“Risk means more things can happen than will happen.” – Elroy Dimson

One of this year’s investment buzzwords is divergences. I hear it all the time these days.

Many investors look for indicators that move in opposite directions to compare to past averages as a framework to think about how things could play out going forward.

The divergence everyone has been talking about all year is the fact that small cap stocks are underperforming large cap stocks. While the S&P 500 is up around 8% in 2014, small cap stocks are roughly flat on the year. Also, small cap stocks at one point were down 10% from this year’s high which has been a harbinger of large cap stock losses in the past.

While these divergences are generally more helpful to short-term traders I’m going to throw out a longer-term hypothesis on the small cap phenomenon and what it could mean for investors. But first let’s review the theories on why small cap stocks have outperformed larger companies in the past.

First of all they’re not covered as extensively on the research front by professional investors. This is partly because many large institutional pools of capital are simply too big to have a substantial allocation to small cap stocks so no one is going to buy that research. Small caps also tend to be less liquid so it’s harder to trade in and out of these names and it’s easier for larger funds to create price impact.

These factors can lead to price distortions for those that are able to invest in small caps.

Smaller market capitalization stocks are more volatile as well, mostly because they have a higher chance of going bust since the companies aren’t as mature as large cap stocks. If you want to really drill down to one reason it’s probably because small cap stocks have a much longer runway in terms of future growth than the more established large cap stocks.

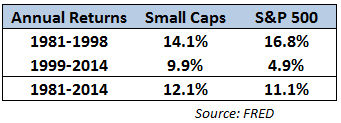

The performance numbers tell the story here – from 1981 through June 30, 2014 the Wilshire Small Cap Index delivered annual returns of 12.1% versus 11.1% for the S&P 500 (and small cap value stocks have performed even better). One percent of outperformance might not sound like a lot, but over 33½ years on a $10,000 original investment it works out to a $120,000 advantage in small caps.

The outperformance is even more pronounced if you look at the breakdown in pre- and post-1999 terms:

One explanation for the recent small cap outperformance is that large caps dominated the 1981-1998 period. It’s mean reversion kicking in. But it’s also interesting to note that small caps have performed so well since 1999 during a time that included two recessions. You would think during economic downturns that smaller companies would run into more trouble.

This could be due to the fact that the Fed has lowered interest rates so much since 1999 which reduces borrowing costs for these businesses.

Since the risk premium for small caps has to partially do with an increased chance of going bust the lower interest rate environment has supercharged the returns of these smaller companies because the risk of default has more or less gone away. Smaller-sized companies are heavily dependent on the debt markets to survive and credit has been easy for a majority of the small cap outperformance.

What if the divergence in small caps is not just short-term in nature, but a longer-term secular trend that incorporates the fact the interest rates will eventually rise? If rates do rise (something investors have been predicting for a number of years now but hasn’t happened) small cap companies would likely be affected the most because of their reliance on the debt markets.

So while many investors spend their time worrying about the effects of rising rates on bonds, maybe the real worry should be what happens to small cap stocks under this scenario.

Of course, I have no idea if this will happen or not. It’s just a theory. Maybe I’m giving investors way too much credit in shifting their risk appetite from small caps to large caps. It could even just be a simple rebalancing effect.

Even if small caps do go on to underperform large caps from here it could just be a case of mean reversion and have nothing to do with interest rates at all. Even though they have outperformed historically, small caps have had long stretches of underperformance.

This is why it makes sense for investors to diversify because no one knows which asset classes will rule over different time frames.

Just something to consider as investing is about using a range of possibilities for future outcomes.

Now for my favorites reads this week:

- Seven truths investors simply cannot accept (Welcome to Kindergarten)

- The wealthy own too many individual securities (Servo Wealth)

- Stock market valuations act as more of a context than a catalyst (Prag Cap)

- Why the future will be better than we all think (Csen)

- Derek Hernquist on what the future holds for investors (Derek Hernquist)

- Boring is good for your portfolio decisions (Millennial Invest)

- Efficient markets and confirmation bias (Irrelevant Investor)

- A history of the high-five in pro sports (Grantland)

- Investing wisdom through quotes from the classic show The Wire. My favorite Wire quote from Avon Barksdale: “You only do two days, the day you go in and the day you get out.” (Clear Eyes Investing)

Also, in case you missed it, I’m very excited to be a contributor for the new Yahoo! Finance blogging initiative. Phil Pearlman created a unique network that brings together a handful of investing legends, some well-known financial bloggers and other not so well-know bloggers such as myself together on a much larger platform. Read more about it here and here. And see the full list on contributors here.

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

[…] Small Cap Divergence […]

Ben,

Enjoyed the article. One way we can test to see if small cap stocks are more sensitive to interest rate changes is to regress historical returns for a small cap index on the Fama/French “term” factor.

One way to do this would be to run large cap (S&P 500) and small cap (CRSP 6-10 ) indexes through the Fama/French 5-Factor model (market, size, price, term, and credit). The other would be to just isolate the bond factors (term and credit). Different approaches yield different results over the period from 1964-2013 (a stretch that included rising and falling rates):

5-Factor

Both S&P 500 and Small Cap indexes have negative exposure to the term factor – S&P is statistically significant and Small Cap is close (t-stat of 1.8). But when I say negative, it’s close to 0 with -0.01 and -0.02 respectively. So not a lot of evidence that interest rate changes are driving returns (and the 5-Factor Model has R^2 of 99% and 98% respectively, so the results are worth observation).

2-Factor

Both S&P 500 and Small Cap indexes have positive and statistically significant exposure to the term factor, but large cap has a greater slope (0.4) than small cap (0.34). In this simplified model, it is in fact default risk and not credit risk that registers strongest, with both large/small at 1.0 or more (with small having more default risk than large). HOWEVER, the R^2 on the 2-Factor bond model is only 11% and 9% for large and small respectively – extremely low. So according to this approach that isolates bond factors, it doesn’t appear that bond risks are explaining that much of the movement of stocks.

That, of course, is part of the beauty of the model: the factors are well specified and distinct without a lot of overlap in risk exposure.

My takeaway: there’s probably not a lot of interest rate sensitivity in small cap stocks beyond the overall market – risks appear to be more default related, which your article alludes to. That being said, “term” IS a risk and is especially so for individuals with a reasonable probability of unexpected cash-flow needs (such as anyone who rebalances during bear markets or retirees with variable income needs). So the best policy is to keep fixed income durations relatively short (5YRs or less) and high quality (less risk of poor performance in bad times and stocks – especially small/value, already seem to have some default risk baked in to their return patterns.

Interesting topic, excuse the diatribe.

Eric

Thanks Eric, that’s helpful. I was actually looking for a way to quantify this theory. Great point (which I agree with) on the bonds and default risk. If you’re going to take risk, then take risk and do it in stocks especially if default could be a factor. factor. Appreciate the comment.

[…] Small cap relative performance can run for years. (A Wealth of Common Sense) […]

Using a low frequency tactical asset allocation model applied to the 3 factor small cap value Fama French data and the S&P 90, 500, small caps outperformed the S&P 90, 500, in aggregate, over 90 years with returns averaging a consistent > 16% CAGR. If an investor were to target the use of the model towards 20 year investment time frames ( as suggested in the work of Prof. J. Siegel ), portrayed in the presentation , then the focus on short term “divergences” and interest rate activity wouldn’t be a factor as the ultimate reward outweighs the “noise”. Also, another burden of the buy & hold of the small cap universe, is the sheer magnitude of drawdowns (shown in the chart) with which one has to has to prepare and contend. https://docs.google.com/presentation/d/1C37CJypoxHWHB09e3g25ewOGjP83wDZhj5j6tlrLJoA/edit?usp=sharing

Interesting data. Thanks for sharing. I think the large, periodic drawdowns are another one of the reasons that small caps tend to product higher returns over time. It’s never easy to sit through those periods, but that’s how risky asset work, unfortunately.

[…] Small Cap Risk […]