Nearly four out of five working households have retirement savings of less than one times their annual income. For those who carry a balance on their credit card, the average amount owed is over $15,000. Forty-seven percent of people would have a hard time coming up with $400 in the case of an emergency.

The problem with these types of statistics is that they don’t tell you anything about the actual people enduring these financial struggles. Tim Maurer has a very simple quote that speaks volumes on this when he says that, “Personal finance is more personal than finance.”

There are so many factors that affect a person or family’s finances — where you live, what career path you take, how much financial support you receive from family, how your family and friends view money, good luck, bad luck, how much money you make, poor choices, hard work, student loans, healthcare spending, a lack of education or understanding about how to run your own finances, what your lifestyle inflation looks like, what your personal relationship is with money and the list could go on and on.

I was reminded of how personal this finance thing can be by two stories I read this week on the subject.

The first was a piece in The Atlantic written by Neal Gabler. Gabler is a successful author who has written critically acclaimed, award-winning books. He’s been a writer for TV shows. He’s owned homes in Brooklyn and the Hamptons. He’s also, for all intents and purposes, broke:

In my house, we have learned to live a no-frills existence. We halved our mortgage payments through a loan-modification program. We drive a 1997 Toyota Avalon with 160,000 miles that I got from my father when he died. We haven’t taken a vacation in 10 years. We have no credit cards, only a debit card. We have no retirement savings, because we emptied a small 401(k) to pay for our younger daughter’s wedding. We eat out maybe once every two or three months. Though I was a film critic for many years, I seldom go to the movies now. We shop sales. We forgo house and car repairs until they are absolutely necessary. We count pennies.

It wasn’t a single poor decision that caused his financial issues. Gabler overextended himself on his real estate purchases and credit card debt. His wife stopped working once they had kids. He sent his children to private school and some of the top universities in the country. He also failed to communicate the family’s financial issues with his wife as the problems piled up.

Each of those decisions probably seemed very reasonable at the time. Just like compound interest slowly builds upon itself over time until it becomes an unstoppable force, so too does the debt cycle, but leverage works against you.

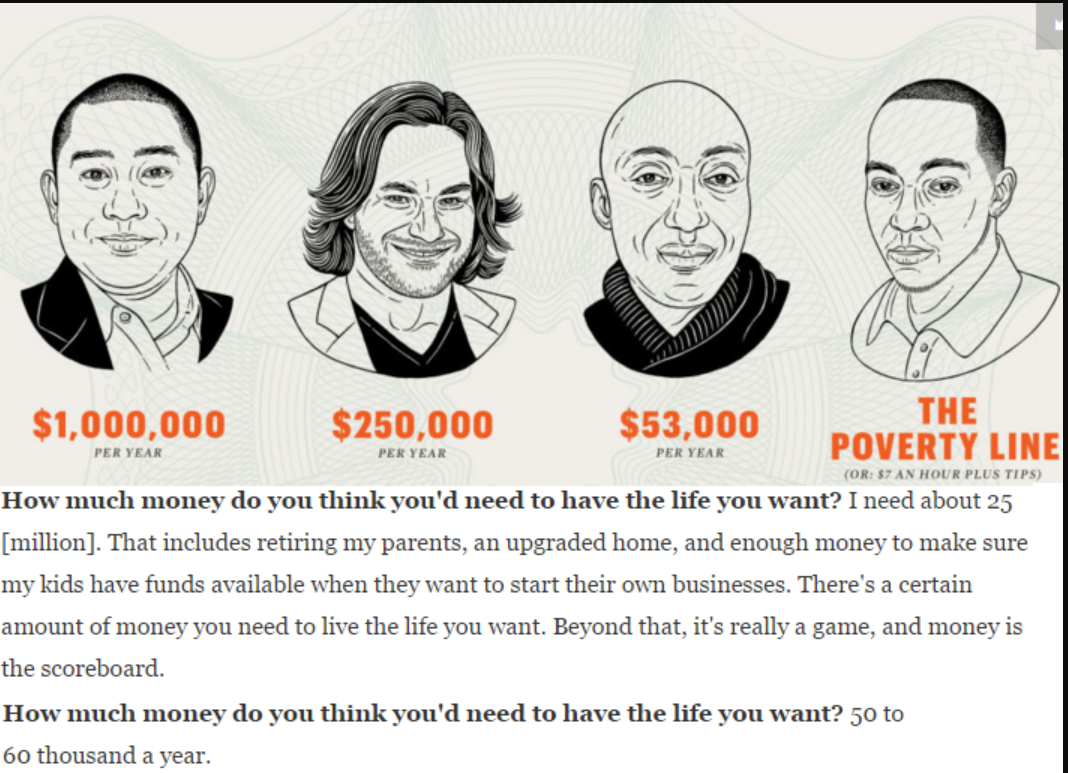

The second story was in this month’s money issue of Esquire. They detailed the financial lives of four men at different levels on the income scale. Each was asked the same questions about how much money they have, what their budgets look like, how happy they are, what they can afford and so forth. It was fascinating to see the different responses. The following one stood out to me (the first response is from the highest earning gentleman on the left and the second comes from the gentleman on the right making the least):

Reading through these kinds of stories is a great way to humanize the problems people face with their finances. Everyone worries about their finances, but those worries change depending on your standing and how much money you have.

Just like there’s not a single problem that causes people’s financial troubles, there’s not a single solution that’s going to solve all of their troubles either. It’s easy to judge others, but also easy to see how things can get out of control for some people. Some experts think you need to be a minimalist who eschews the consumer lifestyle. Others think you should focus on making more money and spending it however you like. Some call for more personal responsibility while others want the government to step in to make saving mandatory or expand the safety net.

I don’t have all the answers, but here are a few takeaways from these articles:

Talk about money. Gabler’s piece in the Atlantic was brutally honest, and I applaud him for laying it all out there like he did, but that level of transparency much earlier in life could have helped. He kept their financial troubles from his wife:

With my antediluvian masculine pride at stake, I told her that I could provide for us without her help—another instance of hiding my financial impotence, even from my wife. I kept the books. I kept her in the dark.

People don’t mind talking about the problems with politicians, sport figures or celebrities, but we seem to have a hard time talking about out own financial struggles. One study showed that couples would rather talk about sex or infidelity than how to handle the family’s finances or how much money they earn.

Pay attention to your money habits. People assume they know what they spend their money on, but one study showed that 70% of people have never balanced their checkbook. Another showed that people underestimate the amount of credit card debt they owe by a third. The best way to figure out what’s important to you is to check your credit card bill and checking account statement every month. Budgeting is a four letter word for many, but just having an understanding about where your money is going and how it’s being spent can be eye-opening.

Have a plan, even if it’s a bad one. This stuff isn’t easy, but it’s impossible if you don’t sit down and draw up a plan about where you are and where you’d like to be to figure out how to get there with your finances. Getting started is half the battle.

Both pieces are worth a read:

The Secret Shame of Middle-Class Americans (The Atlantic)

4 Men with 4 Very Different Incomes Open Up About the Lives They Can Afford (Esquire)

Further Reading:

How to Teach Your Children About Money

Great article. I feel lucky that I’ve never had a problem discussing my ineptitude when it comes to making money. The fact I can discuss it also means I spend time trying to maximize the money I do have and look for ways to do that. Finding you and Morgan Housel has helped immensely. I try to share what I’ve learned with others. Some aren’t interested but I wish someone had helped me when I was younger with things like this.

Thanks. I do think certain people are just never exposed to the right people or information on this stuff.

I hear a lot about this and have seen my older sister fall into those same problems. When she graduated she was making 60k. In 2006 when I graduated I started making 30k. I worked hard from 7 to 7 many days and often skipped lunch. I saved 10% in a 401k and 8% in a cash account w. scottrade. When the financial panic came along I saw my investments drop from 30k to 12k. Everyone in my office was running around like the dollar wasn’t going to be worth toilet paper and people were getting laid off all around me. I rationalized, if the dollar is worthless then I can do one of two things with the extra I had each month, “at this time I was now making 45K”. I could spend it drinking and eating out or I could throw it at the market. In 2008 I decided to start eating peanut butter and jelly sandwiches, I cancelled cable, and cut my expenditures to the bone. The rest of the money I bought safe stocks with little debt that were still turning out some net income. In 2009 at the end of the Obama stimulus I bought a 1000 sqr foot home in a nice area on a short sale for 120k. I now have more investments than my own father and I’ve upgraded my home which is estimated to be worth 300k by buying another fixer upper and so not taking out anymore debt.

Honesty, sacrifice and common sense compound as you say as does bad decision making. I think most people think there is a magic recipe to build wealth but I don’t believe there is. Yes there is some luck but that isn’t the biggest determinant of how well people do in life. I tell my family all the time, buy blue chip stocks. Big companies, little debt and reliable profits. For me it is that simple. It may not make you a millionaire over night but it will give you piece of mind. They always nod there head in agreement and 10years later they still haven’t invested a dime and are racking up debt, buying cars for 30k and living beyond there means. It makes me conclude that you either get it or you don’t and it cannot be taught.

definitely tough to teach, which is why the most important thing for most people is to automate as much as they can. making good, big decisions ahead of time can make a huge difference.

Agree with you. Or even better, S&P 500 Dividend Aristocrats. Same idea – don’t over complicate.

Joshua, if this country had more people with similar philosophies, we’d be in much better shape. Sadly, as you know, we don’t. Incidentally, there are a couple of books about accumulating wealth that you might be interested in. They’re at least 12-15 years old, but the rationale is much the same. One is about getting rich slowly, much as you’re now doing. The other is entitled The Millionaire Next Door. Also, if you’re interested, there’s a book by Graham and Dodd relating to the principles of investing. It’s been around for a good while, one that I studied (somewhat) when I was in college several decades ago at The Univ. of Texas @ Austin.

Thank you for sharing Neal’s piece and the overall issue many breadwinners have of discussing earnings and family lifestyle decisions. I feel every person spends money for different reasons but many spouses simply don’t focus on how their lifestyle is effected by their earning power.

yup, communication on this stuff is key

Excellent work! A “must read” for everyone who cares about improving their financial health.

Loved, loved Gabler’s long-ish book about Walt Disney. Hate he had to go through this financial life. Glad he shared it with us all.

Haven’t read any of his books. Will check it out

Gabler made idiotic decisions (emptying a 401k to pay for his daughter’s wedding; choosing not one but two HCOL areas in which to buy homes, despite essentially working from home; etc). I feel sorry for working stiffs who can’t pay for their kids’ medical co-pays, not for this egotistical, delusional jerk.

And you need to be rude and judgmental because…?

50 years ago how many people had the equivalent of $400 (about $55) on hand in case of an emergency? Which would be harder with no ATMs and credit cards were rare. My parents had at least one credit card for Amoco (later merged with BP) but I don’t think you could use it outside an Amoco station (and when we were in Florida in 1968, one station that we stopped in the panhandle had just started taking plastic..we were their first customer). But general credit cards…my parents got one unsolicited in the mail in 1969 from Americard (Visa) and decided to keep it for emergencies. But you either had to carry cash or hope they would take a personal check.

What I am wondering is I see these stories and they look frightening but are there a lot more people nowadays without emergency cash as compared to the past?

By the way, Amoco gas was good for the fact they were about the only ones that had unleaded gasoline (“white gas” we called it) which was good for Coleman stoves and lanterns we used for camping trips.

Gabler sounds like a smart man with little common sense. Seriously, how much is a house in the Hamptons…even the poor section?