This week’s Animal Spirits is sponsored by MarketSmith:

Go to www.investors.com/animal to receive your first three weeks of the MarketSmith service for just $19.95.

We discuss:

- Why Michael is getting back into trading

- Facebook’s new cryptocurrency

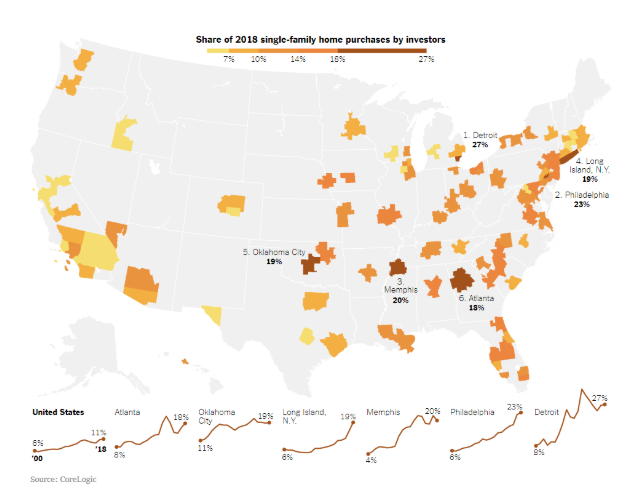

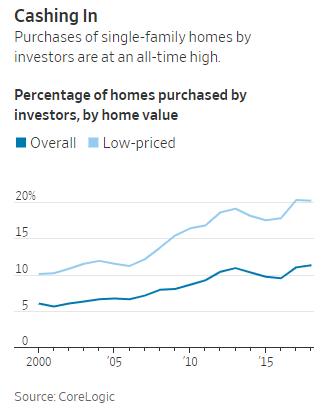

- Is it a good thing more professional investors are buying up starter homes?

- Should Vanguard get into private equity?

- Should the limits be lowered for accredited investors to put their money into hedge funds and private equity?

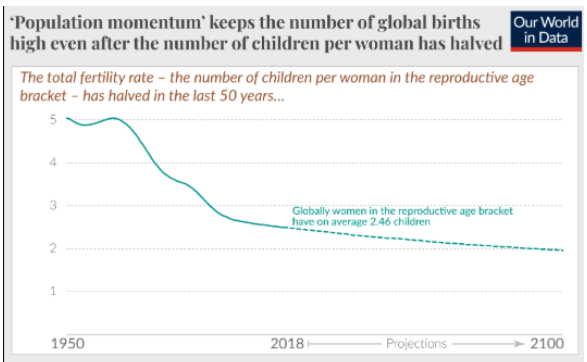

- Why Harry Dent says there will be a depression in the year 2073

- Can you really use demographics to predict the markets?

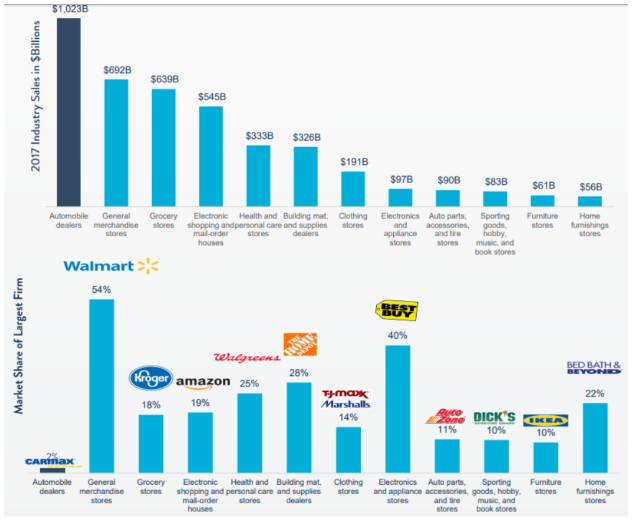

- Amazon has breadth, not depth in market share

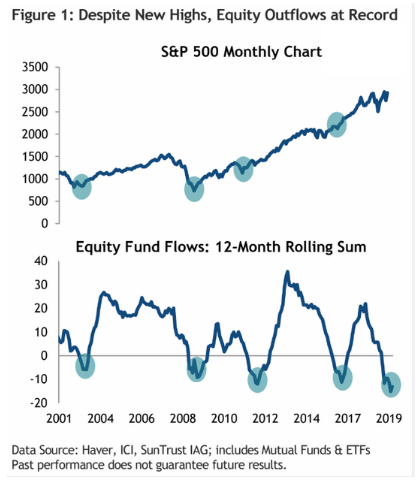

- Down markets attract sellers

- How many people cry after selling their home?

- Why it’s better to peak late in your career

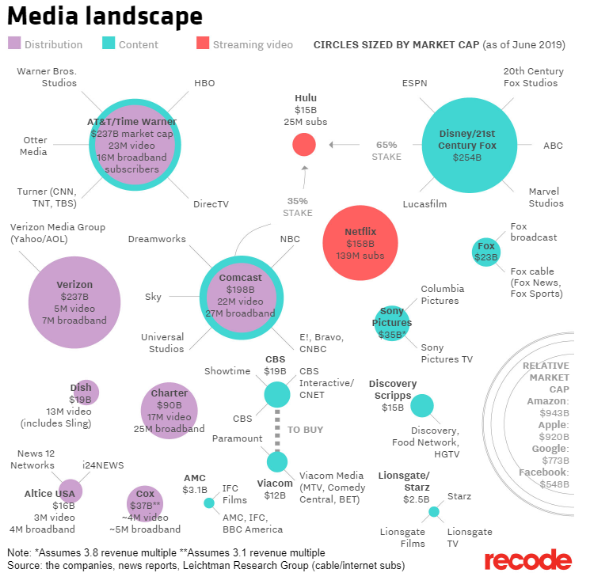

- Who owns the various media entities?

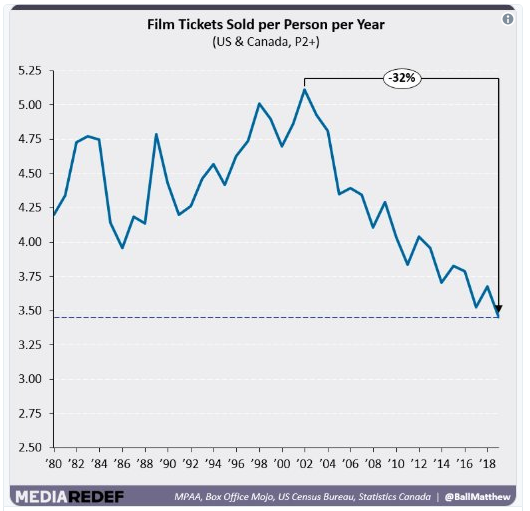

- Why the 1990s had much better movies than we do now

- Why gyms want you to pay but not come to the gym & much more

Listen here:

Stories mentioned:

- Facebook plans global cryptocurrency

- Want s house like this? Prepare for a bidding war with investors

- Investors are buying more of the U.S. housing market than ever before

- Indexing giant Vanguard explores a push into private equity

- Hedge funds for all?

- Your kids’ great depression in the making

- How to sell finance books like Harry Dent

- Your professional decline is coming much sooner than you think

- Here’s who owns everything in big media today

- How goes the behavioral change revolution?

- The Planet Money workout

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook and Instagram

Subscribe here: