A reader asks:

I’m 50-years-old and just started investing for the first time in February of this year. Was promptly kicked in the private parts as a “welcome to the party” from the stock market. With little to no knowledge about investing it looks like ETF’s/Index Funds are safer compared to stocks (i.e. an ETF with a portion of Apple or Microsoft doesn’t appear to get slammed as much as owning the individual stock). Is this the way to go for newbie investors like me who really don’t know anything more than basic investing? Or is it better to be “buying the dip” now and holding on for the next 10 years?

Every investor gets a swift kick in the teeth by the markets at some point.

The good news is you got it out of the way early in your investing journey. Just chalk this one up as a tuition payment to the market gods. It happens to all of us at some point.

Stock-picking is extremely tempting to new investors. I was planning on becoming the next Buffett after reading The Intelligent Investor at the start of my career.

It didn’t take me long to realize this was never going to happen. John Bogle set me straight and I’ve been in a long-term relationship with index funds ever since.

There is nothing wrong with investing in individual stocks but there are some things you should know before sticking with it:

It’s hard. Close to 90% of professional money managers underperform index funds over 10 and 20 year periods.

It’s time-consuming. You can learn a lot about business, the economy and what’s going on with the markets by following individual stocks but it takes time. Professionals listen to quarterly earnings calls, talk to company management, go to industry conferences and perform exhausting financial statement analysis.

And it’s still not enough to beat a simple index fund for most of them.

It’s emotionally draining. Individual stocks are far more volatile than the overall market. They crash more often. They go out of business. And most of them underperform the market itself since most of the gains come from a handful of the biggest winners.

The best strategy for down markets, up markets and sideways markets for the vast majority of individual investors is to dollar cost average into an index fund or targetdate fund.

Buying periodically into a low-cost, tax-efficient, diversified portfolio is boring but boring is beautiful when it comes to investing.

Here’s why:

It’s simple. Markets are often described as complex adaptive systems because they’re often so unpredictable and occasionally unstable. But complex systems don’t require complex solutions.

I would argue the opposite is true — the more complex the problem, the simpler the solution should be.

It’s much easier to be fooled by randomness with a complex investment strategy. Complexity often comes with unintended consequences and unnecessary risks.

The beauty of simply buying stocks at a pre-established interval is that it doesn’t require a lot of brainpower. You can automate the process and get on with your life.

It allows you to diversify across time. Markets are always and forever cyclical. The problem is we don’t know how long the cycles are going to last and we don’t know what the next cycle will look like.

If you have a multi-decade time horizon, you should expect to live through inflation, deflation, high interest rates, low interest rates, booms, busts, bull markets, bear markets, blow-off tops, market crashes and everything in-between.

There is no strategy that will perfectly nail each of these economic or market regimes.

But dollar cost averaging comes pretty close.

How?

By buying on a set schedule, you’re diversifying across time and market environment.

Some purchases are bound to come close to nailing the bottom. Others will come near a temporary top.

When stocks are down you’ll be buying more shares at lower prices, higher dividend yields and lower valuations.

And when stocks are up you’ll be buying fewer shares at higher prices, lower dividend yields and higher valuations.

The wonderful thing about dollar cost averaging is you don’t have to try to predict tops and bottoms because you’re spreading your bets. No single purchase will make or break your portfolio.

It’s the perfect strategy for a bear market. It never feels like it when you’re living through them, but the purchases you make during a bear market will almost always be the best investments you make.

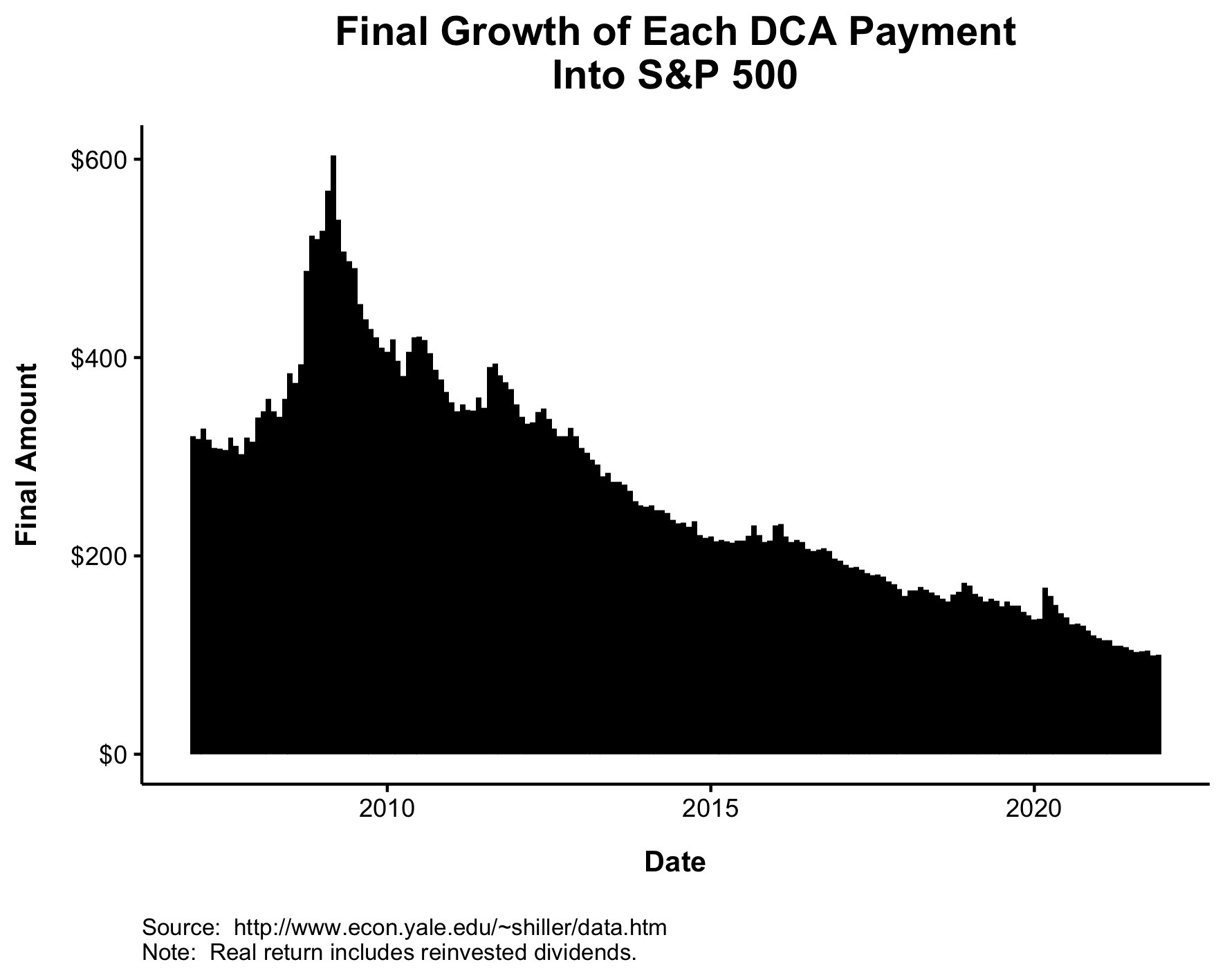

Nick Maggiulli created this lovely chart for me that shows a DCA strategy that simply invested $100 a month into the S&P 500 starting in 2007, right before one of the biggest crashes of all time:

Guess when the best purchases occurred? During the crash!

They probably didn’t feel so great at the time but those buys during 2008 and 2009 paid off handsomely over the long-term with the largest growth.

Buying throughout a down market sets you up for the next up market.

It takes emotions out of the equation. The worst part about investing during a downturn is that we’re all human. We can’t help being nervous, scared or uncertain about what will happen in the future.

Dollar cost averaging doesn’t make those emotions go away but it takes them out of the investment process.

Investing when emotions run high requires the ability to force yourself into good decisions. Automating your purchase decisions ahead of time can help.

We talked about this question on this week’s Portfolio Rescue:

My personal tax advisor Bill Sweet joined me again to discuss questions about inflation hedges, capital gains taxes, maxing out tax-deferred retirement accounts and direct indexing.

Further Reading:

The Simplest Way to Make Up For Portfolio Losses

Here’s the podcast version of Portfolio Rescue: