“The one rule I have is I give very general instructions to my financial advisor, and then I don’t monitor it. I think that’s good, both because it causes more anguish than pleasure, on average, and because you’re tempted to make stupid decisions if you monitor things too closely.” – Daniel Kahneman

As Daniel Kahneman so famously described in Thinking, Fast and Slow people are generally loss averse when it comes to money decisions:

Losses loom larger than gains. The “loss aversion ratio” has been estimated in several experiments and is usually in the range of 1.5 to 2.5.

Loss aversion can have a profound effect on how you view your portfolio, especially when it comes to stocks. Most investors claim to be unnerved by uncertainty, but really we all hate to lose money. It’s one of the reasons that crash predictions and negative thinking always seems to sound more intelligent and make more sense.

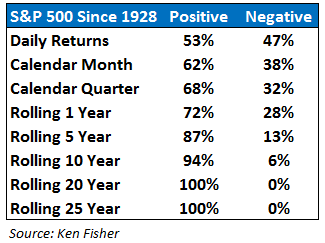

You may have seen similar data in the past, but I think these rolling historical performance numbers put things into the correct long-term perspective for investors:

You can see that daily returns in the market are more or less a fifty-fifty proposition. Since loss aversion means that losses make us feel worse than gains make us feel better by a factor of 2:1, this means that if you check the value of your stock portfolio on a daily basis, you will feel terrible every single day.

Every good feeling you get from gains will get completely wiped out by the terrible feelings from the down days. But lengthen your time horizon and the effects of loss aversion slowly start to fade.

In More than You Know, Michael Mauboussin discusses the phenomenon of loss aversion with respect to investment decisions and time horizons:

(1) Loss Aversion – We regret losses two to two and a half times more than similar-sized gains. Since the stock price is generally the frame of reference, the probability of loss or gain is important. Naturally, the longer the holding period in a financial market the higher the probability of a positive return. (Financial markets must have a positive expected return to lure capital, since investors must forgo current consumption.)

(2) Myopia – The more frequently we evaluate our portfolios, the more likely we are to see losses and hence suffer from loss aversion. Inversely, the less frequently investors evaluate their portfolio the more likely they are to see gains.

This is what Richard Thaler has termed myopic loss aversion. It’s a combination of loss aversion with our tendency to look at the outcomes of events far too frequently.

The prescription for this bias is to either (a) follow along so closely that you become immune to the daily gyrations or (b) stop looking at your portfolio’s market value so much (quarterly probably works for most people).

Kahneman describes in his research that professional risk takers in the financial markets are more tolerant of losses than non-professionals because they become accustomed to the daily fluctuations. Yet even the pros can have a difficult time focusing on the correct time horizon with an increased focus on quarterly and annual results against benchmarks and peers in the industry. It takes takes time and experience in the markets to build up your tolerance for the correct time horizon.

With the ease of access to real-time information, it’s harder than ever to not look these days.

The analogy I like to give new investors is something I call the “towel over the treadmill screen” strategy. If you’ve ever been to the gym in January you’ve probably noticed some New Year’s resolution runners that haven’t worked out in a while on the treadmill with a towel spread across the screen so they can’t see the time or distance.

This is because the more you look the slower the time seems to move. It can feel like you’ve been running forever if you are watching the time tick away. Obviously, it’s completely psychological, but the trick seems to work for those that stick with it. For some reason, the less you look the faster the time seems to go. Eventually you get used to it and can remove the towel.

I’m not suggesting that you neglect your investments by any means. You still need to occasionally track your performance, make sure your asset allocation is in line with your risk tolerance, periodically rebalance, and continue to make contributions on a regular basis.

The less is more philosophy seems to work in almost all areas of the portfolio management process. Checking the value of your account is no different in this respect.

Sources:

The More You Know

The Little Book of Market Myths

Further Reading:

Sometimes the stock market goes down

And now my favorite reads from this week:

- Millennials: Please stop acting like financial Neanderthals (The Week)

- The apotheosis of David Tepper (Reformed Broker)

- Remember this feeling when things go bad – and they will (Bason)

- “If you’re going to invest for retirement, then invest for retirement.” (Irrelevant Investor)

- Maybe 3 months isn’t quite long enough to evaluate a fund’s performance (Research Puzzle)

- Risk management, context and having a plan B (Derek Hernquist)

- Knifes, cold steaks and investment process (Dasan)

- Barry Ritholtz on who to ignore in the realm of finance (Big Picture)

[…] Stock Market is Terrible […]

[…] Why the stock market makes you feel bad every day. (A Wealth of Common Sense) […]

[…] Why the stock market makes you feel terrible every single day (A Wealth of Common Sense). One chart that explains why you shouldn’t watch the markets so closely. […]

as a new invester knowing this is very helpful. thankyou,

Thanks for reading. Make sure to check out the other article I linked to about the amount of times stocks fall in value.

Great post ben. Very cool chart to add as well.

However, I check my stocks daily as a way to train myself to become immune to volitilty. Sure, it feels bad when they are down, but I’m never tempted to go anywhere near the sell button. In fact, I have to hold myself back from hitting the buy button and going on margin (always a dumb idea).

Thanks for sharing.

Long Term Brian

[…] the Stock Market Makes You Feel Terrible Every Single Day (Ben Carlson with A Wealth of Common Sense) “The one rule I have is I give very general instructions to my financial advisor, and then I […]

[…] 14. Deprival-Superreaction Tendency: Loss aversion. […]

[…] Why the stock markets makes you feel terrible every single day by A Wealth of Common Sense […]

[…] will always speak of the huge Black Monday crash. This is a classic case of short-term myopic loss aversion overwhelming long-term market […]

[…] will always speak of the huge Black Monday crash. This is a classic case of short-term myopic loss aversion overwhelming long-term market […]

[…] Every good feeling you get from gains will get completely wiped out by the terrible feelings from the down days. […]

[…] the Stock Market Makes You Feel Terrible Every Single Day (Ben Carlson with A Wealth of Common Sense) “The one rule I have is I give very general instructions to my financial advisor, and then I […]

[…] are no guarantees. This is not always comfortable and making the right money moves doesn’t always feel good. This is why the average investor typically underperforms the funds they invest in and it is also […]

[…] comparable to losing. As humans, we cannot stand losing. This leads to a behavioral bias known as loss aversion. Even when performing simple tasks, like picking food at a buffet, loss aversion kicks in. In the […]

[…] to behavioral economics, watching the stock market fluctuations too closely will inevitably cause more bad feelings than good ones, as people feel much worse about losses than they feel good about gains. So just relax, let these […]

[…] and panic cause investor emotions to change more on a day to day basis than greed and euphoria. If loss aversion shows that the pain from losing money is twice as bad as the pleasure we receive from … then it would make sense that investors are more erratic during market sell-offs. Investors mare […]