Before 1990, there wasn’t an easy way for investors to put money to work in a diversified basket of commodities. Unless you had your own seat on the futures exchange a la Dan Akroyd and Eddie Murphy in Trading Places or hired a broker who did, it would have been nearly impossible to include commodities in a well-diversified portfolio.

That all changed in the early 1990s once fund companies were able to set up investment vehicles to buy and sell commodities to package as investment products for prospective investors. Once commodities started to show promising performance in the early 2000s more and more products started popping up in the form of mutual funds and ETFs that made it much easier for investors to gain exposure to commodities.

This left many long-term investors wondering if it makes sense to include commodities as a permanent position within their portfolio.

Let’s take a look at two of the most well-known, diversified commodity indexes to see how investors would have done since the early 1990s when the asset class became available for wider distribution.

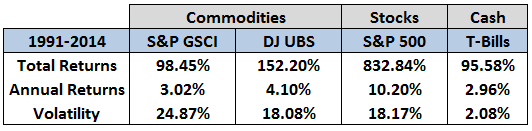

These are the performance numbers for the S&P GSCI (formerly the Goldman Sachs Commodities Index) and the Dow Jones UBS Commodity Index compared to the returns earned in stocks and T-Bills:

Over this nearly 25 year period, a diverse portfolio of commodities would have earned investors similar returns to cash with similar volatility to stocks, the exact opposite of what you would want to see from a long-term asset class. Factoring in inflation the real returns were 0.37% and 1.45% annually for the respective commodities indexes.

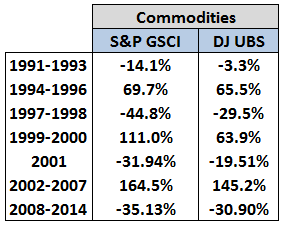

This data makes a strong case that commodities don’t make for a solid long-term investment as a dedicated allocation in a portfolio. They are probably much more conducive to trading than investing as you can see from this performance breakdown by different periods:

There have been bouts of strong performance but there are wild swings in the prices of commodities over time. This makes sense because commodities are really just materials and input costs. They don’t pay dividends or generate earnings like stocks. They don’t pay income like bonds.

It has been argued that the high volatility in commodities could actually help reduce overall portfolio volatility as a hedge because the returns are uncorrelated with stocks and bonds.

A recent research paper refutes this suggestion by showing that commodities actually increase overall portfolio volatility with a decrease in risk-adjusted returns.

Many investors and financial advisors saw the huge returns in the early-to-mid 2000s as a signal to increase their long-term allocation to commodities. The data shows that this was probably a mistake.

Commodities appear to be a trading vehicle, not a viable long-term investing option.

Further Reading:

Do you need commodities in your portfolio?

Excellent information Ben. Thank you. Would love to hear your thoughts on the permanent placement of Treasury Inflation-Protected Securities in a well diversified portfolio too.

Thanks. I do have some thought on TIPs. That’s a great idea for a future piece.

[…] really liked this piece by Ben Carlson on commodities and how they might fit into your portfolio. He goes over the historical performance of […]

[…] Commodities for Trading […]

Thanks for the hard data and thoughts. I placed 2% of my portfolio in commodities (in USCI) three years ago as a long term diversifier. This article convinces me that this was not one of my better moves (live and learn). As of now my commodities fund position is down 17%, however, given the large volatility that your data shows, it seems more sensible to wait for an up period to sell, rather than get out now. Do you agree?

I can’t offer you specific advice but here’s a way to frame this decision: what would you regret more – missing out on future gains in commodities if they occur or taking part in more losses if they occur? Every investment decision can be looked at through the lens of opportunity costs. Think about it that way before making a choice either way.

Also don’t necessarily consider this a bad move just because you got a bad outcome. You have to figure out why you chose to add commodities in the first place.

I find commodity to risky an investment, there is certain life span to it, unlike stock if you buy into good company they can last for hundred of years if not forever.

[…] really liked this piece by Ben Carlson on commodities and how they might fit into your portfolio (I like Ben’s piece primarily because he agrees […]

[…] really liked this piece by Ben Carlson on commodities and how they might fit into your portfolio (I like Ben’s piece primarily because he agrees […]

[…] really liked this piece by Ben Carlson on commodities and how they might fit into your portfolio (I like Ben’s piece primarily because he agrees […]

[…] Are commodities for trading or investing? by A Wealth of Common Sense […]

[…] Further Reading: Are commodities for trading or investing? […]

[…] they’re basically in constant competition with technology. This is why I always say that commodities are trading vehicle, not a long-term investing vehicle. There’s a huge difference. If you’re truly worried about a […]

[…] Further Reading: Are Commodities For Trading or Investing? […]

[…] Further Reading: Are Commodities For Trading or Investing? […]