On this week’s Animal Spirits with Michael & Ben we discuss:

- Is universal basic income feasible in the US?

- How much would it cost to give everyone aged 18-65 $1,000/month?

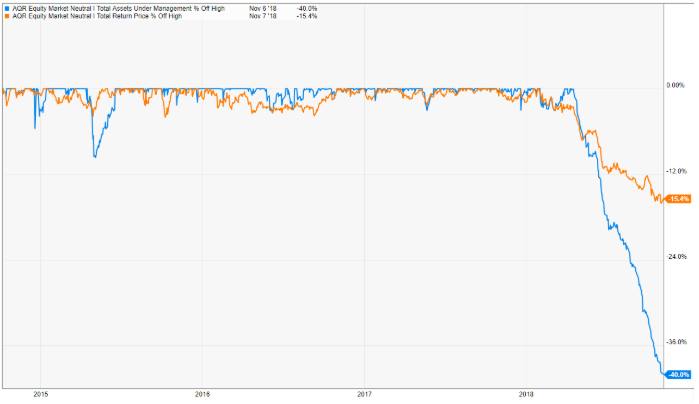

- What does the perfect hedge fund look like?

- What do investors expect from their liquid alts & hedge funds anyways?

- Why isn’t the language of money mandatory in schools?

- Should Robinhood customers care their trades aren’t really “free”?

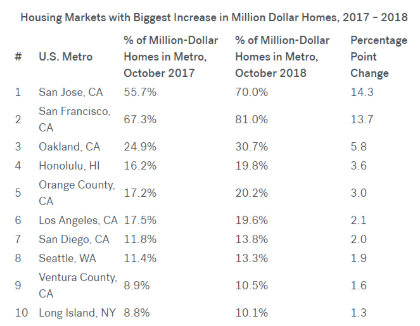

- The ridiculous cost of buying a home in California.

- Is social media or income inequality to blame for the decline in youth sports participation?

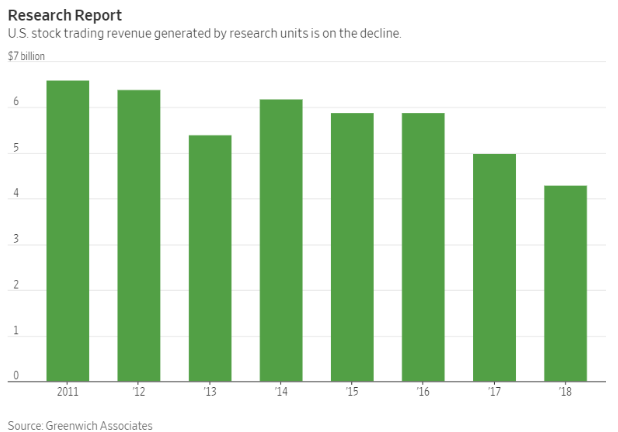

- Why are Wall Street firms selling less research to clients?

- How should you think about dollar cost averaging in terms of your income variation?

- Does is ever make sense to pay a high fee for a fund?

- Career advice for a new mom and much more.

Listen here:

Stories mentioned:

- Presidential candidate wants to give everyone $1,000/month

- Universal Basic Income is ahead of its time

- Quants facing a crisis of confidence

- Hedge funds brace for a bloodbath

- 3 basic financial questions that surprisingly stump most Americans

- Why ‘free trading’ on Robinhood isn’t really free

- Million dollar creep

- Income inequality is killing youth sports

- Wall Street analysts selling more data, less analysis

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: