“Debt hangs over you; it’s a nasty, omnipresent cloud which never makes you feel better and often makes you feel worse.” – Felix Salmon

Ray Dalio of Bridgewater Associates is one of the richest, most well-respected hedge fund managers in the world. Like all of the very best investment minds he has the ability to take complex ideas and explain them in a simple terms that anyone can understand.

Dalio recently released a 30 minute video called How the Economic Machine Works. This is required viewing for anyone that would like to understand how large economies actually work and why we are stuck in the slow growth world that we are currently in. You don’t need to work in finance or be an economist to understand this video. He makes it very easy on you and keeps things very simple.

Learning the main principles of this video can actually help you better understand your personal financial situation, especially from a spending and debt point of view.

One of the most useful topics in the video was Dalio’s explanation of the borrowing cycle for individuals. Here is his take on why we get into trouble with borrowing:

Dalio shows that all credit cycles are created by human nature. There is no law or regulation that says that individuals (or corporations or governments) are forced to borrow more than we should. It’s simply how we’re wired. If lenders are offering cheap money to allow us live beyond our means, we’ll take it, consequences be damned.

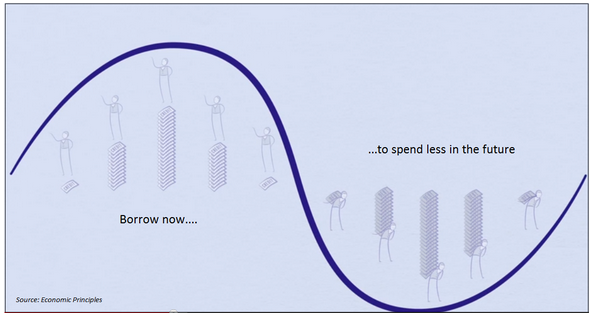

But in order to buy things you can’t afford today, you need to pull your spending forward from the future. You’re basically borrowing from your future self.

Borrowing money now means that you have created a time in the future that you need to spend less than you make in order to pay it back. This is what makes the economy fluctuate and move in cycles. More money is spent on debt repayment, spending on consumption decreases and the economy slows down. The opposite happens after debt gets paid down and things get better. Wash, rinse, repeat.

Here’s another screenshot from the video that explains the credit cycle phenomenon:

These cycles get especially amplified when you borrow to make unproductive purchases. This is what happens when people go overboard with credit card purchases with no cash or savings to pay off the balance. The same thing happens in real estate when people buy too much house without enough funds to pay the increased borrowing costs.

Delayed gratification is no fun, but spending now is. However, every purchase you make on credit now means less and less money to spend in the future. This requires a delicate balance between enjoying yourself in the present and being mindful of your future self. Future you is the one who has to pay for all of the bills that you rack up now.

I’m not saying don’t borrow money for any reason. There are plenty of ways to get ahead through good uses of debt. It’s just that it’s very easy to let human nature get in the way of your long-term financial goals. Avoiding bad debt will help keep you out of your own personal credit cycle.

Just because the economy is set up to crash every decade or so because of human nature doesn’t mean that you must have a personal financial crisis cycle as well. Keeping your debt under control and saving for the future can help.

Watch the entire video here:

How the economic machine works in 30 minutes (Economic Principles)

Further Reading:

Mastering the Machine: How Ray Dalio built the world’s richest and strangest hedge fund (New Yorker)

[…] Further Reading: Ray Dalio on your debt cycle […]