In my last post I talked about how difficult it can be to invest in emerging markets because they are so volatile.

Going back to the late-1980s, emerging markets have exhibited over 60% higher volatility in monthly returns than the S&P 500. Small cap stocks, as measured by the Russell 2000, have also shown more volatility than the S&P (around 30% higher).

My experience has been that the higher the volatility in an asset class or investment the higher the opportunity for investor mistakes/

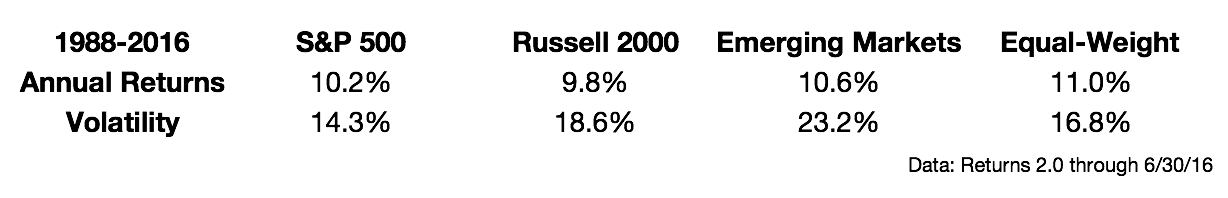

Having said that, investors who are willing to accept more volatility in their holdings can actually use it to their advantage. Take a look at the annual return and volatility data for the S&P 500, Russell 2000 and MSCI Emerging Markets Index going back to 1988:

The performance numbers were all fairly similar, but you can see that the volatility numbers were much higher in small caps and emerging markets, as expected. Now take a look at the last column. All I did here is use a simple equal-weighted portfolio of the three, rebalanced annually.

You can see that the return of the equal-weight portfolio is actually higher than any of the individual markets themselves. It’s also interesting that the overall volatility is much lower than what you see in small caps or emerging markets.

That’s because the volatility of the individual parts does not equal the volatility of the overall portfolio. If you were to take an average of the returns and volatility numbers of these three asset classes you would get 10.2% and 18.7%, respectively. The reason the returns are higher and the volatility is lower than these averages is because of (1) rebalancing and (2) diversification. While each market is volatile, they tend to experience that volatility at different times.

For example, over 28 years there were 14 calendar years where each of these markets were up, exactly 50% of the time. But only 4 times were all three down together, just 14% of the time. There were 5 years where two were positive and 5 years where only one was positive, both 18% of the time, respectively. It’s also striking that 71% of the time these markets were either up or down double digits performance-wise over a given year.

So there were plenty of opportunities to take advantage of rising, falling or different-performing markets from a rebalancing perspective. Alternatively, there were plenty of opportunities to fall prey to fear and greed by chasing after past performance or ignoring beaten down markets.

This is why portfolio construction is such an important aspect of successful long-term investing. You not only have to understand the risk/return profile of the individual asset classes or investments, but also how they interact with and complement one another.

Financial professionals often define risk as volatility. This has never made sense to me, because to earn a decent return on your capital you have to learn to accept volatility in some form. The trick is to understand where and when to accept volatility in your portfolio and how to get paid for accepting it over time.

While volatility can be painful over the short-term, over the long-term disciplined investors can use it to their advantage.

Volatility is only a risk if you have the wrong response to it.

Further Reading:

Misconceptions About Diversification