On this week’s Animal Spirits with Michael & Ben we discuss:

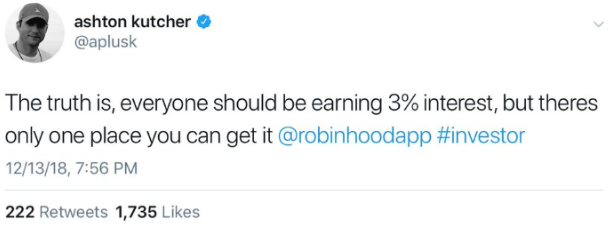

- Robinhood’s debacle of a rollout for their checking & savings accounts

- Or was this all a PR stunt? What does Ashton Kutcher think?

- Do millennials even care about banking regulations?

- Where can you find higher interest rates for your savings?

- What can fund flows tell us about the markets?

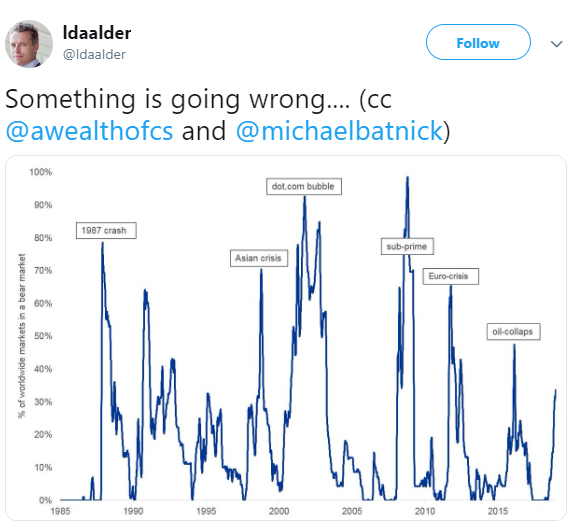

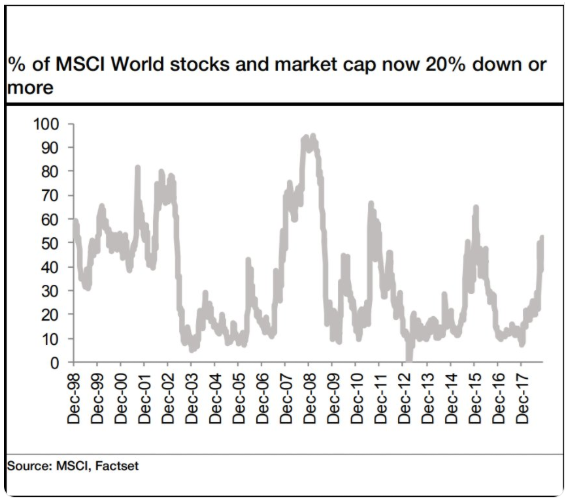

- How many country stock markets are in a bear market?

- Can an individual stock be in a bear market?

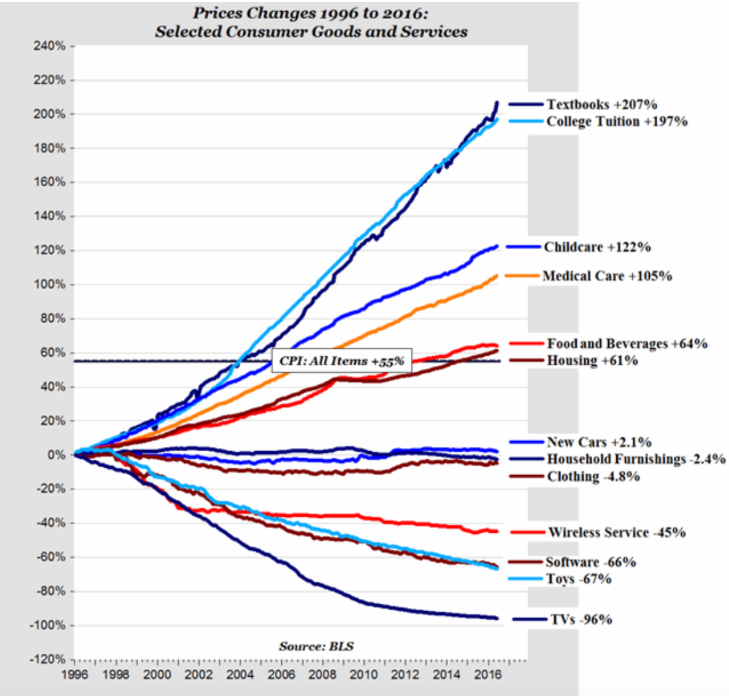

- How worried should we be about the size of student loans?

- Does the good outweigh the bad considering the cost of taking on college debt?

- The NY Times Style section wants to know if you’re ready for the financial crisis of 2019.

- Do ex-FANG market valuations count?

- How long should Twitter threads be?

- What happens when someone from NYC takes you out to a restaurant?

- Jimmy Butler’s minivan and much more.

Listen here:

Stories mentioned:

- Robinhood will retool checking product following scrutiny

- College bloat meets the blade

- Next year

- Are you ready for the financial crisis of 2019?

- Good news and bad news about saving for college

- My dad’s friendship with Charles Barkley

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: