“Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it.” – Albert Einstein

“Someone is sitting in the shade today because someone planted a tree a long time ago.” – Warren Buffett

A great way to figure out how to plan ahead with your finances when you are younger is to ask someone older than you what they wish they would have done when they were younger (investing in Apple stock in 2001 when it was under $8 a share doesn’t count). The answer that I hear over and over again when I ask this question is, “I wish I would have started saving for retirement earlier.” In fact, a recent Scottrade survey published last year showed that only 30% of baby boomers started saving for retirement between the ages of 25 and 34.

You always hear parents say there will never be a perfect time financially for someone to be ready to have a child. The same thing applies with saving for retirement. You get out of school and have to pay off student loan debt. You might get married and then have to save for a house down payment. Then you have kids and they are expensive plus you have to start saving for college. It will never feel like you have the perfect opportunity to set aside part of your salary to save for retirement.

That’s the reason so many are so woefully prepared for retirement right now in this country. A recent study from the Employee Benefit Research Institute showed that 67% of workers say they are behind in planning and saving for retirement with only 58% currently saving anything for their later years. And 60% of workers 55-plus have less than $100,000 in savings and investments (excluding pensions and home equity). Unfortunately, this means that more workers will be forced to work longer into their expected retirement years.

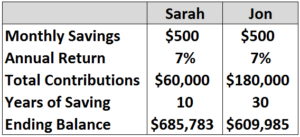

Let’s look at an example to show how saving early can positively affect your investment balances in retirement. Sarah decides to start saving for retirement at age 25. She saves $500 a month in her retirement account until age 35. At this point, she stops saving and just let’s interest work in her favor. At age 65, assuming a 7% annual rate of return she will retire with $658,783 even though she only contributed $60,000 total into her account.

Jon decides to wait until he is 35 to start saving. He saves the same $500 a month that Sarah did but he actually saves that amount right up until the day he retires. His total amount contributed to his account over those 30 years would be $180,000. Assuming he also earns an annual return of 7% on his funds he will end up with $609,985 when he retires. Let’s go to the tale of the tape:

Even though Jon contributed 3x as much money as Sarah did, he actually ends up with almost $50,000 less than her at retirement. The reason for this is compound interest. Compound interest means that you earn interest originally on your principle balance and then continue to earn interest on top of your interest which snowballs until you have a runaway freight train working in your favor.

Just for fun, let’s assume Sarah doesn’t stop saving at age 35. Instead, she continues saving the same amount her entire career until she retires at age 65. With the same assumptions, she now has over $1.3 million at retirement. Her 10-year head start on Jon gave her more than double his ending balance. Again this is compound interest helping her cause. The more time you have to use it to your advantage the less work you have to do.

All is not lost if you haven’t started saving yet. You will just have to make up for your shortfall in years by increasing the amount you save. If you start at age 40 (same assumed 7% return) and save $750 a month you can still retire at age 65 with $607,553. Or if you save $1,000 a month at age 50 you would have $316,962 at 65. Your increased contributions can make up for some of the lost time.

But if you are young don’t wait to play catch up. You never know what life is going to throw at you in the future so be prepared by saving early. Let compound interest do the work for you.

Excellent information from someone who has received the education and applied it to his own personal finances.

I pointed this compound interest to my 20 year old nephew by explaining now that he has a job making more than twice what he had previous, that he could ensure he would have $1M by the time he’s 65 or before if he makes sure to put $100/week for the next 6 years of his life.

He says he started a Roth for himself and is going to fund it. I will be checking in on him in another month to see if he has actually followed through.

I feel it’s great to have a set of checks and balances in place to keep us on track to hit our goals. Having someone in your corner that will follow-up with you to keep you in line is one of the best ways to do it.

Looking back on it now I wish I would have funded an IRA at 18 and just put in a few hundred bucks a year until I was out of college. It really does help starting out early

[…] reason for this is compound interest. Albert Einstein described compound interest as the eighth wonder of the world. The ability to […]

[…] investing when you are young is because you will have the wind at your back through the power of compound interest. This simply means that the longer your investment time horizon the better chance you have of […]

[…] all have a pretty good idea about the main tenets of personal finance (save more than you earn, invest early & often, track your spending, stay out of credit card debt, etc.). But delayed gratification is tough. […]

[…] your net worth. And you get to control the amount you save each and every year. Start early and let compound interest help you along the […]

[…] shelter you from tons of unnecessary risk and likely reduce your costs. Save more: The more you save the lower your risk of not achieving your […]

[…] stocks allow you to take advantage of the wonders of compound interest by reinvesting your dividend income and continuing to build on those investments over time. The […]

[…] is to save as much as you can and then move on to worrying about your investments. Let the magic of compound interest work in your favor and increase your odds of success by continuing to save and increase that amount […]

[…] saving early and let compound interest help your cause. If you haven’t started yet there is no better time than the present. Don’t […]

[…] Reading: The Benefits of Compound Interest How to Lose Money With Stocks at All-Time […]