stock Market Yields Are Higher Than You Think

Now here’s what I’ve been reading lately:

- Maybe millennials will be the wealthiest generation (Quartz)

- New 2019 retirement account limits (Belle Curve)

- The price of greed (Dollars & Data)

- More information can lead to worse decisions (Behavioural Investor)

- Probabilities and contingencies, not certainties (Reformed Broker)

- Some cool lessons from 2018 (David Perrell)

- History is the study of unintended consequences (Abnormal Returns)

- The importance of financial planning when adversity strikes (All About Your Benjamins)

- The wrong debate about your investments (Irrelevant Investor)

1I’m ignoring share buybacks here which are a huge reason for lower dividend yields in the U.S. More on this in an upcoming post…