“Value investors are not concerned with getting rich tomorrow. People who want to get rich quickly, will not get rich at all. There is nothing wrong with getting rich slowly.” – Warren Buffett

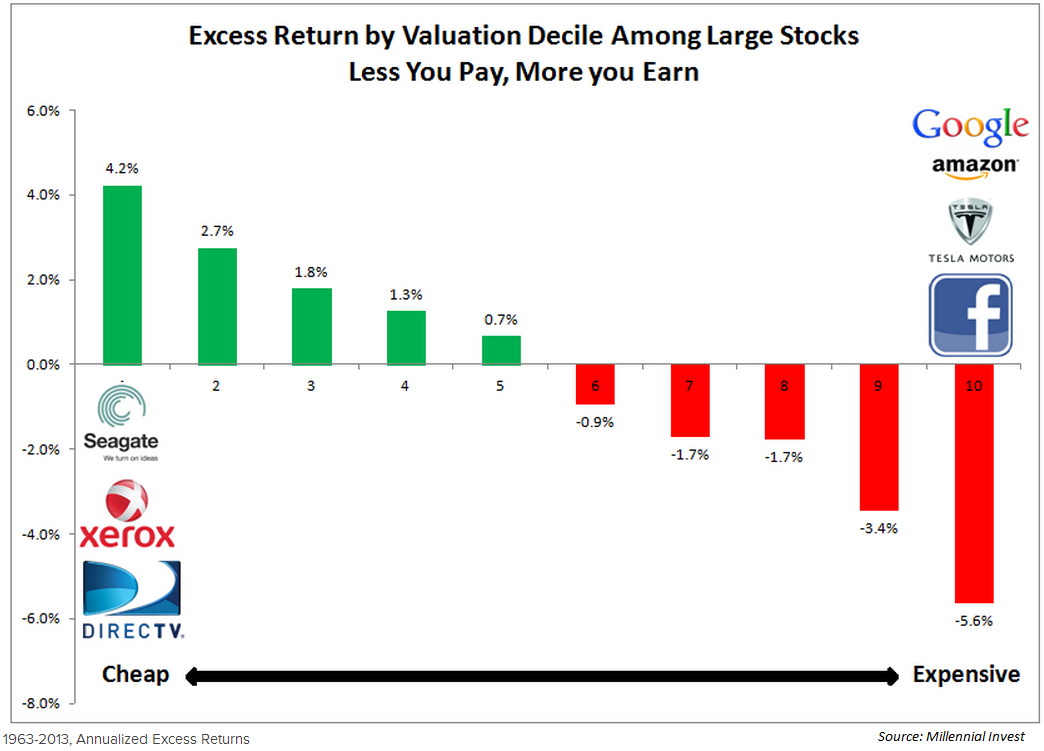

As we’ve discussed previously, value investing has been shown to outperform over longer cycles historically. Here’s a nice chart from Patrick O’Shaughnessy at Millennial Invest that shows the value premium over time:

So companies with lower valuations have given investors a performance boost over the higher valuation companies. This is a well-known fact to most professional investors.

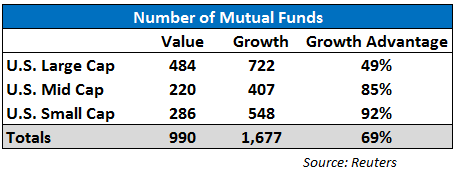

Oddly enough, this dynamic hasn’t translated into the world of mutual funds. I ran the Reuter’s mutual fund screener to break out the total number of U.S. value and growth stock funds . Here are the results:

Overall there are roughly 70% more growth funds on the market than value funds. So why is this the case if value investing has been shown to be the better performer over time?

Here’s Howard Marks on value investing from The Most Important Thing:

Value investors buy stocks (even those whose intrinsic value may show little growth in the future) out of conviction that the current value is high relative to the current price.

Growth investors buy stocks (even those whose current value is low relative to their current price) because they believe the value will grow fast enough in the future to produce substantial appreciation.

The choice isn’t between value and growth but value today and value tomorrow. Growth investing represents a bet on company performance that may or may not materialize in the future, while value investing is based primarily on analysis of a company’s current worth.

Value stocks tend to be boring. Many are stodgy dividend-paying companies while others may have hit a rough patch and sold off. Basically, buying growth is sexier than buying value. Growth investing usually centers on exciting industries, revolutionary products and the potential for a home run.

It’s much easier to build a narrative around growth stocks. Since Wall Street runs on earning fees they will generally push products that are easier to sell. Mutual fund consumers can buy into the growth story but value investing is a much harder sell. Most average investors need that story to invest to rationalize their decisions.

And many times growth stocks do perform better than value stocks for long stretches of time. Famed value investor Joel Greenblatt once said, “If value investing worked every day and every month and every year, of course, it would get arbitraged away, but it doesn’t. It works over time, and it’s quite irregular.”

The reason value investing works over the long-term is because many times it doesn’t work over the intermediate term. In fact, growth has outperformed value by most measures over the past 5 and 10 year periods through the end of March (but the tide is slowly starting to turn in value’s favor).

Of course not every single mutual fund invests in the same value investing framework as Marks or Buffett and not all growth funds buy only the most expensive names. These are simply style boxes they have been put into based on their portfolio characteristics. Plus these aren’t the only two investing styles that work.

Even though it’s been easier to sell growth up to this point, this trend won’t last forever. With the rollout of smart beta funds I expect the gap between growth and value funds to narrow substantially since most smart beta funds are tilted towards value stocks. Smart beta works as a great narrative as well.

If this story follows past cycles, value will become a huge hit with investors right before it goes through an inevitable rough patch. That’s when the patience of the true long-term investors will be tested and the performance chasers will lose yet again.

Sources:

The Most Important Thing

Lao Tsu Can Make You a Better Investor (Millennial Invest)

Now onto the best stuff I’ve been reading this week:

- Understanding the smart beta debate (Prag Cap) and how to evaluate your portfolio whether it’s smart beta or not (Millennial Invest)

- It’s no ones fault but your own if you’re not saving (WSJ)

- How to think about the huge gains in the stock market going forward (Washington Post)

- For most average investors cookie cutter portfolios work just fine (Oblivious Investor)

- Avoid portfolio managers touting it’s a “stock picker’s market” at all costs (Pension Partners)

- Why do Americans think housing is such a good investment (Prag Cap)

- Why you need to get rid of the ad-hoc decisions in your portfolio (Turnkey Analyst)

- Try harder or doing something easier? (Abnormal Returns)

[widgets_on_pages]

Follow me on Twitter: @awealthofcs

[…] More Value Funds […]

[…] Why aren’t there more value funds? (WealthOfCommonSense) […]

I think this is exactly right…value is a tough sell. When you try and sell to the army of consultants who think they are the smartest guy in every room and say what stocks you are buying, they look at you like you are a fool. I’ve done it many times, sometimes they just shut their notebooks 5 minutes in, as the stocks you have, particularly in concentrated value have horrendous headlines and awful narratives, and have typically fallen a lot. In reality it doesn’t take much of a change in narrative to get outsized returns, move from 7 to 11 PE as things stabilize is more than enough to do well. We buy the stocks other rational people know they should have bought after the fact, but can’t at the time. Try and tell them that in advance and they fire you.

The other one that chaps my ass is when the sharp pencilled MBAs come in and ask about factor, sector, weighting concentrations, optimised by markowitz allocations as if that’s the ‘right’ thing to do. When you say no to all of those they again think your an idiot.

Right, the move with less career risk is performing a simple check-the-box routine and investing in SCV, SCG, MCV, MCG, LCV, LCG, etc. Safer even if it’s overkill and somewhat redundant.

[…] Why aren’t their more value funds? (A Wealth of Common Sense) […]

[…] dat professionele beleggers veel vaker waardebeleggers zijn dan groeibeleggers. Recent las ik een artikel van Ben Carlson waarin hij dit had uitgezocht voor beleggingsfondsen. Het bleek dat er op dit […]

[…] Why aren’t there more value funds? – A Wealth of Common Sense […]

I like this, would also note that it’s hard for funds to play in the sandbox of “small value” due to size, which thus opens the opportunity further for those without a mandate. Enjoying your contributions!

Great point. One of the reasons the small cap value premium persists.

BTW, loved your piece from yesterday.

thanks, so cool to be able to share thoughts this way. keep up the great work

I agree. It’s crazy to think about all of the great opinions/investors you can find online these days. It would have been impossible to get that access even 7-10 years ago.

[…] growth stocks. This isn’t a secret. Yet, investors don’t flock to value stock funds. This essay offers a number of reasons why, but the bottom line is that investors aren’t always rational […]

Really ironic that I came across your article today since I just published one on how well cheap stocks do.

http://www.netnethunter.com/buy-cheap-stocks/

Yeah, I don’t know why there aren’t more value funds. I guess, with large cap stocks, it becomes very difficult to achieve great returns since everything is so picked over. Really, small cap and micro cap value stocks are spectacular investments. The draw of collecting AuM must be strong…

Cheers,

Evan

Good stuff. Thanks for sharing. I’m on twitter (@awealthofcs) but have never gotten into facebook for some reason.

Why are you not on Twitter, facebook, etc?

[…] Why aren’t there more value funds? – A wealth of common […]

[…] Further reading: Why aren’t there more value funds […]

[…] Further Reading: Why Aren’t There More Value Funds? […]

[…] Reading: Why aren’t there more value funds? Why value investing […]

[…] you at any given point in time. Behavior is the ultimate equalizer in the markets, Most investors will always prefer to invest based on a narratives over evidence. It’s much easier for the financial industry to sell a story attached to a fee-producing product […]

[…] or momentum personality. My guess is that “value” types would be in the small minority (indeed there are far fewer “value” mutual funds than “growth” funds). The mindset required is rarer, and is best summed up by […]