“We have long felt that the only value of stock forecasters is to make fortune-tellers look good. Even now, Charlie (Munger) and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.”

“A prediction about the direction of the stock market tells you nothing about where stocks are headed, but a whole lot about the person doing the predicting.” – Warren Buffett

How did the stock market do today? Where is it heading in the next month? Is it time to take some profits? Time to add some risk to my portfolio? Surely, since you manage investments for a living, you should be able to give me an idea about what’s going to happen next, right?

I get these types of questions quite often because I give advice on this site, but also because I manage money for a living. It’s what I do at my day job. I read all of the relevant research and follow the various markets very closely.

Because of this fact I have learned the secret to making short-term forecasts about the market. The secret is that “I have no idea what’s going to happen.”

Maybe this makes me sound uninformed about my area of expertise, but I think I have some pretty good company in making this statement (see the Buffett quotes at the top of the page). I have learned my limitations.

In the past, I would try to explain my short-term thoughts by talking about trading ranges, valuation, the economy and sentiment since I felt that telling the truth made me sound like I didn’t know what I was talking about.

I wish I had an answer to these questions, but I now know that it’s nearly impossible.

I’m perfectly fine admitting that I have no idea where the market is heading in the short-term. To paraphrase JP Morgan, stocks will fluctuate.

STOCKS MOVEMENTS ARE BASED ON EMOTIONS

Unless you are an entrepreneur who can build a successful business, stocks are your best bet at building wealth.

This isn’t to say that stocks are always a screaming buy. Being a patient investor requires a good balance between long-term optimism and the short-term reality of the risks involved.

Most of the time stocks trade in a wide range of over- and under-valution based on the historical averages.

The problem is that the market doesn’t become over-valued and immediately go back to being fairly valued. The emotional swings in sentiment cause the valuation of the market to swing like a pendulum and it almost always overshoots on both the upside and the downside.

Fear and greed are powerful drivers of our decisions in the stock market. Excessive optimism leads bubbles, which burst and eventually lead to pessimism. Manias and panics are part of the deal when you invest in complex markets made up of individuals making decisions based on different points of view.

This doesn’t mean you can’t use history as a guide for your actions. It’s just that there is a difference between risk management (diversification, asset allocation, rebalancing, etc.) and forecasting short-term market moves.

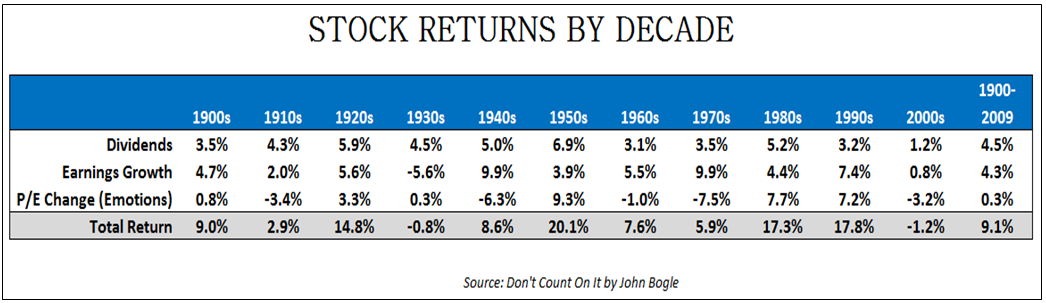

Take a look at this historical stock market performance data that breaks down the main return components, courtesy of John Bogle, in his book Don’t Count On It:

You can see that dividend and earnings growth are relatively stable over the years. The large swings in performance actually come from investors and how much they are willing to pay for those dividends and earnings.

One way to measure this is through the P/E (price to earnings) ratio. I prefer to call this the change in investor emotions.

When investors are feeling good, they are willing to pay a higher multiple of earnings for stocks. When they are feeling nervous, they are willing to pay a lower multiple of earnings for stocks.

This is a bit of an oversimplification, but in the long-term that’s what it boils down to. Over the short-term, stocks can be extremely irrational and inefficient. But generally, over the long-term the results are fairly stable around the averages.

You just have to determine how much short-term irrationality you are willing to accept to achieve your long-term goals.

IGNORE THE NOISE

One of the ways to help you through this process is by avoiding short term market forecasts from anyone (including me). That includes CNBC, Fox Business News, your neighbor, your broker or financial advisor and even the brilliant investment gurus with their own TV show.

There are tons of really smart economists, strategists, analysts and investors out there, all with an opinion and all with research to back up their point of view. But they don’t control the mindset, time horizon or conflicting goals of the day traders, high frequency traders, pension funds, individual investors, hedge funds, endowment funds, etc.

So how are they supposed to be able to predict the short-term moves in the market? The honest answer is that they can’t. Here’s a great take from Barry Ritholtz when he was asked what his outlook is for the markets and the economy:

First, we have learned that you Humans are not very good at making these sorts of predictions about the future. The data overwhelmingly shows that you are, as a species, quite awful at it.

Second, given the plethora of conflicting conjectures in the financial firmament, how can any reader determine which author to believe and which to ignore? You can find an opinion to confirm any prior view, which is a typical way many investors make erroneous decisions. (Hey, that agrees with my perspective, I’ll read THAT!)

And third, relevant to the above, studies have shown that the most confident, specific and detailed forecasts about the future are: a) most likely to be believed by readers and TV viewers; and b) least likely to be correct. (So you have that going for you, which is nice.)

Last, across the spectrum of possible opinions, forecasts and outlooks, someone is going to be correct—how can you ever tell if it was the result of repeatable skill or merely random chance?

Understanding this dynamic will save you from a lot of painful decisions. Short-term forecasting of the markets is an interesting form of entertainment, but at the end of the day, it’s completely worthless. Make sure you look for your sources of advice that think in terms of years and decades, not days and weeks.

Sources:

Don’t Count On It

Financial Advisors

In case you missed it, I wrote a post for Avrom at The Dividend Ninja this week that deals with how companies create value for their shareholders. Read here if you’re interested: Shareholder Yield: A Better Approach to Dividend Investing – Book Review

And here’s the best stuff I’ve been reading this week:

- Waiting to invest doesn’t make things easier (Oblivious Investor)

- A field guide to stock market corrections (Reformed Broker)

- The beauty of limits (NY Times)

- Why investors should ignore economists (Yahoo! Finance)

- The Ninja Lessons (Dividend Ninja)

- 7 lessons from I Will Teach You to be Rich (IWTYTBR)

- Is it worth if being a Boglehead? (My Own Advisor)

- Investment philosophies: Maximize or satisfice? (Abnormal Returns)

- How to not get screwed on your mortgage (Crossing Wall Street)

- Tackling the tough issues: Do Double Stuf Oreos really have twice the amount of creme filling? (ABC News)

- Top 10 beers worldwide (includes one of my favorites – Smithwick’s) (Yahoo!)

Ben, thanks for the mention, and thanks again for contributing to the Ninja! The book review on shareholder yield was excellent. 😉

http://www.dividendninja.com/book-review-shareholder-yield

What? You can’t predict the stock-market? Hmmm, better put me into some of those high MER mutual funds just to be safe. Kidding aside, great post Ben!

Cheers

Avrom

Thanks Avrom. I’ll let you know once I figure out the stock market. I’m sure it’s only a matter of time.

[…] Further Reading: Where is the stock market heading? […]