“Successful investing is anticipating the anticipation of others.” – John Manard Keynes

Professional investors are constantly monitoring investor sentiment in an effort to get ahead of the crowd one way or another.

This makes sense when you consider that the psychology of investors is the real driving force behind price movements over any short to intermediate time frame in the markets. Trends, valuations, trading volume, interest rates, inflation, etc. are all very interesting to debate, but when it comes down to it none of these factors matter as much as investor sentiment in moving the market over any particular cycle.

It’s why both the bullish and bearish camps are constantly arguing that sentiment has gone too far in one direction based on their investment stance. These are some that I have been hearing for some time now:

Bullish Argument: Investors are still way too pessimistic.

Bearish Argument: Investors are way too optimistic yet again.

Bullish Argument: There’s still too much cash on the sidelines.

Bearish Argument: Investors are all in.

Bullish Argument: There’s little interest by retail investors in the bull market.

Bearish Argument: Prices and valuations suggest euphoria in the markets.

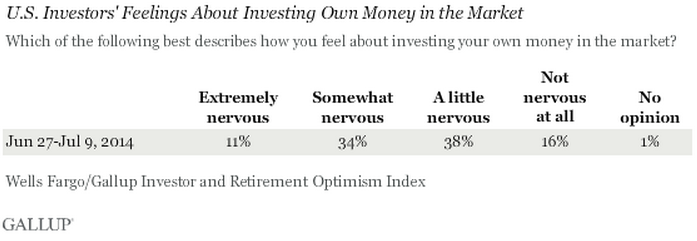

The latest Gallup survey shed some light on how U.S. investors are feeling about the current bull market:

Investors are still a little nervous based on this survey, but who knows how they are currently invested (watch what they do not what they say).

They also found that only 7% of those surveyed knew that the stock market was up by over 30% in 2013 while 37% guessed it was up less than 10% and 21% believed stocks stayed the same. More people (9%) thought the market had declined than those that knew it was up over 30%.

Investors have been burned by two huge boom and bust cycles in the past decade and a half. Most people are fed up with the financial industry because of what we see on the news — bailouts, bonuses, high frequency trading, fraud and billion dollar fines instead of prosecution.

Whether it’s right or wrong, many people simply don’t care about the financial markets. This could mean they’re investing more passively (on their own or through an advisor) or completely out of the markets altogether.

Even for those retail investors that are still in the markets, a majority doesn’t care because they have other things in their lives to worry about. Robert Shiller summed this up nicely in Irrational Exuberance:

In considering lessons from psychology, it must be noted that many popular accounts of the psychology of investing are simple not credible. Investors are said to be euphoric or frenzied during booms or panic-stricken during market crashes. In both booms and crashes, investors are described as blindly following the herd like so many sheep, with no minds of their own. Belief in the rationality of the markets starts to sound a lot better when the only alternatives are such pop-psychological theories.

We all know that most people are more sensible during such financial episodes than those accounts suggest. Financial booms and crashes are, for most of us, not emotion-laden events on par with victories in battle of volcanic eruptions. In fact, during the most significant financial events, most people are preoccupied with other personal matters, not with the financial markets at all. So it is hard to imagine the market as a whole reflects the emotions described by these psychological theories.

However, solid psychological research does show that there are patterns of human behavior that suggest anchors for the market that would not be expected if markets worked entirely rationally. These patterns of human behavior are not the result of extreme human ignorance, but rather of the character of human intelligence, reflecting its limitations as well as its strengths. Investors are striving to do the right thing, but they have limited abilities and certain natural modes of behavior that decide their actions when an unambiguous prescription for action is lacking.

Many assume the average mom and pop investors invest like a gambler in Vegas at 3am deciding to play two blackjack hands at once after a two-day bender to trying to win back all of their money.

Sure there are always people at the extremes of euphoria and panic. But as Robert Shiller pointed out, this is probably the exception not the rule.

Average investors make mistakes just like the professionals, but their mistakes can become amplified because of the emotions that are involved when investing money for personal goals and desires. Professionals have the advantage of investing other people’s money which can take some of the emotions out of the equation.

These emotions combined with an unfortunate general lack of interest in the financial markets make for a difficult clear-cut tell when trying to anticipate what retail investor sentiment will be at any point in time.

That doesn’t mean it’s impossible to use investor sentiment as a market tell, but it’s not easy. Sentiment measures work best at the extremes, but the extremes happen much less often than investors think.

Sources:

Irrational Exuberance

U.S. Investors seem unaware of bull market’s strong gains (Gallup)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

[…] Mom and Pop Investing […]