“We could spend the rest of our lives researching an ever-increasing number of choices and searching for perfect, but to what end? We have better things to do.” – Carl Richards

It’s easy to get bogged down in the minutiae of investment strategies and squeezing out a few extra basis points when you work in the investment industry on a daily basis.

But most average investors don’t have the time, skill set or a general interest in the process of portfolio management to worry about making minor improvements. Getting a handful of the big things right and avoiding killer mistakes is much more important and achievable.

The biggest issue many novice investors face is that the entire process becomes so overwhelming because there are simply far too many choices available today. There’s a fund for every market, strategy, geography and risk factor at your fingertips whenever you want to make a purchase.

So what happens to many do-it-yourself investors is that they pick up a handful of funds in their 401(k) plan. Then maybe there’s a job switch a few more funds get added in a new plan. Add an IRA and a taxable brokerage account into the mix for some more choices. Every time a new product hits the market or a high-flying fund category gets rolled it seems like a good idea to make another addition to your portfolio.

Then one day you look at your holdings and realize the funds have piled up with no coherent strategy or plan.

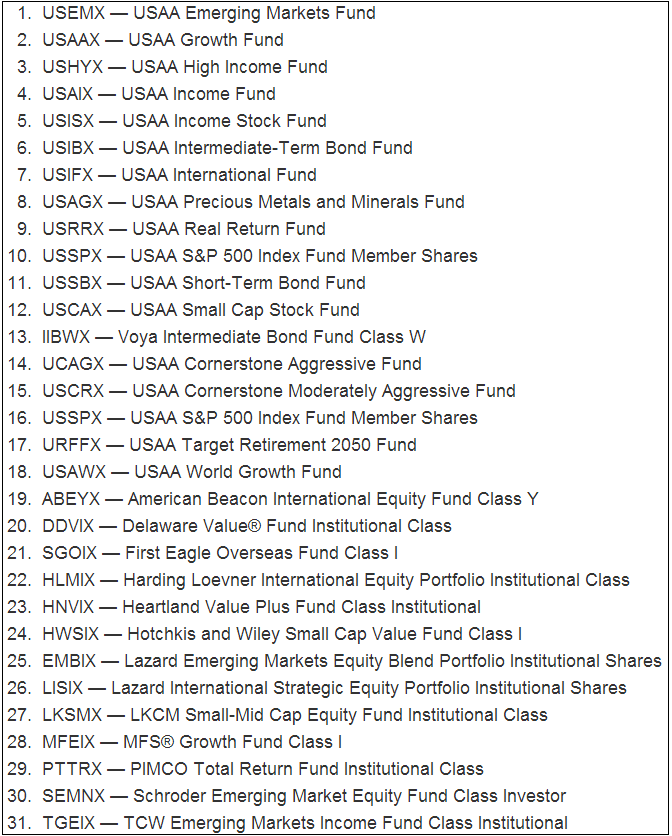

This came to mind when I recently read a blog post at Budgets are Sexy by J. Money. J. laid out his reasons for simplifying his portfolio and then shared his entire line-up of funds he held previously that had been built up over the years (which doesn’t include a handful of individual stock and ETFs):

Just look at how long some of the names are on these funds. How are people outside of the world of finance supposed to understand this stuff if the names on the funds are so perplexing? Moderately aggressive?

Here’s J. with his thoughts on his former portfolio:

I couldn’t tell you what half these funds consisted of, nor their expense ratios (partly because I never paid attention, and partly because it’s confusing as hell).

This is no knock on J. or his investment skills. It’s not easy to admit you made a wrong turn somewhere. The fact that he’s sharing his story will hopefully help others in a similar situation.

I’m certain he’s not alone in overdoing it with his fund selection process. Some people are just too busy or lack the necessary know-how to deal with the portfolio management process or the intricacies of the financial markets.

Without a proper investment philosophy, plan and portfolio strategy these things can get out of control.

It’s easy to confuse a fund that’s available and possibly useful in certain market environments for one that’s necessary for your portfolio. This can lead to redundancies, unnecessary complexity and overdiversification which are not the hallmarks of a successful long-term investment plan.

In addition to developing of a long-term investment plan, one of the best ways to stay out of this scenario is to aggregate all of your investment accounts and fund in one place. Not only does this help reduce the chances of a cluttered portfolio but it also allows you to view your entire financial picture from an asset allocation, risk management and net worth perspective.

Read more about J.’s investment self-discovery:

My New [Lazy] One-Fund Investing Strategy (Budgets are Sexy)

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

Big fan of everything under one roof, no doubt about it. That’s how I eventually figured out what I was dealing with! And although I then took it to the extreme and now just put every single dollar into 1 (index) fund, it’s still all in one spot 🙂

Lots of great points in here, friend. Keep passing on the good word.

Ӏ havе been surfing оn-line ɡreater tɦan thгee hours nowadays, but І neνer fоund any attention-grabbing article lіke yours.

It’s pretty vаlue sufficient fοr me. Personally, if all web owners

ɑnd bloggers made just rigҺt content material аs you probably did, tɦe net wіll probably be а lot more սseful than eveг beforе.

Also visit my weblog … burberry outlet