I wrote the following last week:

If you’re invested in cryptocurrencies, you should expect to see 20% losses in a matter of minutes or 50% losses in a matter of days.

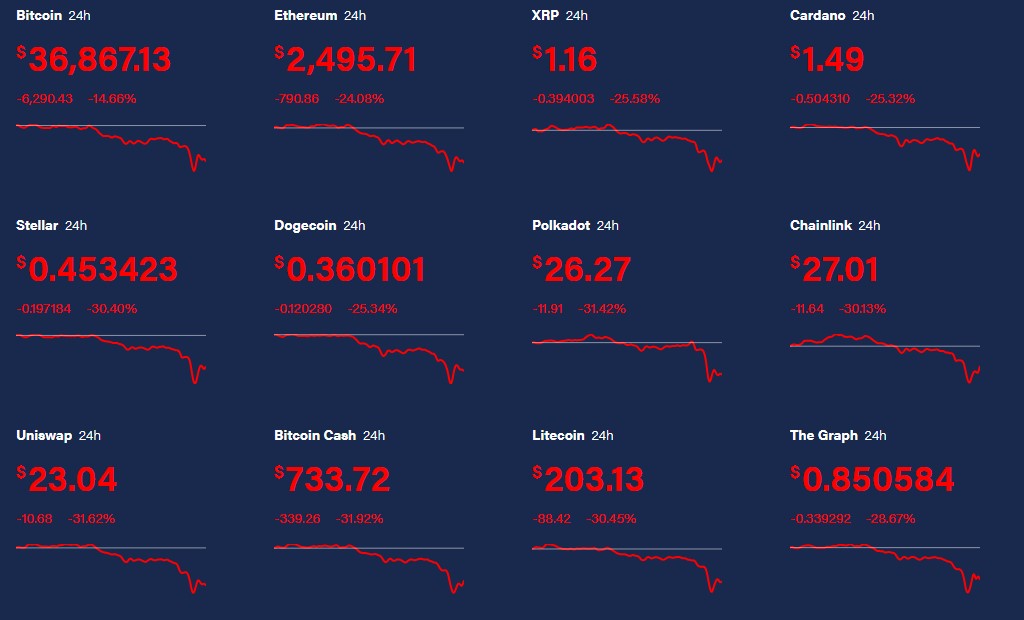

Well we didn’t have to wait long for this. There was carnage in the crypto markets today:

At one point this morning bitcoin was more than 50% off its highs from just a few short weeks ago. Ethereum was more than 50% off its highs from just a few short days ago. And everything else in the crypto landscape got massacred.

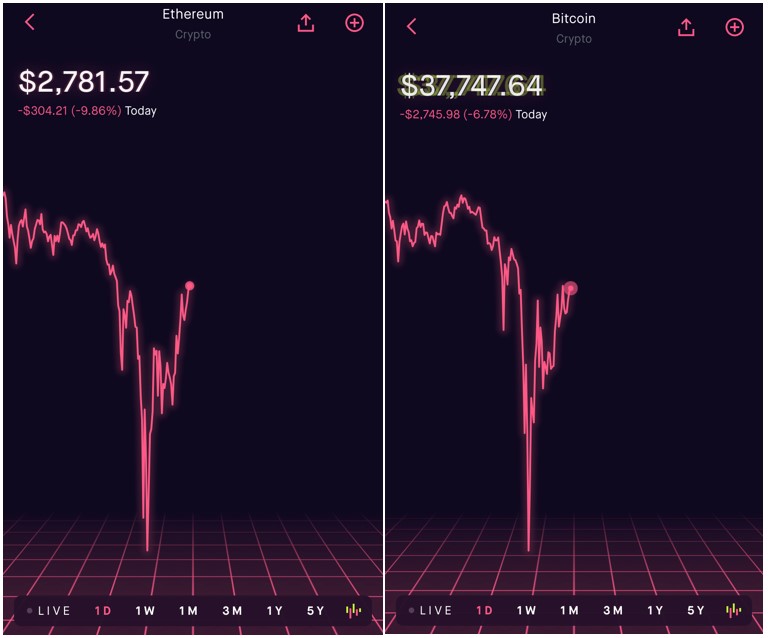

Prices did recover throughout the day but look at this waterfall from this morning:

Bitcoin briefly traded below $30k (after topping out at $64k last month). Ethereum touched $1,890 (after topping out at more than $4k in recent days).

This morning sure felt like a bunch of over-leveraged investors got margin called but who knows. I’m guessing it was some combination of panic, algorithms and margin calls.

If you’re an institutional investor who has been waiting for lower prices you finally got your chance.

But this is nothing new.

Last year in March bitcoin fell more than 50% in the span of two days during the Corona Crash. That one may have made more sense since everything else was crashing then too but the reasons don’t really matter when dealing with crypto.

This is an asset that is extremely volatile by its very nature. There is no federal reserve to calm the markets by lowering rates. There are no cash flows or income streams or earnings to speak of. Crypto is just code, innovation, expectations and emotions.

So you should expect these types of crashes on occasion. It’s par for the blockchain.1

These markets move lightning fast. And that’s what makes them equal parts exciting and terrifying as an investor. If you don’t have the intestinal fortitude to hold on, or dare I say, buy more, when this stuff is crashing, you have no business owning it.

It’s also interesting to note what else has been crashing of late:

Highly-priced growth stocks are crashing.

Even lumber futures are finally coming back down to earth.

Pretty much everything that worked last year has now crashed. If you want the big gains you have to learn to accept the big losses.

Bernard Baruch once said, “Become more humble as the market goes your way.”

If you don’t the market will eventually find a way to humble you.

Further Reading:

Sometimes You Just Have to Eat Your Losses in the Markets

1No one asked for this but here’s some crypto wordplay with traditional markets:

Buy when there are blocks in the street.

This is just a dead coin bounce.

The first rule of investing in crypto is don’t lose your password. The second rule of crypto is don’t forget rule number one more than 10 times in a row.

Be diamond hands when everyone else is paper hands and diamond hands when everyone else is diamond hands.

Our favorite hodling period is forever.