“The only investors who shouldn’t diversify are those who are right 100 percent of the time.” – John Templeton

It’s often said that diversification is the only free lunch in finance. However, this an incomplete statement because diversification alone doesn’t get you all the way there.

There are no benefits to diversification if you don’t rebalance a portfolio by trimming asset classes that have worked and buying asset classes that haven’t. Diversification is a process, not a one-time decision. Rebalancing is the linchpin that holds it all together.

Rebalancing, like all investing principles, sounds easy in theory but can be very difficult to put into practice because it forces you to make counterintuitive and uncomfortable moves within your portfolio.

The financial markets haven’t exactly been a walk in the park since 1999. It’s been one long cycle of booms and busts. This period makes for a great case study in the benefits of diversification and periodic rebalancing.

The S&P 500 is only up a total of 111% or about 4.9% per year since the start of 1999, a far cry from historical averages. But investors aren’t forced to only invest in this one broad market index just because it’s the one most pundits pay attention to.

A very basic three fund portfolio that includes U.S. stocks, foreign stocks and the U.S. aggregate bond market is in many ways a good benchmark portfolio because it’s so broadly diversified and can easily be put together at an extremely low cost through index funds or ETFs.

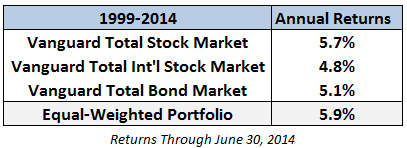

Here are the annual returns for each Vanguard mutual fund as well as an equal-weighted portfolio of all three rebalanced back to equal-weight at year end:

It seems to defy logic but the rebalanced portfolio actually produced a higher return than any of the individual funds. This is because this portfolio would have been selling some bonds to buy stocks in the 2000-02 bear market, selling some stocks to buy bonds in the 2003-07 bull market and once again selling some bonds to buy stocks in the 2008-09 bear market.

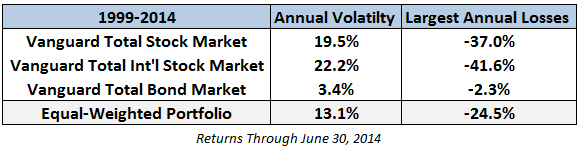

Each time the process of buying low and selling high produced incremental returns to the portfolio. Here are some other relevant statistics:

The diversified portfolio had higher returns than both stock funds but they came at roughly 60% of the volatility and largest annual losses. While decreased volatility is a welcomed byproduct of rebalancing, diversified portfolios aren’t meant to manage volatility. They’re meant to manage emotions.

And you’ll often be surprised where the returns come from on a year to year basis. Although the Total U.S. Fund had the best overall performance of the three, it was only the best performing fund 25% of the time. International equities actually had the best returns about 45% of the time even though they was the worst performer.

It’s worth noting that this was a perfect period for a diversified portfolio. If we looked at the 1990s the diversified option wouldn’t have worked out as well because the Total U.S. Fund was the clear winner. But you don’t diversify to gain the highest returns. You do so to ensure you don’t get the lowest.

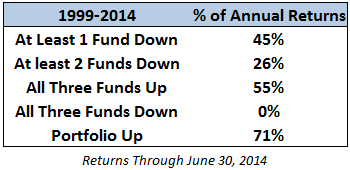

Plus, no one can predict which asset classes are going to lead the way from year to year. This becomes apparent by looking at some of the winning and losing percentages from this portfolio:

In almost half of all annual periods you had a loser in the group. Each of these losses created opportunities to rebalance to boost future returns. And even though there were plenty of down years for each fund, the portfolio as a whole was still positive over 70% of the time.

Diversification is by no means a panacea for market losses over shorter periods. It won’t protect you every day or even every year. What it can do is protect you from bad cycles that can last upwards of decades in certain asset classes.

Just remember — diversifying is the easy part; rebalancing takes discipline.

And here’s what I’ve been reading lately:

- Confessions of an index investor (Rick Ferri)

- We need more people like Josh Brown preaching in the financial industry, not less (Reformed Broker)

- Teaching your children to invest (Meb Faber)

- Nothing really changes about investing (Servo Wealth)

- Please make sure you have a plan (Irrelevant Investor)

- How to not get squirrely with your investments (Bob Seawright)

- 6 signs of a good investment process (Clear Eyes Investing)

- Beating everyone else is not a financial goal (Carl Richards)

- Why you stink at market timing (Consumer Reports)

- Diversify or lose your wealth (Noah Smith)

- Also, here’s my latest for Yahoo! Finance on future opportunities in emerging markets (Yahoo! Finance)

[…] Diversification […]

[…] Diversification doesn’t work if you’re running it. (WealthOfCommonSense) […]

[…] diversification and rebalancing actually increases your returns, as an article from A Wealth of Common Sense this week […]

[…] Diversification works over the time frame that matters: the long run. (A Wealth of Common Sense) […]

[…] Already Talking About It, and You May Be on the Hook (Bloomberg) • How Diversification Works (A Wealth of Common Sense) • My eBay MBA: a dozen business lessons from online auctions (FT) • The history of […]

[…] for the Lower 93% (Pew) Bond market conundrum redux (Econombrowser) How Diversification Works (A Wealth of Common Sense) Secular Stagnation & Personal Savings (GaveCal) At Work, Every Friday Should Be a Summer […]

[…] Of course a bond-heavy portfolio is going to perform better in the down years – that’s what bonds are for. They act as portfolio stabilizers during economic downturns or stock market crashes. Each one of these asset classes on its own has a pretty good winning percentage. Combining them together in a portfolio predictably lowers the volatility. That’s how diversification works. […]

[…] Further reading: Global diversification: Accepting good enough to avoid terrible How diversification works […]