In my last post I looked at a short history of drawdowns in foreign developed stock markets.

Investing in international markets may seem like a kick in the pants at the moment. Not only have U.S. stocks been outperforming for some time now, but the losses have been more severe and commonplace overseas.

Markets are inherently cyclical so investor risk appetites are up and down right with them. Diversification is supposed to take advantage of cycles or at the very least lessen their impact on performance. So an aversion to markets that are performing relatively poorly is an aversion to diversification.

It makes sense that U.S. investors would be looking to avoid poorly performing markets.

I would guess it could work out for investors who have all their equity exposure in the U.S. but here are some considerations for those who are both for and against diversifying globally:

Diversification benefits. Since 1970, the U.S. has outperformed the MSCI EAFE (Europe, Australasia and the Far East) 23 out of 48 calendar years (thus, foreign stocks have outperformed 25 of 48 years).

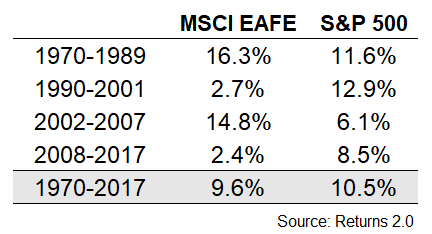

Relative performance numbers have been extremely cyclical as well:

The U.S. has outperformed over this entire period but it’s interesting to note that all of this outperformance has occurred since 2010. From 1970-2009, the annual returns were 10.2% annually for the EAFE and 9.9% per year for the U.S.

A portfolio split 70% in the U.S. and 30% in foreign stocks, rebalanced annually, would have given an investor an identical 10.5% annual return to U.S. stocks with a slightly lower volatility that each of the individual indexes themselves.

The S&P had a lost decade from 2000-2009, falling almost 10% in total. In that time, the EAFE index rose almost 20% in total. Both of these are dismal returns for a 10-year stretch but 30% in relative returns is better than nothing.

While it’s always difficult to hold onto or rebalance into a relative underperformer, diversifying reduces the regret from not owning the better performer of the two. So international diversification can provide psychological benefits beyond portfolio management considerations.

Behavioral diversification. Diversification can not only help with your own emotions about investing, but it can allow you to take advantage of the emotions of others as well. Human nature is the one constant we’re all forced to deal with when investing but people from different countries and regions are bound to react differently to their own situations.

You could perform all of the sector, valuation, or economic analysis you want to compare foreign stocks to U.S. shares but the cultural element and different ways people approach the markets is an underrated facet of global diversification.

Globalization. Globalization is blurring the lines between what constitutes an investment in a certain country. S&P 500 companies get more than 40% of their sales from overseas customers. Honda is a Japanese country but it manufactures the Accord at a factory in Ohio. The Odyssey minivan my wife and I haul our 3 little ones around in was made in Alabama.

Owning stocks is one way to take part in the innovation of people, businesses and ideas. Investing in foreign markets is a bet that people in other parts of the world wake up every morning wanting to improve their standing in life as well, no matter where their products are purchased.

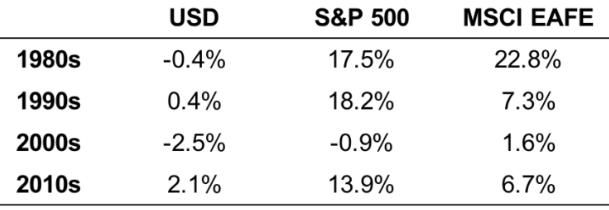

Currencies matter. The EAFE return numbers I’m showing here are from the perspective of a U.S. investor which takes into account currency fluctuations from other countries back into the dollar. Here’s a look at how the dollar can impact these returns from a post I wrote earlier this year:

Currencies can add additional sources of volatility, diversification, and gains or losses depending on the environment. You can hedge currency exposure but it’s best for most investors to not overthink this decision. Trying to time currency cycles can lead to performance chasing if you’re not careful.

I prefer an approach that picks either hedged or unhedged and stick with it come hell or high water as these things have a way of balancing themselves out over the very long-term.

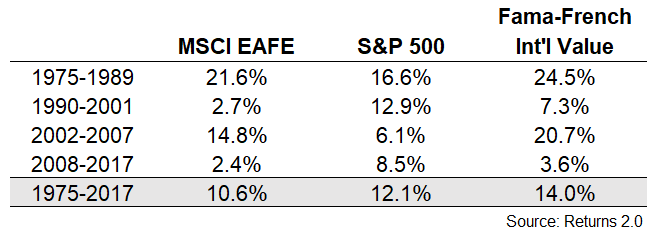

Factors abroad. Investing globally isn’t the only strategy investors have become wary of during this cycle. Value investing has been going through an annual funeral for years now. But if you look at the numbers, value has been holding up well overseas:

Fama-French data only goes back to 1975 so I’ve tried to recreate the same cycles I showed above from that starting point. Of course, these are all indexes I’m showing here with no costs involved but you can see from a fundamental standpoint that there could be additional diversification benefits by looking at factor investing abroad, as well.

Even if the outperformance doesn’t show up in the future there should be a positive impact from rebalancing and mean reversion assuming a disciplined approach to asset allocation.

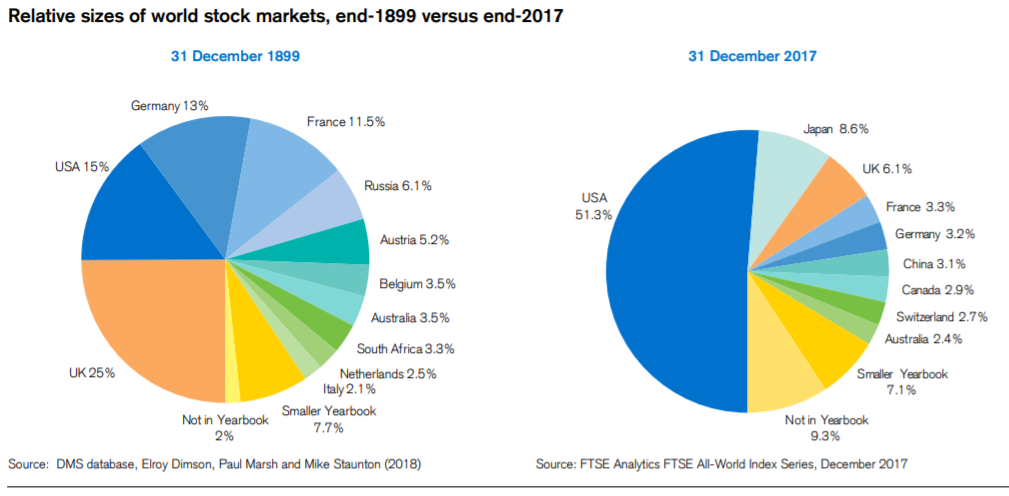

No one knows what’s going to happen. I find myself coming back to this chart from the Credit Suisse Global Investment Returns Yearbook on a regular basis an exercise in remaining humble:

Some may cite this data as a reason to invest solely in the U.S. but I see it as the opposite. No one had a clue at the turn of the last century that the U.S. would be the clear winner among the world’s largest economies.

You could make a pretty strong case that the U.S. will continue to dominate the economic landscape for the remainder of this century as well but nothing is guaranteed. And even if the economic ranking for the U.S. remains strong, that says nothing about the returns investors will receive.

What international diversification will not do for you. International diversification will not protect you from market crashes. When the Fed finally does away with their ban on crashes in the U.S., foreign stocks will likely crash too.

And diversification is never about protecting investors from a bad week, month or even multi-year period. Diversification is not for impatient people.

Diversification can protect you from having a home country bias and the risk of holding a concentrated position in a single economy or market. So international diversification is a risk management tool.

Even if it doesn’t enhance returns, it’s hard to put a price on the protection it provides from being invested in the wrong country at the wrong time for an extended period.