I’ve spent the past few weeks skimming all sorts of 2017 market outlooks. Lots of people are looking for answers, but most investors aren’t even bothering to ask the right questions.

I don’t know what’s going to happen so here are 10 questions I’m pondering going into the new year:

1. Is President Trump going to set off some animal spirits or scare the markets with a tweet? Maybe a little bit of both? Neither? The thing is no one really knows what’s going to happen with our incoming president. All I know is anyone who thinks they know with any degree of certainty is nuts. It’s impossible to handicap these things.

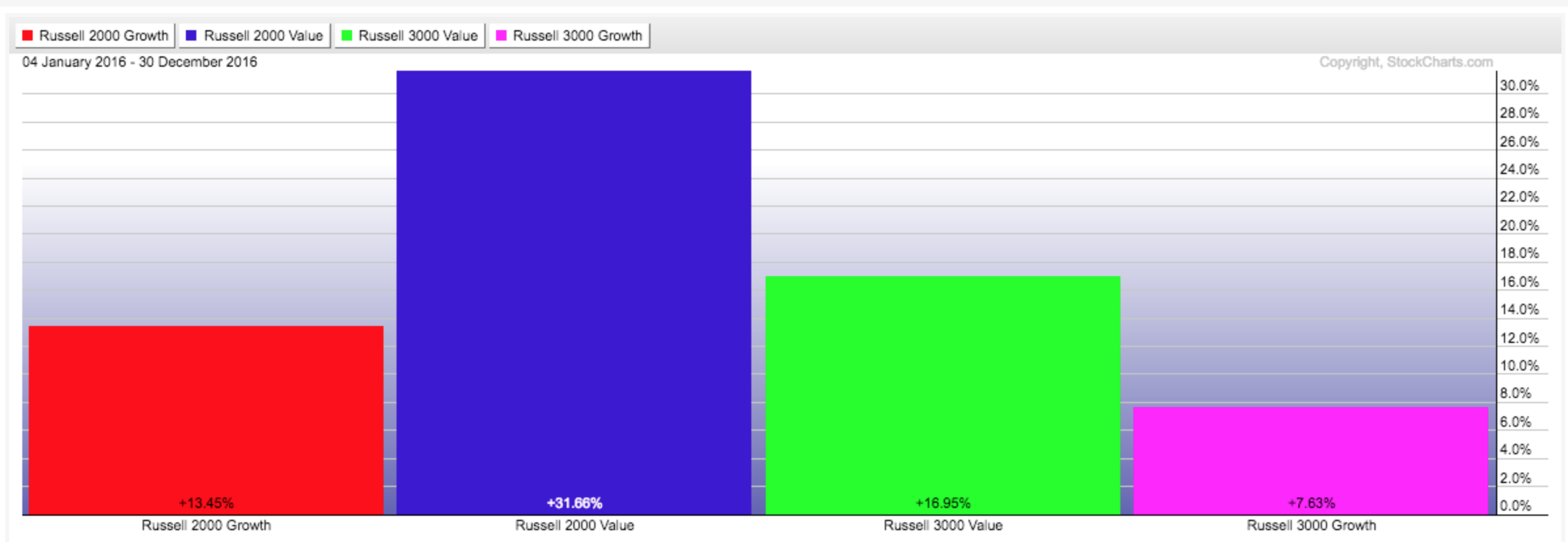

2. Will value stocks continue their comeback over growth stocks? From 2009-2015, the Russell 3000 Value Index underperformed the Russell 3000 Growth Index by more than 65%. In that same period the Russell 2000 Value Index (small-cap stocks) underperformed the Russell 2000 Growth Index by almost 75%. This trend saw some mean reversion in 2016:

Will it continue? Are we finally seeing a comeback by value after a rough stretch?

3. Will emerging market stocks finally have their day in the sun over U.S. stocks? Since 2011, the S&P 500 is up over 100% while emerging market stocks are down more than 10%. These markets tend to be very cyclical in terms of their relative performance, but both markets finished with similar gains in 2016. Could we finally see emerging markets outperform after years of poor performance?

4. Will we ever see both stocks and bonds down in a calendar year at the same time again? Going back to 1928, stocks and bonds have only had negative calendar year returns in the same year three times — 1931, 1941 and 1969 (using the S&P 500 and 10 Year U.S. Treasuries as proxies). Is it possible we could see this play out in the coming years?

5. Will interest rates continue to rise or were the past 5 months or so an aberration? There’s been a huge shift in the direction pundits and investors seem to think rates go from here (up). Maybe everyone is right but this is a question that’s not so easy to answer.

6. Will rising mortgage rates have an impact on the housing market? The 30 year fixed rate mortgage has quickly shot up from 3.5% in October to over 4.3% in the latest reading. Will this get more people to buy homes because they’re worried about rates going even higher? Or will this slow the housing market because higher rates make it more expensive to buy?

7. Will this finally be the year we see a comeback in hedge fund and liquid alt strategies? It feels like every year this industry predicts a coming stock-picker’s market or an influx of opportunities from higher volatility. As a group, the results have been subpar to say the least for some time now. Will this finally be their year to shine?

8. When’s the next big Ponzi scheme, fraud or fund blow-up going to hit? After so many years of low interest rates and above average stock market valuations it seems like we’re ripe for a blow-up of some sort. Isn’t it possible certain investors or fund managers will reach too far in this environment?

9. What’s the market scenario that will frustrate the most investors? This usually isn’t a bad way to handicap what’s possible in the markets. It seems to me that rates falling, stocks going nowhere or commodities outperforming would catch a lot of investors off guard.

10. Let’s say I had the ability to tell you exactly what’s going to happen with all of the economic indicators, geopolitical events, every surprise piece of market-moving news and even corporate earnings growth — would it even matter? You could have given me all of this information before 2016 and there’s no way I would have predicted that stock markets would have been up double digits. So why waste your time trying to predict these unpredictable events?

Happy New Year to all. I hope you all have a wonderful 2017.