One of the hardest parts about being a long-term investor is the fact that sometimes your money is going to get incinerated and there’s nothing you can do about it.

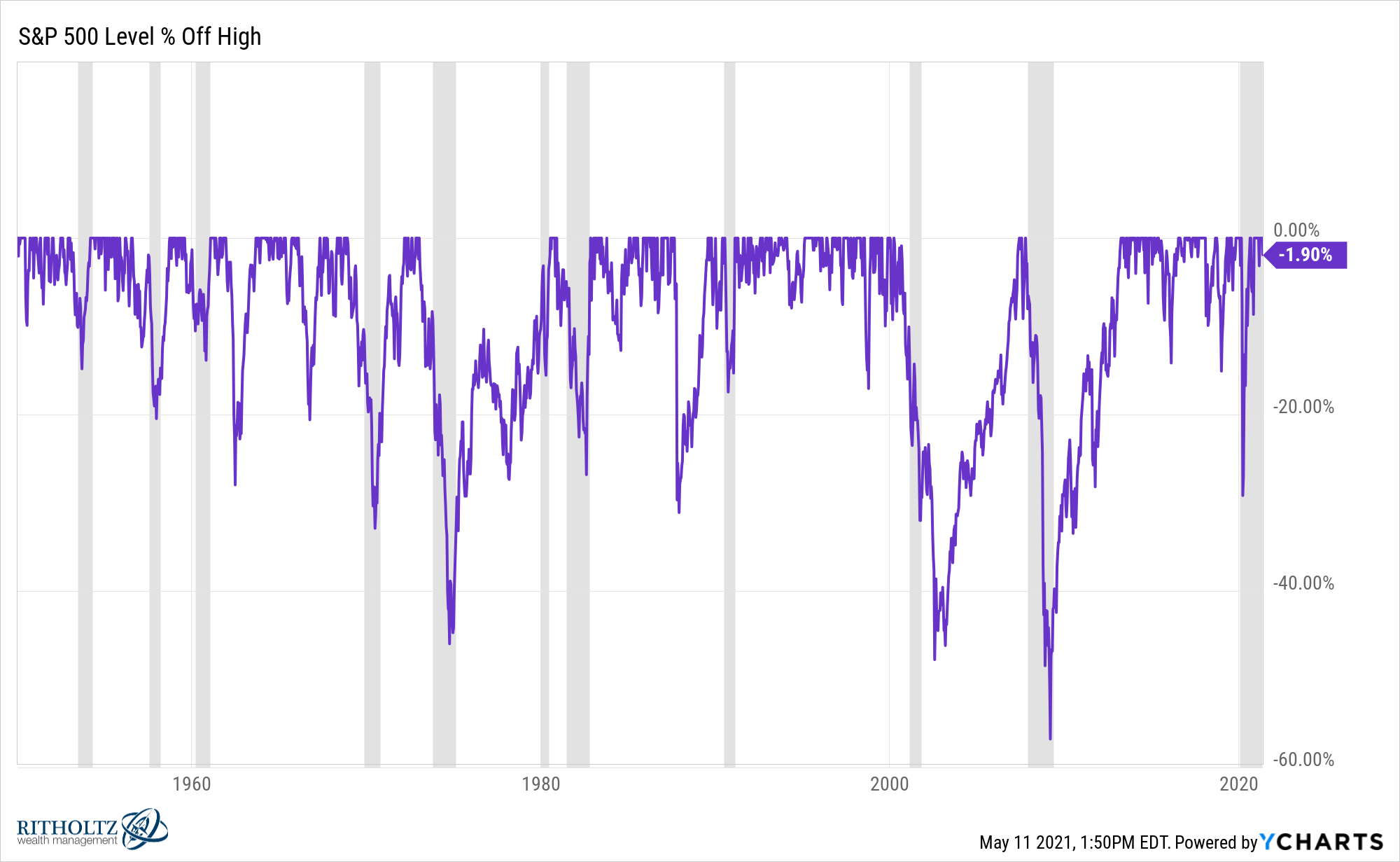

Over the past 100 years or so the stock market has hit a new all-time high on 5% of all trading days. Said another way, 95% of the time you’re in a drawdown wondering why you’re not at your peak portfolio value anymore.

I wrote the following in my latest book:

As I write this book, I’m entering the last year of my 30s. Please respect my privacy as I go through the mourning process before turning 40. According to the Social Security actuary table, people my age live to be 79 years old, on average. Let’s keep things optimistic and say I’m above average in terms of longevity. I have somewhere in the order of four or more decades remaining to prepare for financially over the rest of my life.

In the coming 40-50 years I’m planning on experiencing at least 10 or more bear markets, including 5 or 6 that constitute a market crash in stocks. There will also probably be at least 7-8 recessions in that time as well, maybe more.

Can I be sure of these numbers? You can never be sure of anything when it comes to the markets or economy but let’s use history as a rough guide on this. Over the 50 years from 1970-2019, there were 7 recessions, 10 bear markets and 4 legitimate market crashes with losses in excess of 30% for the U.S. stock market. Over the previous 50 years from 1920-1969, there were 11 recessions, 15 bear markets, and 8 legitimate market crashes with losses in excess of 30% for the U.S. stock market.

Bear markets, brutal market crashes and recessions are a fact of life as an investor. They are a feature, not a bug, of the system in which we operate.

If you’re investing in the stock market that means you should plan on losing at least 10% of your money once every 1-2 years, on average. You should also plan on losing 20% of your capital once every 3 or 4 years, 30% once every 6 or 7 years and 40% or worse every 10-12 years.

These time frames aren’t set in stone since actual stock market returns are anything but average but you get the point. If your money is invested in the stock market for the long-term, expect it to grow over time but also evaporate without warning on occasion.

The same applies to pretty much any risk asset.

If you’re invested in a fund like the ARK Innovation ETF (or any hot fund), you should expect to see 30-50% losses following huge gains.

If you’re invested in high-flying growth stocks, you should expect to see 40-50% losses even when the companies are still growing like weeds (even when the stock market is hitting all-time highs).

If you’re invested in cryptocurrencies, you should expect to see 20% losses in a matter of minutes or 50% losses in a matter of days.

Finding success as a long-term investor requires navigating a psychological minefield.

You set aside money today so you can have more money in the future. But getting to whatever the “long-term” means to you requires seeing the present value of your holdings fall, sometimes in soul-crushing fashion.

If you’re constantly anchoring to whatever high watermark your portfolio or holdings reach you’re going to be disappointed most of the time. Nothing that makes money over the long-term goes up all the time over the short-term.

A portfolio of risk assets will likely be worth more in a decade than it is today but it’s not guaranteed to be worth more. In two to three decades your risk assets will almost certainly be higher.1

In the meantime, who knows?

Sometimes higher, sometimes lower. If you’re not spending that money today, tomorrow or within the next few years, you probably shouldn’t care all that much.

You have to be willing to lose present wealth to give yourself the opportunity to gain future wealth.

Further Reading:

A Short History of U.S. Stock Market Corrections & Bear Markets

1And if they’re not we have bigger problems on our hands.