A reader asks:

Putting aside the opportunity cost of the financial markets and 401k contributions and focusing only on making early mortgage payments, are you really making 4%/year if you make early payments on your mortgage? Extra mortgage payments ($50k for example), if paid early would only pay off the last scheduled payments of your payment stream—aka the ones with the highest principal balance and least amount of interest expense thereby reducing your term effectively in this case years 24-30 if paying off 20% days one you take out your mortgage. Here’s where the trick is, those last 20% of your payments have very little interest associated with them—so you are essentially paying off only the interest that would be attributable in the years 24-26, a much smaller sum than 50/250k, or 20%. This effectively makes your rate of return on paying off your mortgage in chunks earlier much less than a 4% return, likely down to less than 1%. Something to consider when treasuries offer a superior return to this and even saving accounts are now between 2 and 2.5%.

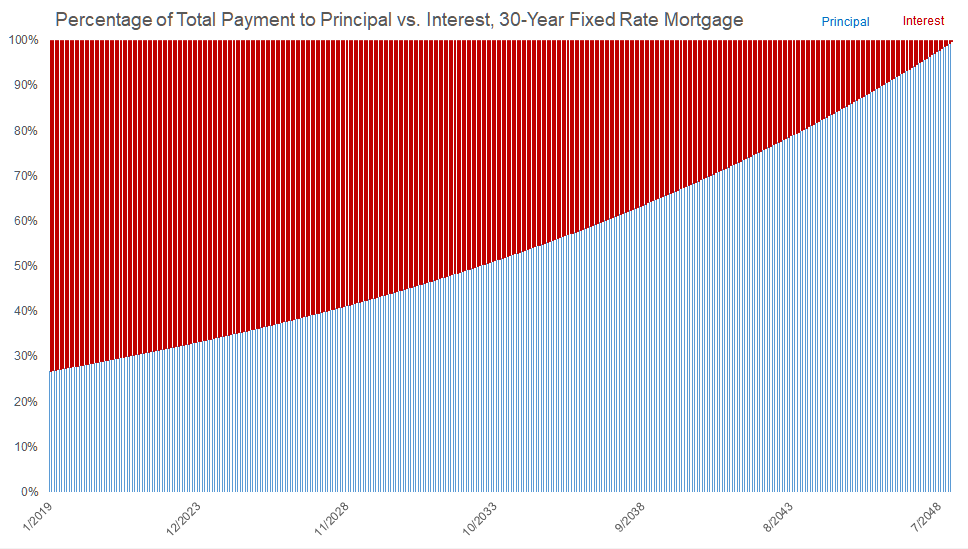

This question initially made my head hurt from thinking through all of the variables involved but this reader does have the right idea in mind. On a conventional 30 year fixed rate mortgage, this is the proportion of monthly payments that go towards paying off the interest expense and princpal over the life of the loan:

At the outset of your loan, around 70% of your payments go directly to the cost of borrowing. Even over the first 10 years of payments, the average is well over 60% of payments going to interest payments. You don’t start making a huge dent in principal for a long time.

This is the reason so many people like the idea of prepayments on a mortgage — that money goes directly to principal repayment. Paying down your principal balance lowers your overall interest payments over the life of the loan and shortens the length of the loan as well.

Let’s walk through a couple of examples to see this in action.

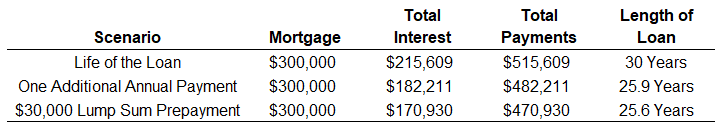

A 30 year fixed rate loan on a $300,000 mortgage would cost roughly $215,600 in interest over the life of the loan with a monthly payment of $1,432. So the total outlay would be around $515,000.

Now let’s say you would like to make the equivalent of one extra payment on an annual basis. This would require an additional $119/month. Paying an extra $1,432 a year would take a little more than four years off the life of the loan and save you nearly $34,000 in interest costs for a total outlay of $482,000.

Next let’s say you decided to make a lump sum prepayment because you came into some cash because of a bonus or inheritance. A $30,000 lump sum prepayment would have an even greater impact, taking the life of the loan to just under 26 years, with a total outlay of roughly $471,000 over the life of the mortgage.

Here’s the summary:

To get the life of the loan under 20 years in this scenario, you would have to pump in an extra $400 a month or so.1

The problem with coming up with an actual return on these calculations, as my reader pointed out, is that there are so many variables to consider. Not only is there opportunity cost, but there is the illiquidity of your home to consider, the potential tax benefits, and the fact that most people don’t stay in a home for 30 years.

There are a number of considerations people should take into account before deciding to forgo other financial opportunities before plowing the majority of their cash into their home:

- How long do you plan on living in your home? If you’re not going to live in the house for the life of a 15 or 30-year mortgage (or whatever your payment period happens to be) it doesn’t make a ton of sense to pay off your house early. It’s an illiquid asset that may or may not appreciate but if it represents the bulk of your financial assets, there are huge concentration risks to consider when you do have a liquidity event (sell the home).2

- What is the money being used for? We lived in our first home for around 10 years and ended up making double the payments for the last 5 years or so. It helped build some equity but after we sold that money was simply there for either a down payment on our next home or to pull the money out and use for something else. That process made me realize our money was basically doing nothing for 5 years when it could have been put to more productive uses. At the very least it could have sat in a liquid savings account to at least give us some options.

- Do you need a form of forced savings? This gets back to the idea that some people need tax refunds as a form of forced savings, even though they act as a de facto interest-free loan to the government. You may be able to find better returns elsewhere but if you don’t dutifully invest the money you would be using to pay off your mortgage early, then it makes sense from an emotional perspective. Not every financial decision comes down to a spreadsheet.

- Do you have a specific date or time frame in mind? Many people would like to go into retirement with a clean slate in terms of debt. Paying off debt by the time you retire is a worthy goal and offers enormous flexibility and peace of mind. Others shoot for having their mortgage paid off by the time their kids go off to college to free up the cash to help pay for it. This one makes a little less sense if those prepayments are made in lieu of 529 contributions, but I get the idea.

Paying off your mortgage early may not lead to a guaranteed return equivalent to your mortgage rate but for some people that may not matter. They just want the peace of mind that comes from getting rid of their debt payments. And if you are in the financial position to afford that option, I can see how the emotional return could trump whatever you could get from the financial markets.

In many ways, this discussion is much like the debate between renting and buying a home. There are so many variables to consider that it’s impossible to offer boilerplate advice or even figure out the exact financial implications. Every situation will be different depending on the personal circumstances involved.

But it is important to understand that prepaying your mortgage does not necessarily guarantee you a rate of return equal to that interest rate.

Further Reading:

Rebalancing Your Personal Balance Sheet

1You could also use a 15 year fixed rate mortgage to earn a lower interest rate which could help.

2An adjustable rate mortgage (ARM) is another option for those not willing to stay in their house for very long but that’s a subject for another post.