In the wake of the recent college admissions bribery scandal that ensnared Aunt Becky and a whole host of other wealthy people, there were generally two takes from the content/social media apparatus:

(1) College is a meritocracy that benefits the rich. It shouldn’t come as a shock to anyone that rich people pull strings to get what they want but the numbers that came out of this story shows how skewed things are. In 38 of the top schools in the country, there are more students from the top 1% of income than the bottom 60% combined.1

(2) It doesn’t matter where you went to college. Once you get a job no one cares where you went to school. No one even bothers asking and the further away you get from graduation the less it matters. Success in the working world has little to do with the name of the school on your diploma.

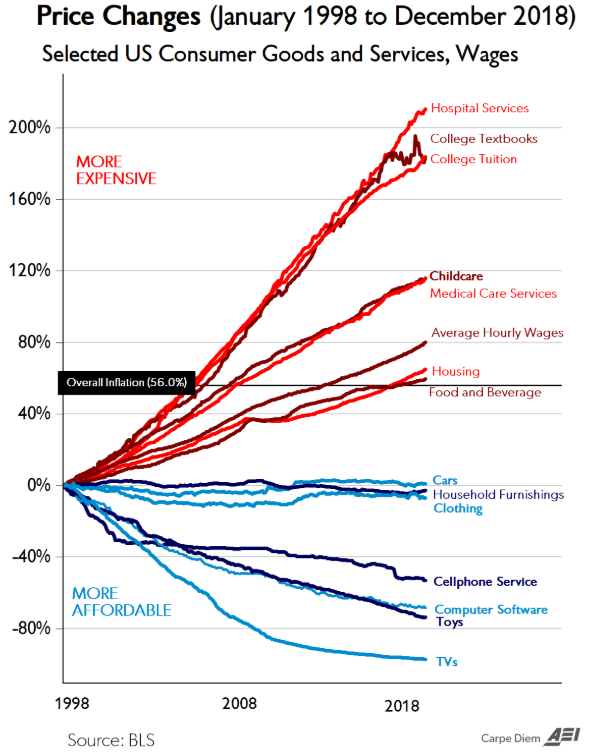

One of the biggest reasons this scam irked so many people is the cost of education is out of control:

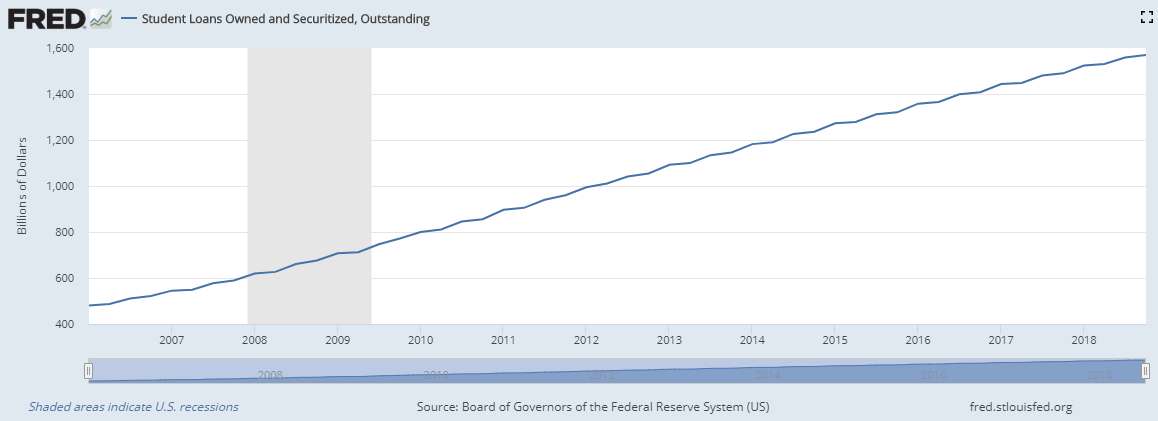

Which has led to student loans to explode higher:

What’s the point of taking out all of these loans to pay for an expensive education if all the benefits are just going to go to the wealth class anyways?

As with most things in life, there is some nuance required here. Both takes have an element of truth in them. It is unfair how many advantages the system gives to rich people but that doesn’t mean an elite school is the only way to attain a successful career.

Making extreme claims has become the default posture for many these days because we confuse outrage with truth in the social media era. Most things are a shade of gray, not black or white.

This same idea applies to the advice-giving business. Rules of thumb, pithy one-liners, inspirational quotes and phrases that rhyme can tell a good story but that story is often incomplete because there are few iron-clad rules in life or business.

Some people in the lifehack crowd tell you to say yes to everything so you don’t miss out on an opportunity.

Others tell you to say no to everything so you can stay focused on those things that are important to you.2

Both pieces of advice can work depending on your opportunity set. People who are truly successful have the luxury of saying no. People still trying to make it may not.

Investing advice can be similarly contradictory if you’re trying to base decisions based only on rules or thumb or quotes from famous investors. Some examples:

Buy when there’s blood in the streets. But don’t try to catch a falling knife.

Buy with a margin of safety. But don’t be afraid to pay up for high-quality businesses.

Diversification is a sign of ignorance. Actually diversification is the only rational deployment of our ignorance.

Only take advice from someone who has skin in the game. But ignore people who are simply talking their own book.

Markets are wildly inefficient and filled with irrational players. That may be true but the market is really hard to beat.

Don’t fight the Fed. However, the Fed is constantly blowing bubbles.

You never lose money taking a profit. However, buy and hold is your best bet over the long haul.

Think like a business owner when buying stocks. But price is the only thing that pays in the market.

You have to look at the world from a top-down perspective to understand what’s going on. But remember to ignore the noise and use a fundamental bottom-up approach to pick stocks.

Don’t try to buy at the top or sell at the bottom. Well, I make all of my money at the market turns.

You have to be disciplined in your investment process. But you must be extremely flexible to succeed in the markets.

Rebalance your portfolio by buying what’s lagging and selling what’s working. Also let your winners run.

If you like a stock you should hope it goes down so you can buy more at a lower price. But remember that losers average losers.

The stock market is not the economy. But the only thing that matters over the long-term is economic and productivity growth.

The trend is your friend. But you have to go against the herd to make money in the markets.

Rule number one is never lose money. But learn how to take losses quickly.

Each of these sayings could be true under the right circumstances but they are situational. You can’t create a comprehensive investment plan based on one-liners and quotes from Jesse Livermore. The world is not that easy.

Annie Duke tweeted earlier this week:

Instead of asking, “Are you sure?” Try asking, “How sure are you?”

“Are you sure” is a yes or no question. It demands unreasonable certainty.

“How sure are you?” allows for shades of gray. It says uncertainty is okay.

Many investors would like to hear advice that is unreasonably certain. It provides a level of comfort, even if it’s a false sense of comfort.

Hot takes and extreme positions may be more fun to debate but advice and decision-making are always context-dependent.

Further Reading:

Edges That Won’t Go Away

1And how do you know if someone went to an elite college or university? Just wait a couple of minutes; they’ll be sure to bring it up on their own.

2Many rich, successful people also espouse the benefits of meditation. But did they become successful because they meditate or do they meditate because they’re successful (and likely stressed out)?