The behavioral benefits of having a fun portfolio.

The behavioral benefits of having a fun portfolio.

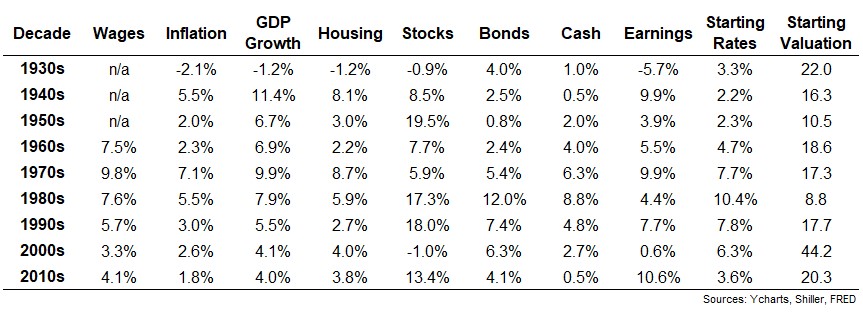

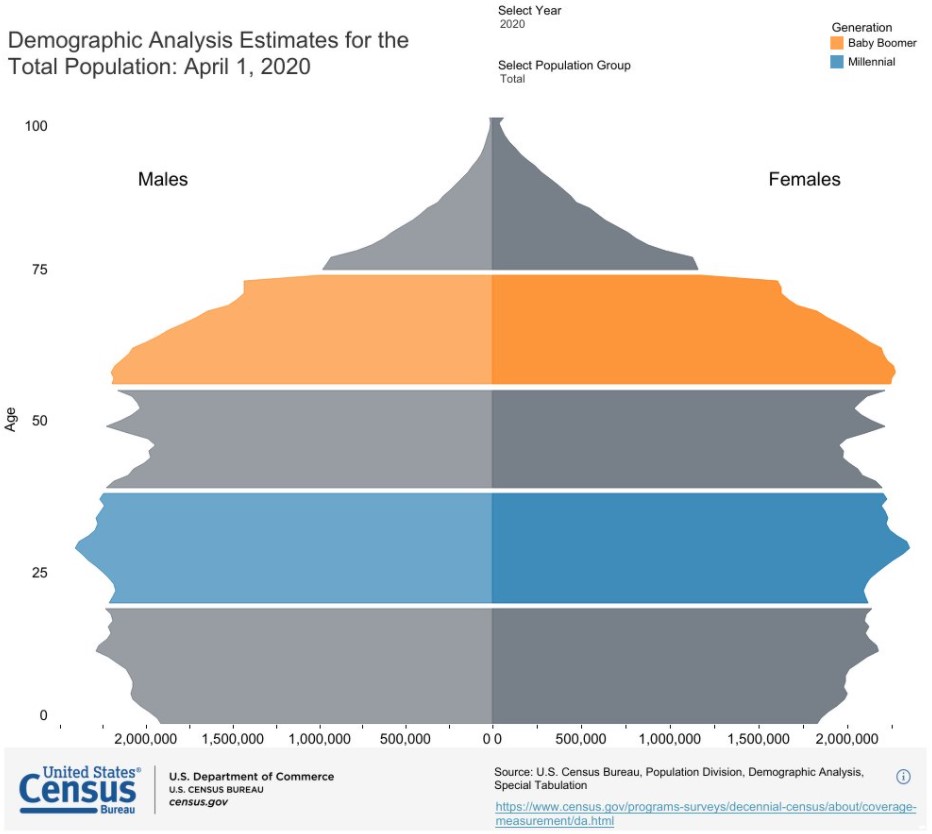

Financial and economic relationships are never static.

There are a number of factors that drive the markets that most investors pay attention to. Things like earnings, economic growth, interest rates, inflation, market trends and valuations. All these things matter in terms of setting prices. But they are not the be-all, end-all. You can’t simply take fundamental data as gospel for how the markets…

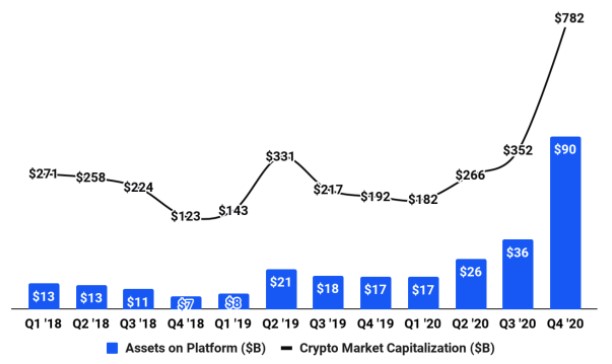

Today’s Animal Spirits is presented to you buy Osprey Funds: Subscribe to Osprey’s newsletter about all things crypto here. We discuss: The joke cryptocurrency going nuts Why dogecoin annoys me so much The problem with meme stocks and joke cryptocurrencies Do we really need the ability to trade stocks 24/7? All models are wrong but…

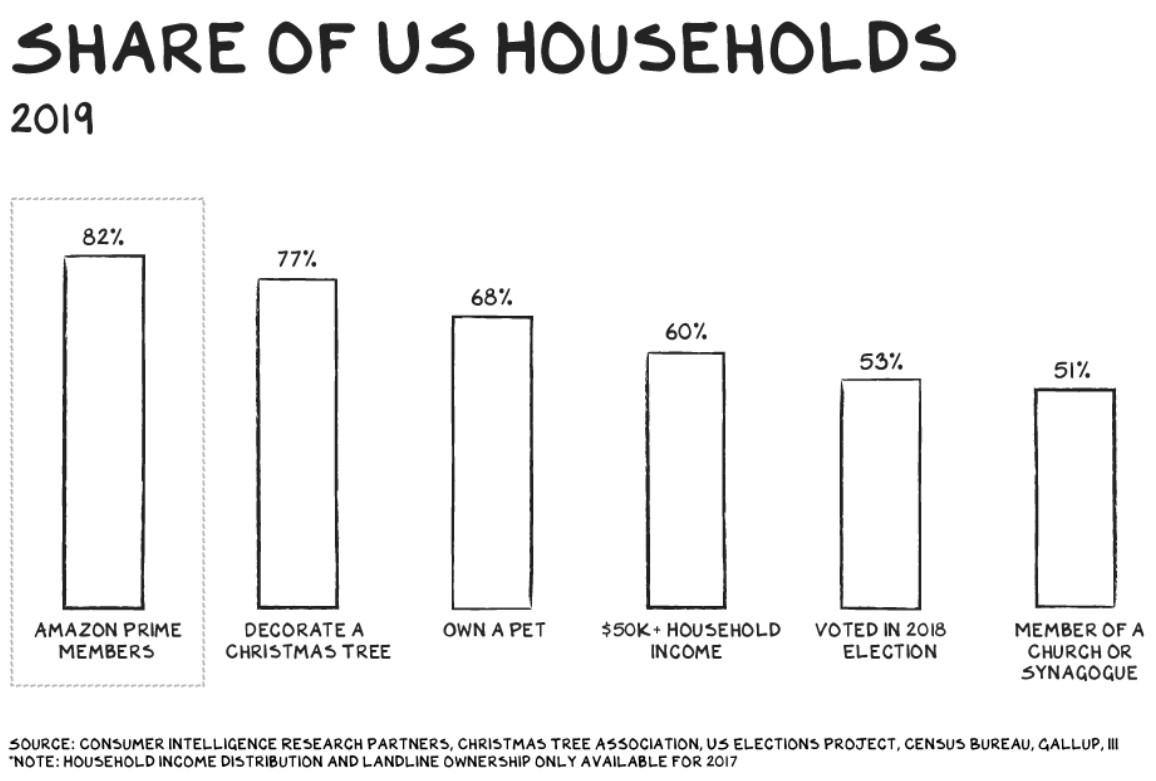

The importance of spending money on convenience.

Some thoughts on dogecoin.

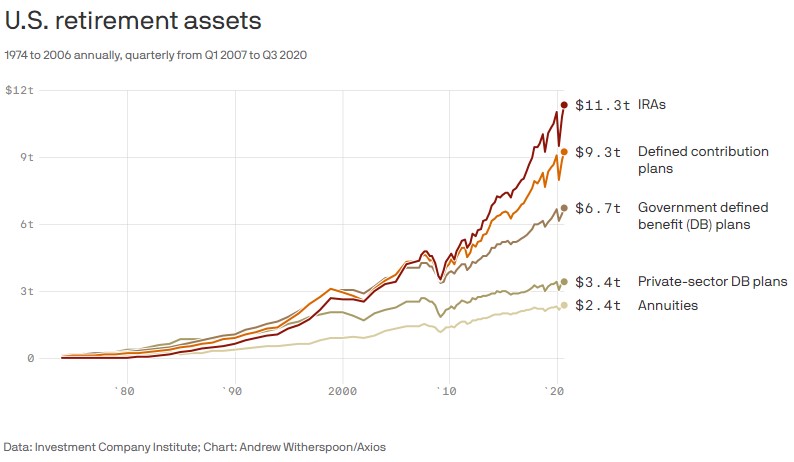

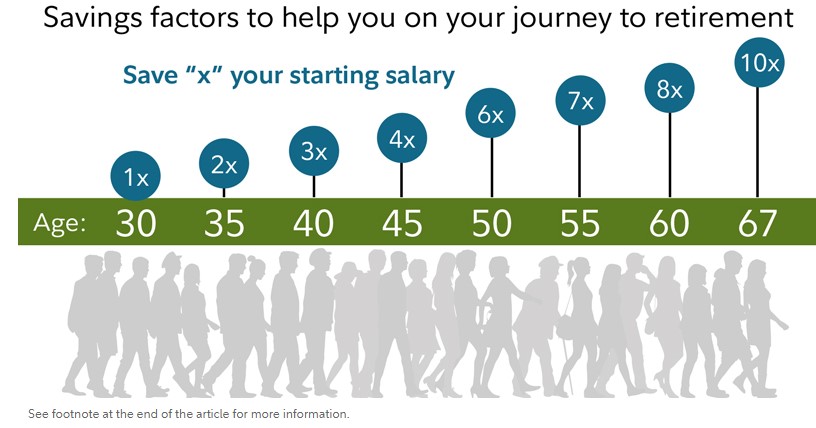

Retirement planning for people in their 30s.

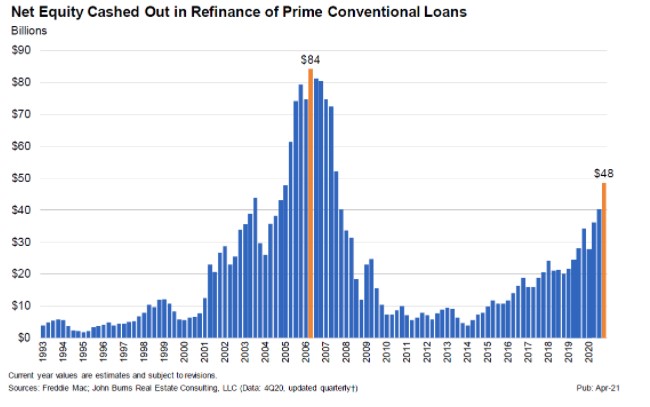

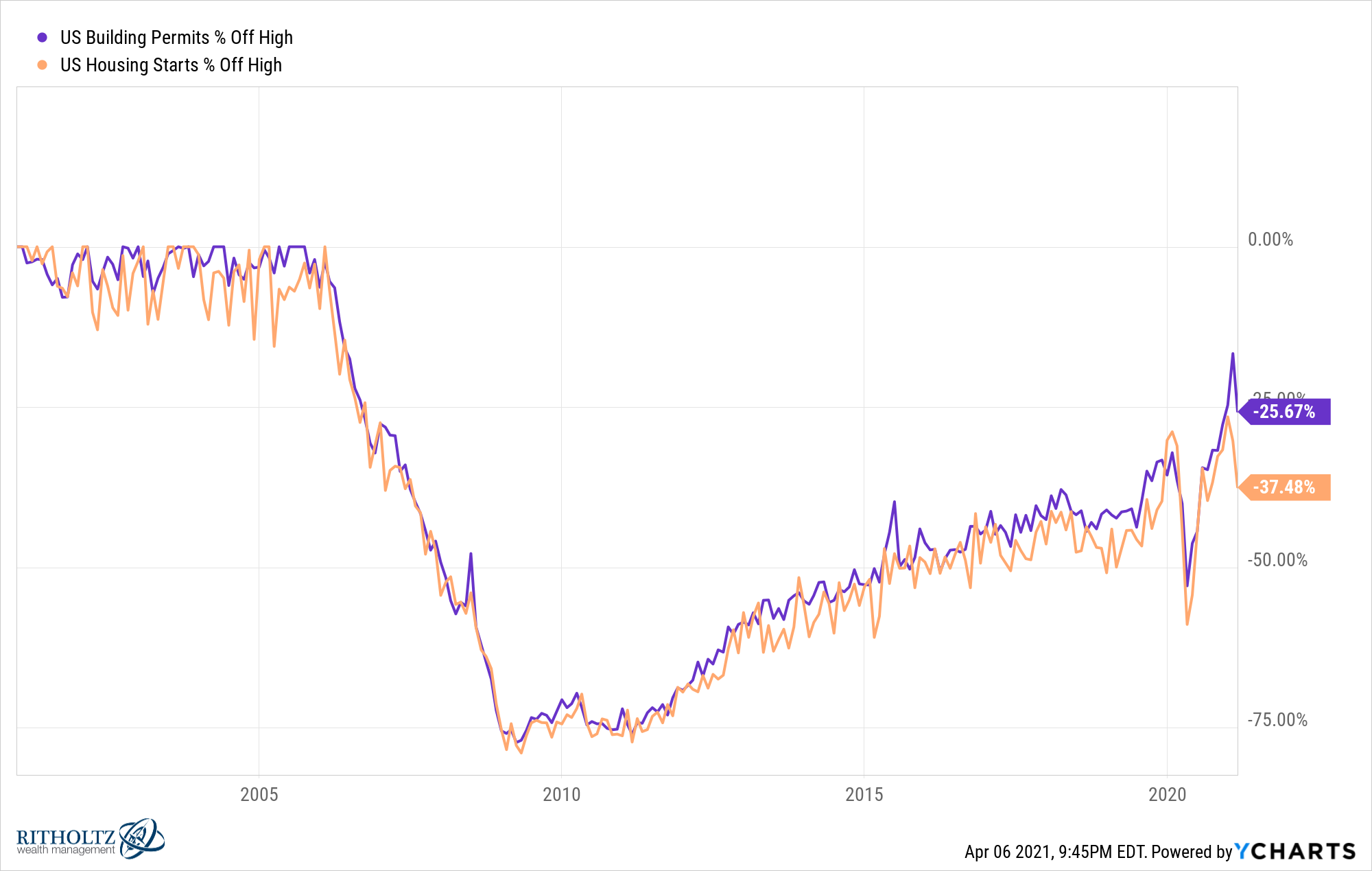

A podcast listener asks: Location: Seattle, WA Based on my current savings for a downpayment, $300,000, I am pre-approved for a $1.5 million home purchase, but was hoping to stay closer to $1.2 million. My wife and I looked at houses in our preferred budget, and everything went $200k to $300k over. I have a…

What the Coinbase IPO means for the crypto market and other financial firms.

Michael and I discuss the scalding hot housing market, investing in collectibles and more.