On this week’s Animal Spirits podcast Michael and I predicted some vicious countertrend rallies in the midst of the current bear market in stocks. Here’s the tape:

There was some fortuitous timing with the release of the show and the market action that followed. We taped this one a little early because of the holidays but Animal Spirits comes out every Wednesday morning. And it just so happened that the S&P 500 rallied hard yesterday, to the tune of a 4.96% gain.

I’m not looking to take a victory lap here (OK, maybe a little) but to use this example as a way to use situational awareness in the markets to help set expectations for your portfolio.

Markets are never predictable in the sense that if A occurs then B is sure to follow every time. But human nature is predictable in the sense that our reactions are heightened during periods of stress. And losing money can be one of the most stressful situations for our brain to handle because we’re simply not hardwired to deal with loss in an evenhanded way.

Volatility is almost always heightened during market downturns but that volatility manifests itself both to the upside and the downside because investors overreact when things aren’t going well.

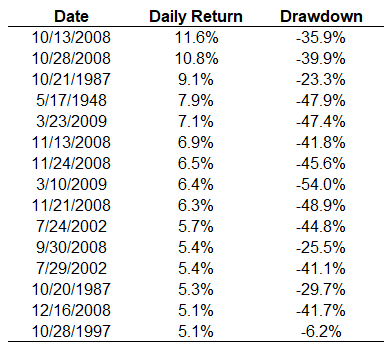

I looked at the daily returns on the S&P 500 going back to 1945 and found 48 instances where the daily gain was 4% or higher. That’s pretty rare when you consider there have been more than 18,000 daily trading sessions in that time. So gains of this magnitude have only occurred less than 0.3% of the time over the past 70+ years.

However, those rare big up days do have a lot in common. 38 out of 48 occurred during a drawdown of 20% or worse while 45 took place during a drawdown of 10% or more. And two of the 3 big up days that took place when stocks weren’t in correction territory happened during the dot-com bubble (October 1997 and March 2000).

Here are the 15 biggest up days on the S&P 500 since 1945 along with the drawdown they were in heading into that advance:

It’s pretty obvious the big up days tend to take place when markets are falling.

A lot of the analysis on social media yesterday reminded investors of this fact. “This isn’t the type of behavior you see during market bottoms,” said everyone and their brother who has ever looked at the historical pattern of stock market returns.

But even traders can become overconfident when spouting off these rules of thumb because there are always exceptions to every rule. Market participants adapt. Memories shape how we view future risks and opportunities.

So as long-term investors, why should we concern ourselves with understanding uptrends and downtrends in stocks?

One very simple reason is situational awareness allows us to prepare for a range of possibilities, without having to bet on one of those outcomes in advance. The most important thing to understand about market downtrends is that they pave the way for a broader set of possible outcomes, and not always in a good way.

But it’s not just the path of stock market returns that matters during these environments. Everything is turned up.

The volatility of opinions is crazier during market downturns.

The charlatans come out in full force to prey on your emotions during these trying times.

Bear markets never let any investor stay comfortable.

The markets are going to toy with your emotions every which way.

Michael and I didn’t exactly go out on a limb by predicting enormous countertrend rallies during a swift stock market sell-off. That was almost guaranteed by human nature. What matters most is what comes next.

While no one ever knows for sure how long the volatility will stay with us, it’s important to remember that your actions aren’t nearly as important as your reactions during a bear market.

*******

Listen to our full thoughts on the current market environment and much more and don’t forget to subscribe, rate, and review the show as well:

Animal Spirits Episode 61: The Bear Market