On this week’s Animal Spirits with Michael & Ben we discuss:

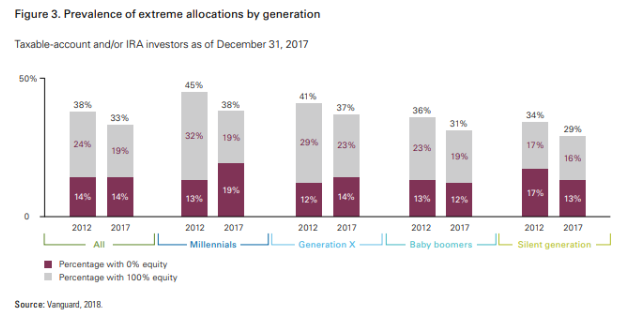

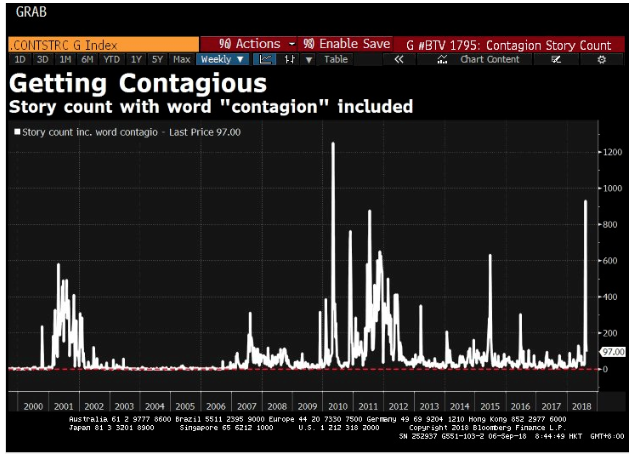

- The lingering impact from the financial crisis on investor risk appetite.

- How a financial crisis in your formative years can leave lasting scars.

- Every generation has their own ‘Death of Equities.’

- Even the Fed makes decisions based on pasts crises.

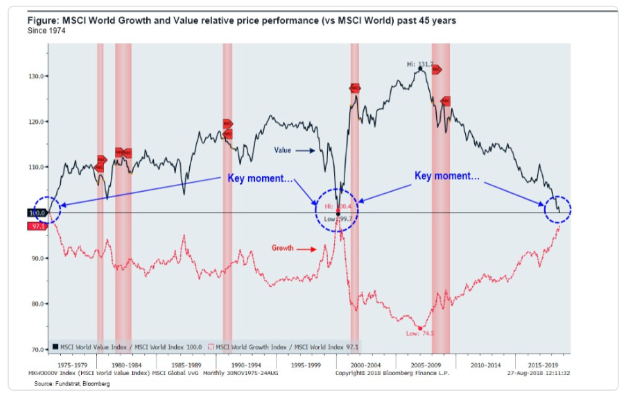

- Cliff Asness on how to think about performance struggles.

- Is there mean reversion in liquid alts?

- Are half of all young people deleting the Facebook app?

- Will half of all colleges be bankrupt in 10-15 years?

- How much money will you spend in retirement?

- Fake day trading guys concoct the worst Ponzi Scheme of all-time.

- Why do athletes keep hiring scumbag accountants?

- Can you use Google trends to invest?

- What if Goldman Sachs would’ve purchased iShares in 2009?

- Some follow-up thoughts on the FIRE movement and much more.

Listen here:

Stories mentioned:

- How the financial crisis still affects investors

- A death of equities redux

- Risk-taking across generations

- The man in charge of TARP

- Liquid alt Ragnarok?

- Life insurance is not for saving

- Facebook exodus

- Half of American colleges will go bankrupt in 10-15 years

- Watch what people do, not what they say

- How to think about healthcare costs in retirement

- Fake day trading platform nets fraud charges

- Oxycontin maker gets patent to treat opioid addiction

- Kevin Garnett sues accountant

- How banks lost the battle for power on Wall Street

Books mentioned:

Charts mentioned:

Tweetstorms mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: