A podcast listener asked Michael and I the following:

Wanted to get your thoughts on the concept of stocks for the long run and why the investing world all generally agrees that over long time periods stocks will be up big. Why do stocks generally go up over time and why can we expect them to continue to increase in value over time?

We discuss this question briefly in this week’s episode (which will be available on Wednesday) but I wanted to flesh this one out a little more.

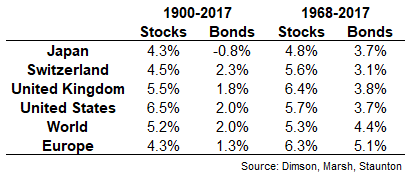

I’m not sure I agree with the assertion that the entire investing world agrees stocks will be up big over long time periods because of the pervasive negativity that has entered the minds of many investors since the financial crisis. But here is the long-term track record of stocks around the globe courtesy of Elroy Dimson, Paul Marsh and Mike Staunton in the Credit Suisse Global Investment Returns Yearbook 2018:

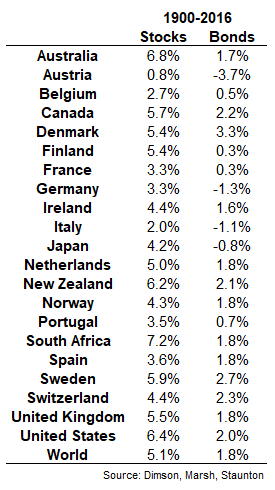

These returns are real or net of inflation. They didn’t break things down by other countries this year but they did in last year’s edition:

The real returns vary across different countries based on a number of factors — war, political structure, diversity of the economy, corruption, etc. — but the overarching theme here is a premium in performance for stocks over bonds. These types of very long-term numbers are likely the ones that investors hold onto when assigning high expected returns to stocks.

Although these returns show why investors would assume stocks will offer the highest expected return of the main asset classes (stocks, bonds and cash), this says nothing about why stocks should offer a risk premium over time.

There are two explanations in my mind as to why stocks should offer higher expected returns — one is structural and one is risk-based.

The structural idea is that stocks offer a piece of ownership in corporations. They represent earnings power, dividends, technological progress, innovation, and the human drive to improve. In a lot of ways, it’s kind of insane that something like the stock market even exists in this capacity, allowing anyone with a brokerage account the chance to buy an ownership stake in the global economy.

The other piece is the fact that stocks are the low man on the totem pole when it comes to the capital structure. Stocks are more or less a promise for an extremely unknown future stream of earnings. Bonds, on the other hand, are simply a loan. This means their upside as a security are limited to the interest payments and principal repayment at maturity. Stocks and bonds could both go to zero for any number of reasons but stocks have a much higher ceiling than bonds.

This structural distinction is important to remember when trying to understand asset classes but the ‘risk’ in risk premium is the real key here.

Risk and return are attached at the hip when it comes to investing. Risk does not guarantee that you’ll see a decent return on your capital but it is a prerequisite that you must bear risk in one form or another to earn returns.

For stocks the biggest risk is that they can go down…a lot.

Stocks lost around 85% of their value during the Great Depression. During the 1973-74 bear market, investors in stocks lost well over half their money after accounting for inflation. The 1987 Black Monday crash saw stocks fall more than 20% in a single day and more than 30% in less than a week. In Japan, the stock market has gone nowhere since 1989. More recently, investors are well aware of the two times stocks have been cut in half since the turn of the century. Bonds have outperformed stocks over multi-decade periods in the past.

Each of these events likely led millions of investors around the globe to shun stocks altogether. They simply couldn’t stand to bear the risk anymore.

There are no guarantees that stocks will be up big over the long run for the simple fact that everyone has a different definition of what the long run means to them. There will be times when stocks will offer investors a phenomenal value and times when stocks will have much lower expected returns.

The long-term track record of the world stock market is not perfect but it is quite compelling. However, long-term average returns are promised to no one because we don’t know what the future holds. In many ways, investing in the stock market is a faith-based exercise; faith in human ingenuity; faith in the capitalist system; and faith in other people wanting to improve their lot in life.

Not everyone has enough faith in the system to take the risks involved when it comes to investing in the stock market. But for those who do take a leap of faith and understand the inherent riskiness of stocks, I do believe they will continue to offer investors higher expected returns.

But it will require some combination of patience, discipline and intestinal fortitude to give yourself a chance to earn them.