It’s easy to forget about bonds when the stock market is doing so well. It’s even easier to forget about bonds with all of the talk about the “end of the bond bull market” which is the latest topic du jour in financial circles. Here are a few reminders for investors looking to abandon bonds in their portfolios.

*******

DoubleLine Capital’s Jeffrey Gundlach recently warned of the possibility of an end to the bond bull market that has been going strong since the early 1980s:

Eventually that day will come and investors will experience a rising rate environment. In fact, we technically may be in one already, as the 10-year Treasury yield sunk below 1.4 percent in July 2016. Since the summer of 2016, rates on the 10-year are now about 100 basis points higher.

The combination of rising yields coming off a low base has made owning bonds during a stock bull market feel like a sucker’s bet. The Bloomberg Barclays U.S. Aggregate Bond Index is up just 3.9 percent a year from the start of 2009 through the end of October. This pales in comparison to the 15 percent annual return on the S&P 500 in that time. On a total return basis, bonds are up just 44 percent; stocks have returned almost 250 percent in that time.

Long-term bond returns will be muted compared with current interest rate levels, while volatility in the fixed-income markets will likely be higher because lower rates provide less of a cushion to shield investors from price fluctuations. Although the current situation will require bond investors to lower their expectations from returns seen during the last 40 years or so, bonds can still prove to be a useful portfolio tool for a number of reasons.

Diversification benefits. Stocks tend to perform poorly in a deflationary environment as economic conditions hurt earnings growth. Bonds perform well in this type of market, and give investors the potential for preservation of capital, relative stability and low correlation to equities.1 From 1928 to 2016, 10-year Treasuries have outperformed stocks in 33 out of 89 years, or close to 40 percent of the time. Stocks have earned higher returns in that period2 but bonds have given investors a much smoother ride with lower volatility.3

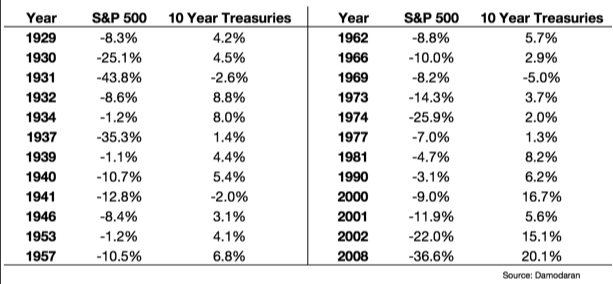

Hedge stock market risk. While stocks still have a huge edge in terms of long-term returns, bonds earn their keep by providing a shock absorber when stocks fall. This table shows every down year since 1928 on the S&P 500 in this time along with the corresponding returns for 10-year Treasuries:

Stocks experienced a down year roughly once every four years during this period. Bonds had positive returns 21 out of 24 times. This means that over the past 90 years or so, stocks and bonds have only fallen during the same calendar year on three separate occasions.4 Bonds also provide a premium during stock market sell-offs as the average loss in stocks during these years was around 14 percent while 10-year Treasuries gained an average of more than 5 percent.

Emotional hedge. Finally, bonds offer investors something of an emotional hedge against poor behavior when stocks act up. Very few investors have the intestinal fortitude to keep their entire portfolio invested in stocks at all times. Bonds may not earn the high returns they’ve seen since interest rates were in double digits in the early-1980s, and it’s possible they could lose some value during a stock bull market, but the hope is that paper will provide investors an anchor to stop them from making a poor decision at the wrong time.

In this respect, bonds can as a source of funds for either rebalancing into stocks at lower levels or for spending purposes for cash-flow needs. But they also give risk-averse investors the stability they crave to balance out the craziness of the moves in the stock market.

Investing in bonds is not easy. Investors still have to figure out the duration, maturity profile and credit quality of their fixed-income holdings. And bonds are not without risk — investors still have to worry about inflation over the long haul as people are living longer. We will likely see more volatility in fixed income in the future than investors have been used to. But bonds can still serve a purpose in a diversified portfolio of assets, as long as investors have the right expectations going in.

Originally published on Bloomberg View in 2017. Reprinted with permission. The opinions expressed are those of the author.

1 The correlation of S&P 500 to 10-year Treasuries over the past 89 years was -0.03, meaning almost no relationship between the two asset class returns.

2 9.5 percent for stocks and 4.9 percent for bonds.

3 Volatility from 1928-2016 was 19.7 percent for stocks and 7.8 percent for bonds.

4 1931, 1941 and 1969, meaning it hasn’t happened in almost 50 years.