“The problem with patience and discipline is that it requires both of them to develop each of them.” – Thomas Sterner

Investing is all about balance. You must balance your tolerance for risk with your desire to build wealth. You must balance your short-term needs with your long-term goals. And you must find balance within your portfolio strategy between the various asset classes that you use to make up your portfolio.

RISK AND REWARD

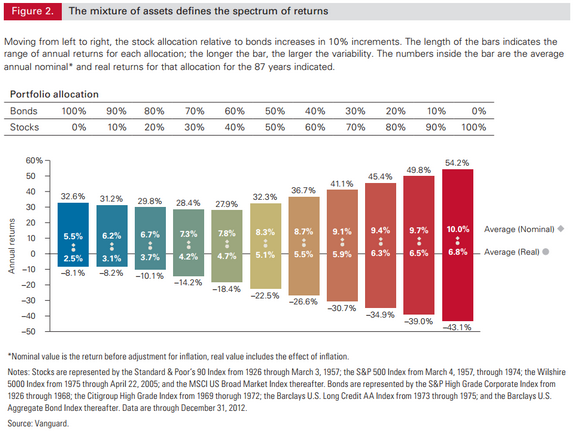

Vanguard has a graphic that shows how various allocations between stocks and bonds have performed since 1926.

The wide spectrum of gains and losses that can be seen going from a portfolio of 100% bonds to one with 100% in stocks is a perfect example of the balancing act between risk and reward. As the asset allocation moves to the right and increases the amount in stocks the returns are larger but so are the largest annual losses.

These numbers show that you are required to balance your need for higher returns with your ability to withstand losses while being able to follow through with your investment plan.

SPENDING VS INVESTING DURING RETIREMENT

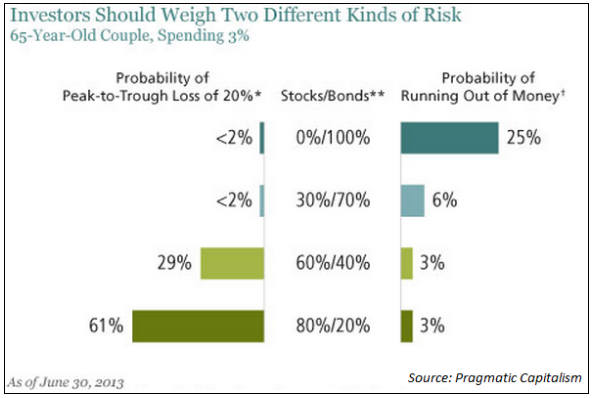

This next chart courtesy of Pragmatic Capitalism breaks down the probability of large losses and running out of money in retirement assuming different stock and bond asset allocations using a 3% spending rate and shows another aspect of the risk-reward relationship.

The need for a balance between risk taking and risk aversion depends on a number of factors (lifestyle, spending habits, income needs, etc.), but you can see that there are risks involved on both fronts. You have the risk of large losses on the one hand and the risk of running out of money on the other.

In retirement you must be able to balance your need for short-term spending money with the fact that you still have a long time horizon for your investments to grow.

DIVERSIFICATION

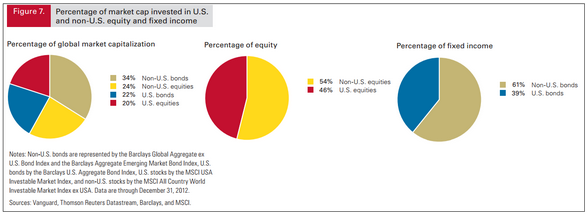

You also need to balance your investments within your asset allocation between domestic and international markets to take advantage of global diversification. Here’s a breakdown of the global markets by Vanguard to get a sense of how things are spread out across the stock and bond markets.

You don’t have to necessarily structure your portfolio in these exact percentages to capture the benefits of global diversification, but this gives you a good sense of how the different markets are structured. A balance between investing throughout the different world markets along with your ability to not get scared out of unfamiliar investments is the key here.

NOT MUCH BALANCE REQUIRED HERE

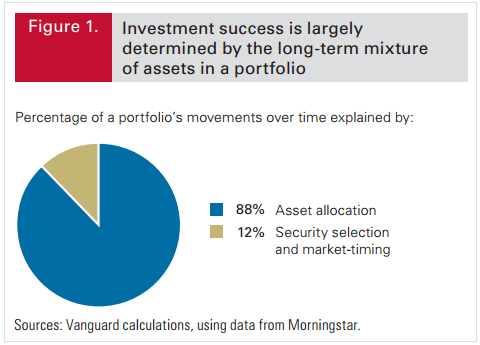

However, there is one area of your investment plan where balance isn’t really necessary. That’s the importance of the asset allocation decision. Here’s another chart from Vanguard that breaks down asset allocation versus picking individual securities & market timing.

Almost 90% of your portfolio’s movements can be explained by your asset allocation or the mix of different investments in your portfolio. This goes against many long held beliefs most investors carry that assume that picking the best stocks, bonds or funds and jumping in and out of the market is the way to achieve success over time.

Look no further than the first graph at the top of the page that shows the different asset allocation weights along with the corresponding returns to see the data behind this idea.

Obviously for some, picking a 10-bagger stock will have large effect on their portfolio if the magnitude of the investment is large enough. But to be successful as an investor in such a strategy requires that you are able to repeat this process over and over again.

Since most investors don’t have that ability, focusing on your diversified mix of investments is still the best way build long-term value in your portfolio.

Sources:

The Case for Dow 20,000 – One Year Later (Pragmatic Capitalism)

Vanguard’s framework for constructing your portfolio

[widgets_on_pages]