A reader asks:

Now that factor funds keep getting launched, do you think that will ultimately spell doom for any potential future out-performance?

This is a great question. Investing in factors, tilts, anomalies or whatever you want to call them is definitely becoming more mainstream because the academic research is now well-known. ETFs and mutual funds make it easier than ever to invest in specific risk factors including momentum, value, size and quality. But, as this reader so astutely points out, it’s possible that we could see an overcrowding in these risk factors, disrupting future performance.

In his book Rational Expectations, William Bernstein touched on this issue with an interesting analogy:

Over thirty years ago, my wife and I came upon a shop in Paris that made the most exquisite umbrellas we had ever seen. Although their products weren’t cheap, they were still within our budget. In the following few years we bought several, which we treasure to this day.

Each time we returned to the umbrella store, we found it ever more crowded with shoppers from around the world. Its prices grew correspondingly out of reach, particularly after the elderly sisters who ran the store passed it on to their tonier niece.

Similarly, now that everyone knows about and can visit the “equity umbrella shop,” stock prices have risen and lower expected returns have resulted. This likely goes double for “tilted portfolios,” the term used for small-cap and value-oriented stocks.

It used to be nearly impossible for individual investors to invest in something like a small cap value or momentum strategy because the costs were simply too high or the strategies too complex to build on your own. But the fact that they’re now so easily obtained through ETFs in a tax efficient manner at much lower expense ratios offers something of a margin of safety. You can invest in these different factors at a fraction of the cost than the past, so even if the future premiums are compressed compared to historical averages, the lower costs could mean no meaningful difference in performance on a net basis.

I also think that the ease of access means that there will be plenty of weak hands piling into these factors hoping to hit immediate pay dirt. When volatility spikes or there’s a period of relative underperformance, these investors will quickly hit the exits. The biggest gains will only be made by strong hands that can live with higher tracking error.

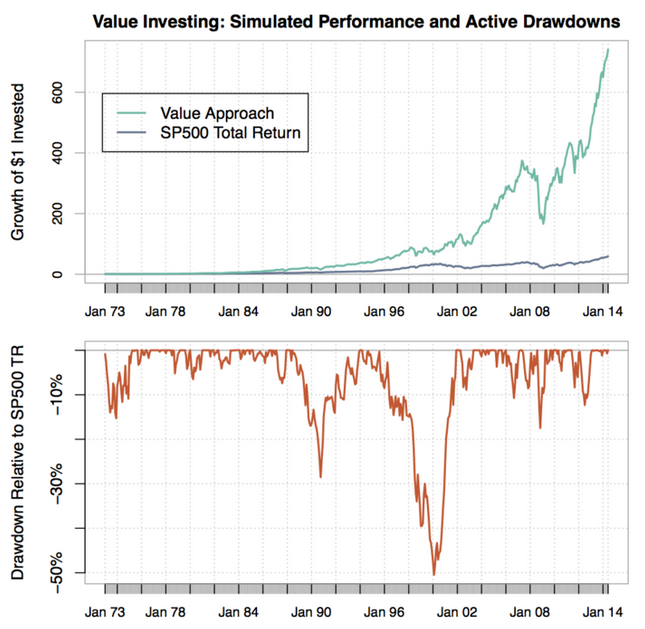

No factor or strategy works every year. The cycles can be extremely uneven. The reason these factors have worked in the first place is because there are plenty of times when they don’t work. Take a look at the following chart from Euclidean Technologies that shows a simple value strategy (buying the cheapest stocks by EBIT) against the S&P 500 going back to the 1970s:

You can see the value outperformance up top, but look at the relative underperformance in the lower chart. There have been periods where value underperformed the market by anywhere from 30-50%. How many investors will have the discipline to stick with a strategy when it underperforms by that much for a lengthy period of time? I think the majority of the gains to any factor in the future will be made by those investors that have the intestinal fortitude to stick with them and even rebalance into periods of underperformance.

Plus there’s the fact that much of this knowledge has been around for quite some time now. Warren Buffett has been preaching the virtues of value investing for decades. Benjamin Graham’s books on the subject have been around since the 1930s. Everyone now knows that buying cheap or high quality stocks works if you’re patient. Most people aren’t patient. Therein lies your edge as an investor.

One of the hardest parts about investing is that no matter what it is that you buy there will almost certainly be another investor, asset class, sector, fund or security that will be outperforming you at any given point in time. Behavior is the ultimate equalizer in the markets, Most investors will always prefer to invest based on a narratives over evidence. It’s much easier for the financial industry to sell a story attached to a fee-producing product than the virtues of a long-term strategy that could take some time to play out.

The degree of tilting in any given portfolio will all depend on each individual’s theshold for short-term pain and tracking error from the overall market.

All of these views fall under the category of something I believe but can’t prove with statistics because no one really knows what the tipping point is for the different risk factors. Even if the premiums from these anomalies narrow in the future, I can think of worse ways to build a diversified portfolio than by investing based on the weight of historical evidence and common sense mixed in with the ability to look past difficult short-term periods of underperformance.

Sources:

Rational Expectations: Asset Allocation for Investing Adults

Why is Value Investing so Difficult (Euclidean Technologies)

Short termism will always be present in investing as it takes years of experience in developing the type of special discipline necessary to think “long term”. As I have had my work peer reviewed by academics, I wrestle with the prospect of publishing an “official” academic paper with the formula “exposed”. Does one chance the dilution of the process’s continued viability in favor of a possible credibility boost and receiving of accolade or does one keep it under wraps for use towards personal profit ? I can see at this point that, even if the ( small cap ) value anomaly becomes too wide spread, the risk mitigation feature of my work would stand as a proprietary “edge” against the shrinking of the performance premium. https://docs.google.com/presentation/d/1C37CJypoxHWHB09e3g25ewOGjP83wDZhj5j6tlrLJoA/edit?usp=sharing

I like to think the edge for most investors comes from ignoring the short-term and being able to focus exclusively on their process regardless of what everyone else is doing.

I think factor investing as a whole will continue to persist because there are essentially endless ways it can be applied.

I’d lump almost all fundamental/quantitative methods under factor investing. Anyone who performs disciplined investing is tapping into factor returns whether they realize it or not.

Overly simplistic index tilts could get crowded, especially if everyone starts tilting on the exact same ratio.

That’s a good point. There are so many different ways you can slice and dice these things with different rules and strategies. many fundamental indexes or smart beta funds could be a slight tilt while some quant funds seek to really focus on the specific factor.

I agree with you on the discipline part to. Anyone that systematically rebalances their portfolio is using a value strategy in my view.

[…] What happens if factor investing /Smart Beta gets too popular? – AWOCS […]

[…] What Happens When the Umbrella Shop Gets Too Crowded? – Ben Carlson – @awealthofcs […]

[…] News flash: factor investing involves risk. (awealthofcommonsense) […]

[…] What occurs if issue investing /Sensible Beta will get too in style? – AWOCS […]

[…] Further Reading: Is Technology Speeding Up Market Cycles? What Happens When the Umbrella Shop Gets Too Crowded? […]

[…] Reading: What Happens When the Umbrella Shop Gets Too Crowded? The Small Cap Value Cycle The Small Firm Affect is Real and It’s Spectacular […]

[…] Reading: What Happens When The Umbrella Shop Gets Too Crowded? Why Value Investing Works Why Momentum Investing […]