I don’t have any groundbreaking insights on the cryptocurrency phenomenon. Some people think it’s going to revolutionize payments and transactions while others assume it’s the no different than the Dutch Tulip Bubble. I’ve done a fair amount of reading on the topic and have concluded that it falls into my too hard pile. But it is fascinating to watch the price movements from a psychological perspective. This piece I wrote for Bloomberg discusses how those factors could affect future returns and how this is related to the stock market.

*******

Bitcoin has been on an unbelievable run. The cryptocurrency is up around 124 percent for 2017. And that’s after it gained 125 percent in 2016. In May alone, it’s up more than 60 percent. It’s hard to know what the long-term impact or performance will be, but one thing’s for sure — investors are swept up in cryptocurrency mania.

One simple theory for Bitcoin’s vertiginous rise in recent weeks is that it’s turning into something of a self-fulfilling prophecy. Momentum begets momentum and buying begets buying when gains begin to come hard and fast.

Consider that Bitcoin’s price is up, on average, four out of every five days in May. It’s up seven out of every 10 days in 2017. When you combine these types of batting averages with large gains, it’s sure to grab people’s attention and attract performance chasers and speculators who want to get in on the action. Seeing gains on top of gains increases investor confidence that those gains will last indefinitely. Confidence grows with each new high.

Contrast these results with the stock market. Since 1926, if you were to take the daily performance of the S&P 500 and break things down into gains and losses, the numbers show that it’s basically a coin flip between up and down days, with 54 percent of all days showing positive performance and 46 percent with negative returns.

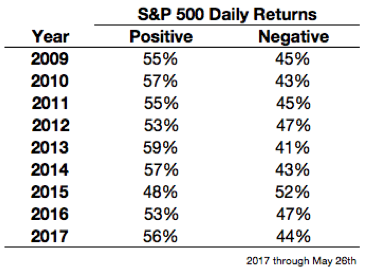

Even during the huge bull market since early 2009, the daily returns have followed a similar pattern:

The positive days slightly outweigh the negative days, but it’s close enough that any time stocks begin to fall investors worry that the end is near for this lengthy rally.

The reason these types of statistics matter is that human nature makes it difficult for people to process losses in the same way they deal with gains. Research from the behavioral psychologist Daniel Kahneman shows that we regret losses twice as much as gains make us feel good. This bias is called loss aversion.

So the probability of seeing gains or losses can have a huge impact on our actions as investors.

Since the daily performance in the stock market is more or less a 50-50 proposition, loss aversion means that checking the value of your investments on a daily basis will make you feel terrible every single day. All those warm feelings you get from the winning days in the markets will be completely wiped out by the double dose of pain of the down days.

The simple solution to deal with this issue for stock market investors is to avoid evaluating your portfolio on a regular basis. The more you look, the more likely it is that you’ll see losses since stocks don’t hit new highs every single day. While stocks alternate gains and losses, on average, if you lengthen your time horizon, the probabilities for a positive return are much higher.

Using the same data for the S&P 500 going back to 1926, all one-year periods showed gains roughly three out of every four years. Extend the time horizon to 10 years, and it was close to 95 percent of all periods with gains. Less frequent portfolio evaluations make it more likely that you’ll see gains, and, in effect, reduce the pain experienced through loss aversion.

Everyone seems to have an opinion about how high the price of Bitcoin can go or how quickly it will fall back down to Earth. Yet it’s impossible to forecast the emotions of other investors, and at a certain point that’s all that ends up driving these types of price moves. But my guess would be that the current Bitcoin rally will start its downfall once the daily returns are more evenly balanced out between up and down days.

It may be obvious to state that an increase in volatility will cause investors to bail, but it’s helpful to understand the reasons behind this type of price action. Once loss aversion begins to be felt again in the price of Bitcoin, that will likely spell the end of its relentless rally. Unfortunately, figuring out when this will happen is extremely difficult, as predicting a change in market direction has almost no rhyme or reason.

Originally published on Bloomberg View in 2017. Reprinted with permission. The opinions expressed are those of the author.