A few weeks ago Steve Chen asked me on his podcast for my thoughts on zero coupon bonds and how they potentially fit into a portfolio.

There are no right answers in terms of what fits into a portfolio because portfolio construction can take many shapes and forms.

So when working through something like this I like to take a step back and look at the characteristics of the asset or strategy in question and determine how they would work in the context of an overall portfolio.

I may have to harken back to my CFA days for the explainer on zero coupon bonds but here goes…

You can think of a zero coupon bond as something like a CD where you don’t receive regular interest payments. Instead, you simply purchase these bonds at a discount and when they mature you would receive full par value.

For example, let’s say you buy a zero coupon bond with a $10,000 par value. If this bond had a life of 10 years and was discounted back to the present value at 3% interest rates, you would pay just under $7,500 for it. Then in 10 years, you would receive $10,000 for your troubles with no interest payments made along the way. Going into this type of investment you would know that your return is going to be $2,500 or so at maturity. The return is baked into the price you pay for the zero coupon bond.

These bonds could be useful if you know you’ll have a specific payment or cash flow on at a specific time.

But there are downsides. Even though you don’t technically receive periodic interest payments, you would still have to pay taxes on the imputed interest so it would make sense to hold these in tax-deferred accounts. And because there are no interest payments on these bonds, they tend to fluctuate more widely than a standard bond, all else being equal. Zero coupon bonds are much more sensitive to changes in interest rates.

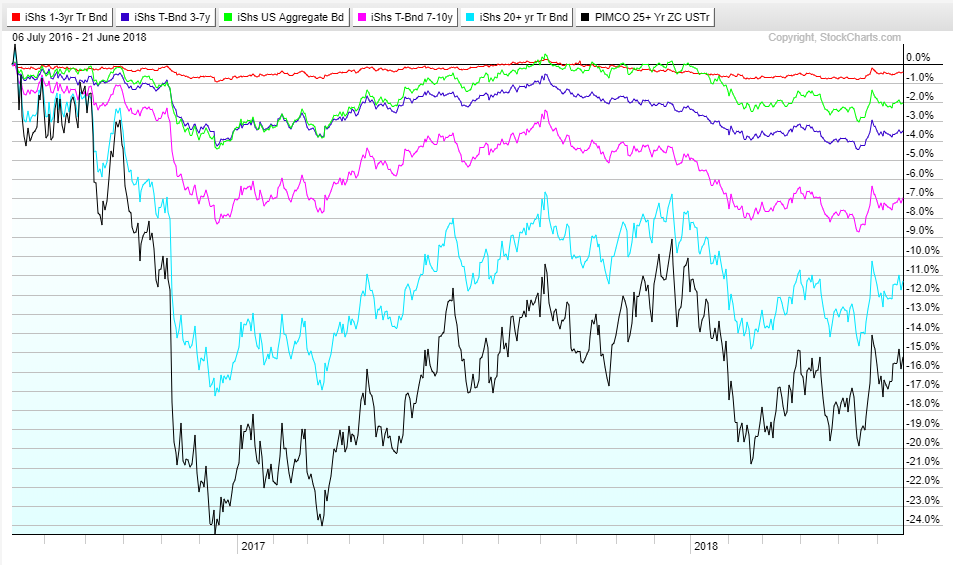

You can get a good sense of this by comparing the drawdowns on a handful of bond ETFs since rates bottomed in the summer of 2016:

In this time, 10-year treasury yields have roughly doubled, but this rising rate environment has had a drastically bigger impact on the zero coupon bond ETF (ZROZ). The losses were close to 25% in the second half of 2016 alone. This is partly due to the fact that this is a long duration fund but you can see the volatility has been even more severe in ZROZ than in long-term treasuries (TLT).

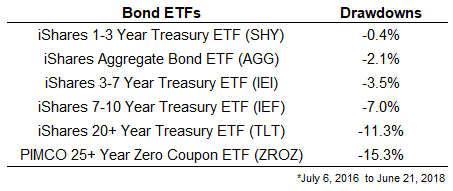

Here’s a table that shows the values of these drawdowns:

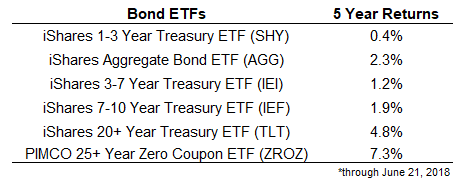

I would be remiss if I didn’t take a look at the other side on this topic and show the returns of these various funds:

Even with the larger losses in recent years, long duration bond funds have still outperformed over the previous five years, mainly from their higher yields. This is a nice illustration of the risk-reward relationship in bonds. Higher yields don’t guarantee higher returns over the short-term but there’s a fairly strong relationship over the long-term in bonds.

I’ve been beating this drum for some time now, but investors in fixed income — no matter how they invest in that asset class — need to prepare for more volatility in the years ahead than they’ve been used to. That’s true for rising or falling rates (neither of which is a foregone conclusion).

I can’t offer a final verdict on zero coupon bonds because these decisions are always portfolio and personality dependent. It really depends what you want to get out of the fixed income side of your portfolio and how willing you are to accept duration risk.

Regardless of the bonds you choose for your portfolio, it’s helpful to understand the relationship between yields, risk, and returns.

*******

You can listen to my entire podcast with Steve from New Retirement here:

Ben Carlson Shares the Wealth (NewRetirement)

Now here’s what I’ve been reading lately:

- Happily misbehaving (Humble Dollar)

- Why incompetent people don’t know they’re incompetent (Psychology Today)

- Our exorbitant privilege (Big Picture)

- The fall of GE and the rise of indexing (Prag Cap)

- It ain’t what you don’t know that gets you into trouble (AQR)

- CAPE of good hope? (EconomPic)

- Trust the process (Alpha Architect)

- Most improved (The Lund Loop)

- Nobody likes the micros (Gambler Bias)

- Mistakes were made (What Works on Wall Street)