A few weeks ago we were having a discussion on Twitter about the greatest finance movies. Here’s the list we came up with:

- The Big Short

- Trading Places

- Wall Street

- Boiler Room

- Margin Call

- The Wolf of Wall Street

Someone then had the bright idea to recommend Michael and I re-watch some of these classics to see how well (or poorly) they aged, discuss how realistic they are/were, and talk about how things have changed in the markets since they came out.

For the first one, we decided to check out Boiler Room, the late-1990s/early-2000s movie about the old school chop shop commission-based brokerage firms who ripped off their clients.

We discuss:

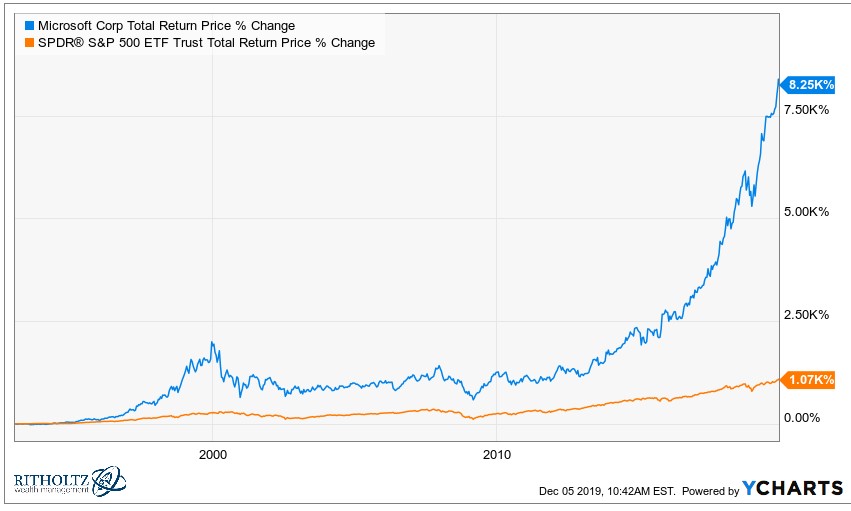

- How many millionaires did Microsoft produce in the 1990s?

- Can you believe people used to actually buy stocks from people who cold-called them on the phone?

- Did people really pay $2/share for stock commissions?

- What’s Vin Diesel’s real name?

- Is Ben Affleck’s speech one of his all-time acting performances?

- Would Matt Damon have made this movie much better as the star?

- Why selling is so important in finance.

- Is Boiler Room better than The Wolf of Wall Street?

- How normal people view the finance industry and much more.

Listen here:

Stories mentioned:

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: