In a recent piece, I discussed why it’s not that out of the ordinary for a handful of stocks to account for a large portion of the stock market’s gains. This is just the nature of the beast with the stock market. There are very few big winners and lots of big losers over the long haul.

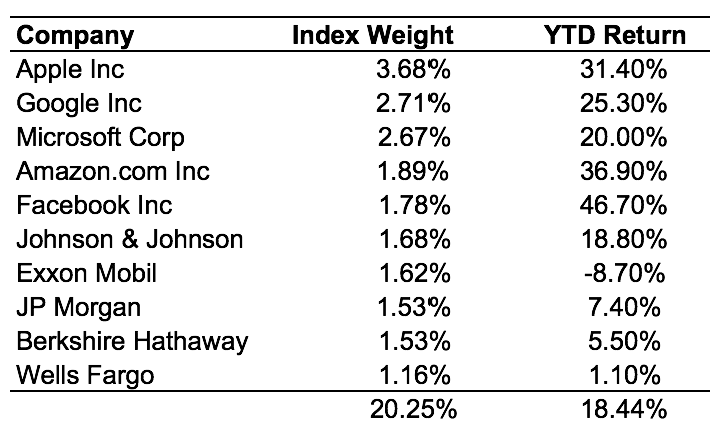

This year the largest stocks are some of the biggest winners in the market:

The average return for the top 10 stocks is almost 19%, just shy of double the 11% or so return on the S&P 500. While it’s not an aberration for a small number of stocks to carry the returns in the stock market over time, it is out of the ordinary to see the biggest names outperform like this.

Ned Davis Research wrote a piece a few years ago that showed from 1972 to 2013 the S&P 500 was up close to 5000% but if you would have owned just the biggest stock in the index every year you would have only gained around 400%.

Trees don’t grow to the sky so it would make sense that there is a ceiling for the performance of the biggest names in the market. The biggest gains come from getting to the top spot, not after you already make it.

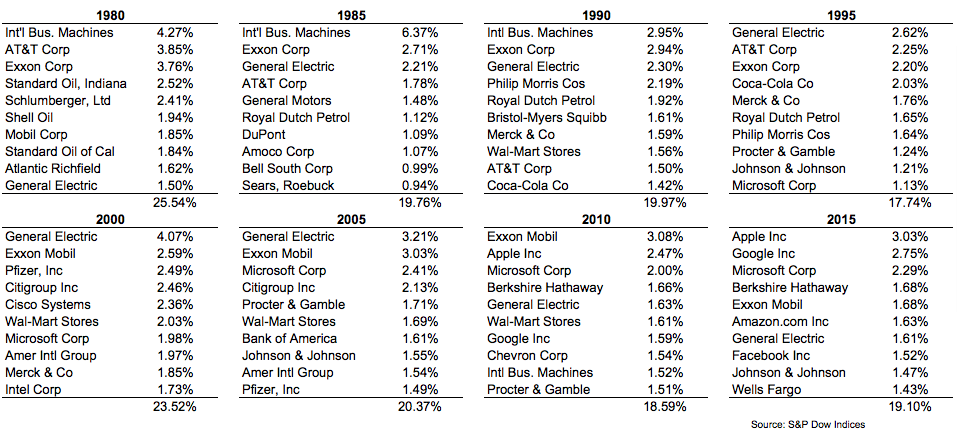

It can also be useful to see how the composition of the biggest stocks in the market has changed over the years. Using data from S&P Dow Indices, I broke out the top 10 stocks in the S&P 500 at year-end every five years going back to 1980:

Here are some observations on this data:

- The turnover in the ranks of the top 10 stocks is fairly healthy. Every five years there has been an average of 4.5 new companies that enter the top 10. I view this as a good thing as this is capitalism at work.

- There isn’t that much variation in how much the top 10 companies comprise of the overall index. It’s fairly stable over time plus or minus a few points around 20%.

- General Electric had quite a run as it was on the list every 5 years from 1980-2015. Alas, nothing lasts forever and GE isn’t on the list today.

- The top 5 companies today are all technology companies (we can quibble on how to define some of these firms but they are mostly tech firms). This has some people worried. Maybe it should cause us some concern but look at the top 10 companies in 1980 — the list was dominated by energy companies, a much more cyclical industry.

- Both Citigroup and AIG were on the top 10 list in 2000 and 2005. These were two of the companies that were responsible for nearly taking down the entire financial industry and have suffered enormous losses because of it. Since the end of 2005, Citigroup is down 86% while AIG has fallen more than 95% in market cap.

- Some other stocks that appeared on this list over the years that have fallen on hard times: Sears, Eastman Kodak, General Motors, Ford Motor, America Online and Bank of America.

- The relative newness of the top 5 is quite a story. Apple was rescued by Microsoft with a $150 million investment/loan in 1997 which was one year before Google was started. Amazon was founded in 1994. Facebook was founded in a dorm room in just 2004 and is already the fifth biggest stock in the S&P 500. It feels like these companies can do no wrong right now and maybe they’ve all built up impenetrable barriers to entry and lasting brands but history says not all of them will remain at the top in the decades to come.

Further Reading:

The S&P 500 is the World’s Largest Momentum Fund

Thanks to Lawrence Hamtil for providing the data for this.

Now here’s what I’ve been reading lately:

- The Butcher of Park Avenue (Reformed Broker)

- 44 things a personal trainer has learned over the years (Bryan Krahn)

- On simple markets (The Lund Loop)

- Peter Bernstein: “Risk and time are opposite sides of the same coin, for if there were no tomorrow there would be no risk. Time transforms risk, and the nature of risk is shaped by the time horizon: the future is the playing field.” (Of Dollars and Data)

- Second guessing your life in finance (Abnormal Returns)

- “The easy money is being made, enjoy it while it lasts.” (Irrelevant Investor)

- Numbers can lie (A Teachable Moment)

- 3 lessons learned from the financial crisis (Prag Cap)

- There’s a difference between low-cost and passive investors (Bloomberg)