“Projections tend to cluster around historic norms and call for only small changes…The point is, people usually expect the future to be like the past and underestimate the potential for change.” – Howard Marks

In the past cycles, new stock market highs would usually be greeted with excitement and exuberance. But the experience of having two giant bubbles pop since 2000 seems to have investors nervous this time around.

Every time the market tops a previous high level investors seem to rush to judgment and proclaim that stocks are “due” for a fall. Investors need to realize that although knowing the historical average experience of the market over long-term cycles can be very beneficial, over the short term, anything can happen.

Just because we’ve minted new high after new high doesn’t mean stocks necessarily have to fall immediately. They could fall, but they could also continue to climb. No one knows.

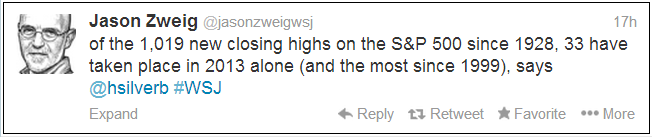

Plus, there is the fact that stocks rise more often than they fall over time, so they are bound to hit new highs more than you’d think. Here’s the stat of the week courtesy of Jason Zweig (@jasonzweigwsj):

So we’ve had 33 new closing highs in the S&P 500 this year alone. This would explain the chorus of crash predictions we’ve seen that haven’t come true just yet (eventually, there will be a crash, and these prognosticators will all take the credit for “calling” the top).

During a given calendar year there are normally 252 trading days. Going back to 1928 would give us more than 21,000 trading days in the market. Since there have been over 1,000 new highs that means that just short of 5% of all trading days have closed with a new high. So 1 out of every 20 days.

Remember this the next time you hear an investment strategist claim that the market must fall because we’ve hit new highs. It’s perfectly normal to hit new highs in the market.

Of course we could be “due” for a correction as so many experts have been saying for the past year and a half or so. Markets do fall for a variety of reasons. Investors take profits, people get nervous, buyers aren’t willing to pay ever higher prices at the moment, etc. The list could go on.

I actually think a pullback in the markets would be healthy right now. Markets that rise too far too fast don’t tend to end well (although bull markets never end well).

However, the underperformance in both bonds and commodities along with the strength in stocks could be the final straw that brings in those who have missed out on the enormous market gains since early 2009 or are currently underinvested in stocks.

I don’t know where we go from here, but as always, it should be a wild ride.

That’s what I was reading in many posts about investing and stock market as well – about the under performing bonds and thus pushing those investors into the equities, so we may actually experience probably another 5 years of bull market (they say). And when you take a look at the market, represented by S&P 500, you can see that investors are jumping on any dip proving that there is a buying power still strong. We will see. However the current trend is making me nervous so I am increasing cash reserves. the reason for that is that on my taxable account I use margin, so I need cash reserves to avoid potential margin calls if the market turns violently down. Other than that, I don’t care and I actually would welcome any crash. That’s why I love dividend investing. The stock price in the portfolio is not the primary objective. Dividends are, so any crash is a great opportunity to add more shares.

Right, even if we are in a sustained uptrend (still to be determined), there will still be pockets of volatility to the downside as there always are. Markets average a 20% correction every 4 years or so, but they don’t always track exactly with the averages.

You’re right that stocks are a better place to be on a relative basis, but that doesn’t mean everything can’t go down at the same time. After such a high run up in prices I think it’s not a bad idea that you’re raising cash. At the very least, it’s a great time to rebalance and take some gains.

Who knows how things shake out…

[…] Reading: How to think about new highs in the stock market Stocks will go down Now is not the time to get […]

[…] Further Reading: How to think about new highs in the stock market […]