Whenever markets fall investors look for comfort anywhere they can find it. Two favorite investor past-times include (1) finding someone or something to blame and (2) seeking out other investors or strategies that are performing worse than you are. It doesn’t make any sense, but for some reason people find solace in the relative misery of others.

I’m not judging. I say do whatever you have to do to make it through the rough patches. This time around risk parity is acting as the punching bag as you can see from these recent headlines:

Risk parity is an asset allocation developed by Bridgewater’s Ray Dalio in the mid-1990s. Here’s a short description of the strategy from a Bridgewater white paper on the evolution of what they call All Weather:

All Weather was originally created for Ray’s trust assets. It is predicated on the notion that asset classes react in understandable ways based on the relationship of their cash flows to the economic environment. By balancing assets based on these structural characteristics the impact of economic surprises can be minimized

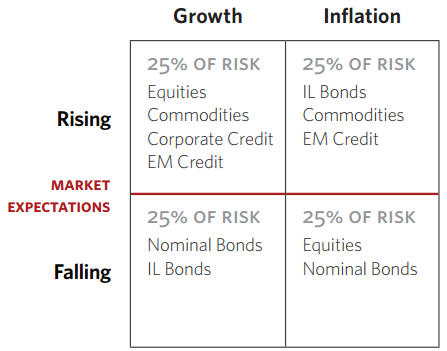

This is the basic allocation outlined in the same report:

Risk parity utilizes a moderate amount of leverage to equal-weight the allocations by risk, using volatility as the equalizer. What ends up happening is that bonds typically gain a higher weighting than most portfolios through this use of leverage by giving them a similar volatility level as the other asset classes.

I feel there are more important considerations than creating the highest Sharpe Ratio portfolio since I’m generally not a fan of using volatility as a measure of risk. But the point here is not to debate the merits of risk parity as an investment strategy. Different investors look at the world in different ways.

I actually think that this strategy has a perception problem more than anything. ‘Risk Parity’ or ‘All-Weather’ are misnomers. The idea that you can somehow level the risk playing field among the different asset classes or security structures always seemed like a stretch to me. Correlations and relationships change. Volatility regimes are unsteady at best. But this is a minor quibble because no allocation approach is ever precise.

The ‘All-Weather’ label is the one that’s probably over doing it a little. There’s no such thing as a strategy that works in all situations. That’s asking too much and has the potential of placing unrealistic expectations in the minds of investors. But we also have to remember that this is a long-term strategy. I like this conclusion from Dalio and team on this strategy (emphasis mine):

Overconfidence often pushes people to tinker with things they do not deeply understand, leading them to over-complicate, over-engineer, and over-optimize. All Weather is built very intentionally to not be that way. With the All Weather approach to investing, Bridgewater instead accepts the fact that they don’t know what the future holds, and thus choose to invest in balance for the long-run.

Long-run is the key phrase here. Performance in many risk parity strategies has been underwhelming lately, but it’s only been a few months. The four allocation quadrants they chose are set up to diversify by cycle. Cycles don’t play out over the course of a few months. Every long-term, diversified asset allocation approach will see disappointing periods of performance like this. It’s almost guaranteed as future cycles never quite play out like they have in the past.

I’m not sure how risk parity will perform in the future. It won’t have the tailwind from a three-plus decade bond bull market that it’s had in the past, so the potential for lower returns from here is a good possibility for some time. But the point of setting up this type of portfolio was so investors wouldn’t have to worry about predicting how the future would play out. That’s worth remembering for investors who expect miracles out of their portfolios over the short-term.

Further Reading:

Back-Testing the Tony Robbins All-Weather Portfolio

[…] In defense of risk parity strategies. (awealthofcommonsense.com) […]

[…] In defense of risk parity strategies. (awealthofcommonsense.com) […]

Stocks were down sharply in August. But long Treasuries, after rising through Aug. 24th, took a header in the final week of August and ended slightly down too. One bad week for risk parity, and the critics are out with their sharp knives, saying it’s broken.

As always, the question is, what is the alternative? The inverse stock fund SDS had a great month in August, up about 11.5%. But one can’t hold short funds as a long-term strategy: volatility drag and the expected positive return on equity would eat you alive.

Every multi-asset strategy I’ve tested has had bad years (e.g. 1969) when absolutely nothing worked. Drawdowns go with the territory in risky assets. Folks who can’t stomach drawdowns can buy T-bills, replacing the pain of drawdowns with the envy of being left behind during rallies.

Unfortunately, the only sure-thing bets — such as front-running and insider trading — are illegal.

I think people’s difficulty in coming to this realization is one of the reasons performance-chasing is so prevelant among investors. There’s always either the next best thing or the last best thing to hang your hat on. No one likes to sit through the pain.

[…] In defense of risk parity strategies. (awealthofcommonsense) […]

The combination of Human Nature and our Culture always look to blame and compare. Consider the PGA Boston Monday when Henrik Stenson misses a green, and what is the immediate reaction? Blame his caddie”…. The caddie should have known the 2 mph wind would impact Henrik’s +220 yard par 3… GEEEZE – Blame permeates our culture… Investor Behavior and Investment Advisor Behavior are the same…. Flawed…. It takes discipline, focus and training to not fall short – blaming, comparing, and self-doubt. Remain focused and tenacious.

Reminds me of Shooter Mcgavin firing his caddie in Happy Gilmore. This is one of the main reasons consultants are so heavily relied upon in so many industries — it gives people someone to blame.

[…] Bridgewater All-Weather Fund, which is a key flagship RP fund, was -4.2% in August and -3.8% YTD, Ben Carlson has also correctly pointed out that these strategies have had a terrific long-term record. They […]

[…] In defense of risk parity (or any long-term strategy) (awealthofcommonsense) […]

[…] In defence of long-term strategies – A Wealth of Common Sense […]

[…] In Defense of Risk Parity (Or Any Long-Term Strategy) How Much Diversification is Necessary? 6 Reasons For David Swensen’s Success at Yale Something Most Investors Simply Cannot Accept […]

[…] All-Weather Fund, which is a key flagship RP fund, was -4.2% in August and -3.8% YTD, Ben Carlson has also correctly pointed out that these strategies have had a terrific long-term record. […]