Robinhood announced last week they were rolling out checking and savings accounts with no fees that pay 3% interest.

A day after the announcement almost six-hundred thousand people signed up for the program on their waitlist.

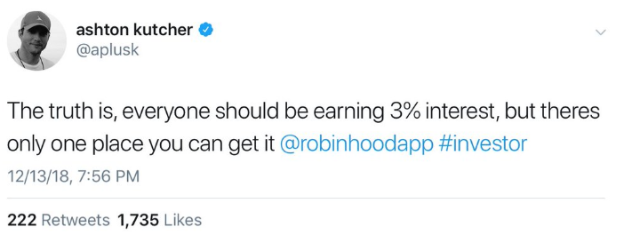

Ashton Kutcher, an #investor in the company, had this to say:

(update: this tweet was later deleted)

Robinhood backtracked on their promises after finding out it’s difficult to offer banking services when you’re not an actual bank but there’s obviously some pent-up demand for yield.

One place you’re not going to find yield is at a big brick and mortar bank. According to Bankrate.com, the average savings and checking account interest rates are just 0.10% and 0.08%, respectively across the nation. Banks would like to earn a spread on their money by loaning it out at higher rates and paying it out at lower rates but these levels are ridiculous in comparison with what you can get elsewhere.

Most online banks will pay at least 2% on your savings these days. Marcus currently pays 2.05% with no fees or minimums. Ally offers 2% interest. If you have a savings account at a big name bank, making the change to an online bank is a no-brainer. It’s simple. It’s convenient. And you don’t have to walk into a branch to open an account.

Credit unions are another option. They don’t have to answer to shareholders because they’re not public companies so they’re able to offer higher yields to their customers. The local credit union I use offers 3% max checking on the first $15k.

CD rates have also been on the rise over the past couple of years back to respectable levels. CDs ranging from one to two years are paying anywhere from 2.7% to 2.9%. Minimums do apply in some cases but these are a far cry from the 0.5% rates from a few years ago.

Money market funds at fund firms are another place to look for yield. Vanguard has products with yields ranging from 2.2% to 2.4% (these funds do charge fees though).

You could also look at short-duration bond ETFs. The iShares 1-3 Month T-Bill ETF (BIL) currently yields around 2.1%. The 1-3 Year Treasury ETF (SHY) is yielding 2.6% but that one comes with some minor duration risk (currently around 1.8 years, meaning a 1% move in interest rates would cause an inverse move of roughly 1.8% in the price of the fund).

Short-term Muni ETFs have the added bonus of offering tax efficiency. The two largest funds in terms of assets are SHM and SUB. SHM currently yields around 1.8% but using a 25% tax federal bracket, that would be a tax-equivalent yield of around 2.4%. SUB yields closer to 2% for a tax-equivalent yield of almost 2.7%.

Unless you have an enormous portfolio, these yields still aren’t at levels where you can throw all your money in and live off the interest.

But I would expect these yields to continue to rise in light of the Fed’s decision this week to raise short-term rates for the ninth time since 2015. It can take some time but eventually, these types of products are the beneficiaries of rate hikes.

Savers of the world rejoice — the Fed is no longer punishing you (unless you’re currently invested in the stock market).

If you have money that’s meant for three years or so in duration or under, there’s no reason you shouldn’t be earning at least 2% or so on your savings.

Listen to more thoughts about Robinhood on this week’s Animal Spirits:

Everyone Should Earn 3%

Now here’s what I’ve been reading lately:

- 3 reasons you’re never satisfied (Reformed Broker)

- Fear not (Above the Market)

- My dad’s friendship with Charles Barkley (Only a Game)

- Julian Robertson and the crash of 1987 (Insecurity Analysis)

- Investing lessons from Bill Browder (Enterprising Investor)

- Where we’re going (Irrelevant Investor)

- “This world is pretty much designed to convince us that we’re always at DEFCON 1” (AQR)