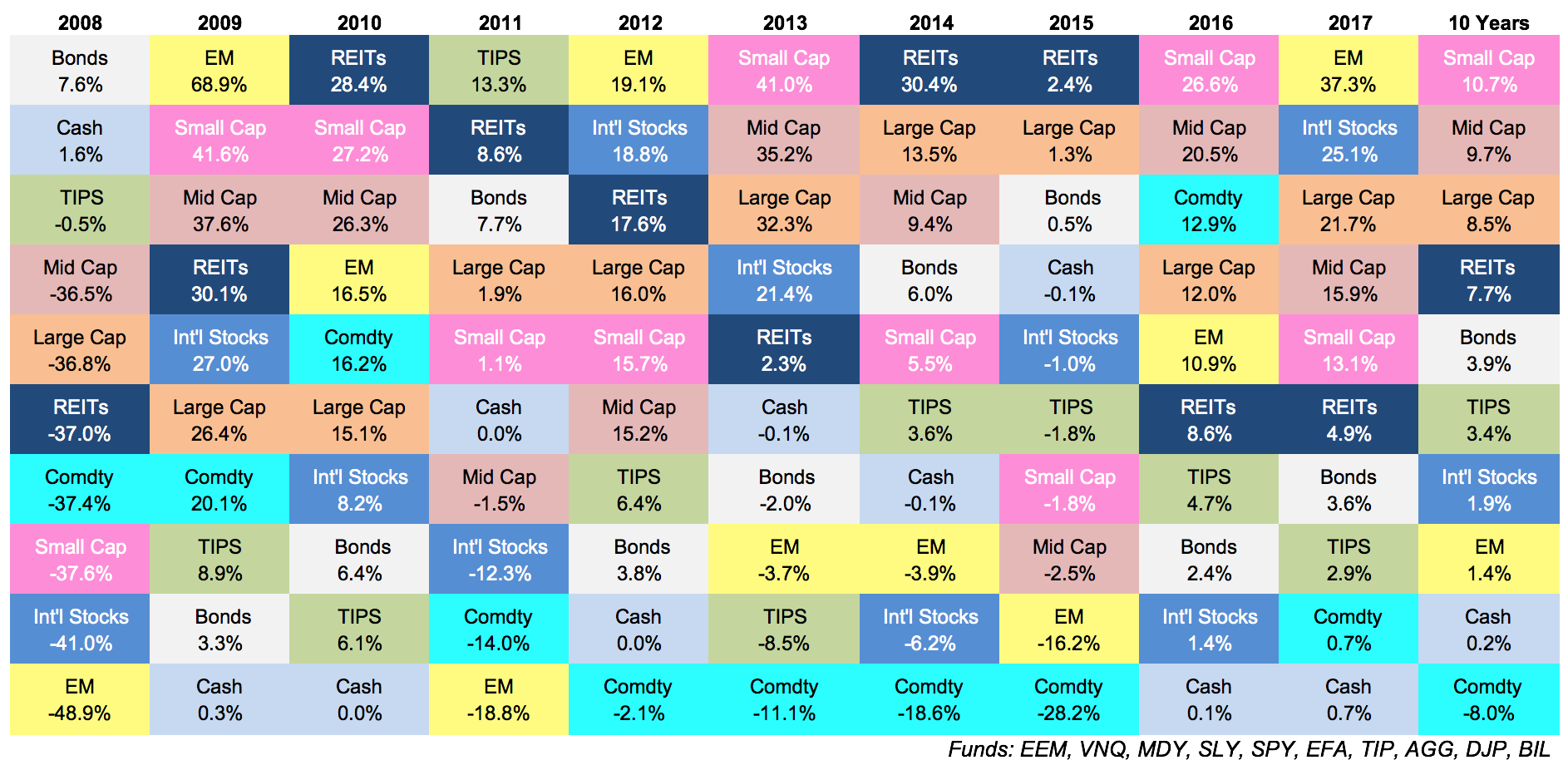

Each and every year since I started this website I’ve updated the following asset allocation quilt:

For the second year in a row each asset class on this chart was positive. 2017 was a good year for investors.

Looking at this list also serves as a reminder that next year the 2008 data will drop off the 10-year return numbers. So while the current 10-year numbers look pretty good, barring a market meltdown in 2018, the 10-year numbers at the end of this year are going to look fantastic for most of these markets.

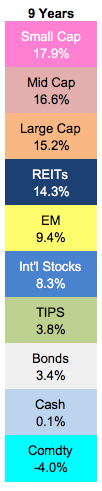

To give you an idea, here are the 9-year annualized returns:

Investors who pick their holdings based exclusively on past performance are going be in heaven when they see these results which will likely lead to disappointment for many.

This is my favorite performance chart for a number of reasons:

- It reminds me to stay humble. Predictions about the top (or bottom) performing asset classes in any given year are hard. There are probably some rules-based strategies to sort these asset classes to do a little better than a simple strategic allocation but there are many ways in which to do worse by trying to select the best one year in and year out.

- It reminds me to think and act for the long-term. Charley Ellis once said, “The average long-term experience in investing is never surprising, but the short-term experience is always surprising.” One-year performance numbers don’t really tell you a whole lot. Even the 3- and 5-year numbers can be misleading in most cases so it takes a lot of discipline and patience to be an actual long-term investor to think beyond short-run performance numbers.

- It reminds me how random markets can be. Sometimes the worst performer in one year becomes the best in the next year and vice versa. Sometimes these asset classes go on hot or cold streaks and put together a string of solid or subpar performance. Cash makes for a lousy long-term investment option (especially at current rates) but can be a top performer when risk assets sell-off. Even 10 years can show terrible returns on your stock investments (see international and emerging markets over the past 10 years as a perfect example).

- It reminds me of the importance of diversification. Diversification is a boring way to invest but it’s the simplest form of risk control for those who would like to avoid going broke or losing their mind in the markets. You’ll never get rich overnight by diversifying but you’ll never lose it all overnight either. When markets are rocking (as they have been wont to do of late) diversifying makes you feel silly but there will come a time when it comes in handy.

- It reminds me of the importance of understanding the concept of mean reversion. No asset class outperforms always and forever. It may have felt like international stocks or emerging markets or even commodities were dead money in recent years as they all got destroyed by U.S. stocks. Eventually, these cycles turn, often before you can prepare for it or find a legitimate reason for it.

- It reminds me how vast the investment universe is. This is a fairly broad group of asset classes. There are many more options available to investors these days beyond this group. I could’ve created one of these using sectors, countries, risk factors, alternative investments or hundreds of different variations. Last year someone took my quilt and added Bitcoin to the mix. Creating an asset allocation is the easy part. Being content with the portfolio you choose and avoiding the temptation to constantly tweak it and make changes is the difficult part.