On this week’s Animal Spirits with Michael & Ben, we welcomed Morgan Housel back to the show. The three of us discussed:

- Elon Musk’s bizarre tweet about taking his company private.

- What odds we all place on TSLA actually going private with funding secured.

- The shrinking U.S. stock market.

- Is venture capital in a bubble?

- Why everyone wants to get into private investments.

- The impressive rise of Tinder, Slack, Snapchat, and Peloton.

- Why Tinder might be the preferred sin stock of the future.

- Is “The Netflix of…” the new “The Uber of…”?

- Are there more suckers at the poker table in the VC market?

- Do investors need to participate in private investments to take part in the growth of tech companies?

- If you had to pick a fictional character to manage your money for you, who would you pick?

- Is loss aversion a fallacy?

- Our favorite books of the summer and much more.

Listen here:

Stories mentioned:

- Elon Musk does some fun stuff with Tesla

- The shrinking U.S. stock market

- Old money billionaires are chasing new tech riches

- Instagram added more new users last year than Snapchat has in total

- Slack is raising $400 million

- The Netflix of fitness

- Snapchat shrinks by 3 million users

Books mentioned:

- Rocket Men: The Daring Odessey of Apollo 8 and the Astronauts Who Made Man’s First Journey to the Moon

- Behave: The Biology of Humans at our Best and Worst

Be sure to check out our previous episode with Morgan:

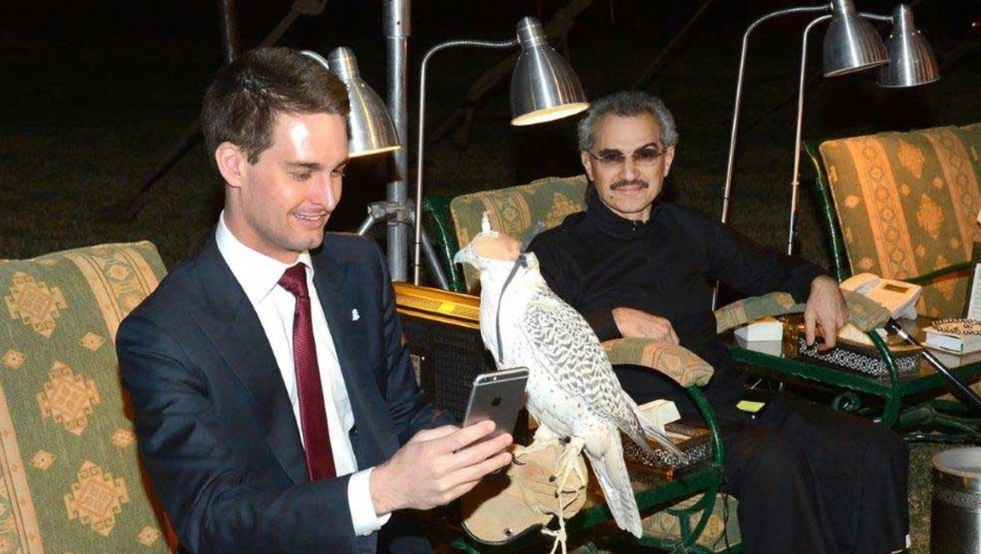

Photo of Prince Alwaleed and Snapchat founder Evan Spiegel mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: