“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves. I can’t recall ever once having seen the name of a market timer on Forbes’ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.” – Peter Lynch

Trying to time the stock market sounds very tempting to investors these days. We can all look back and see the two enormous bear markets that followed the tech and debt bubbles along with the sharp rebounds that followed.

In hindsight, it’s easy to think you could have gotten out of the way of these huge meltdowns and gone to cash just in time while buying back in at the bottoms.

This is yet another example of our behavioral biases wreaking havoc on our decision making. Hindsight bias causes us to think that events were much more predictable after the fact.

If I would have just followed investment strategist X. If I had only based my strategy on this one valuation method.

Here’s what Josh Brown from The Reformed Broker had to say on “professional” market timers recently:

“But just know that the list of all-time great market-timers is pitifully short. Given how many professionals and amateurs attempt to sell tops and buy botttoms each year, it’s actually shocking how few have ever demonstrated the documented ability to do so. And if you think the guy selling a service for a couple of bucks a month can do it, well, you’re probably a great client for him. Don’t let me waste any of your time here.”

“The simple fact is that the complexity of the modern markets is such that reading the technical or economic tea leaves is probably more helpful for risk management or volatility aversion than for anything else.”

All of those investors who have been sitting on the sidelines for the past 5 years and counting know this all too well. They’ve been sitting in cash or other low-risk investments as stocks have reached new highs on a seemingly daily basis.

BULL MARKET GAINS

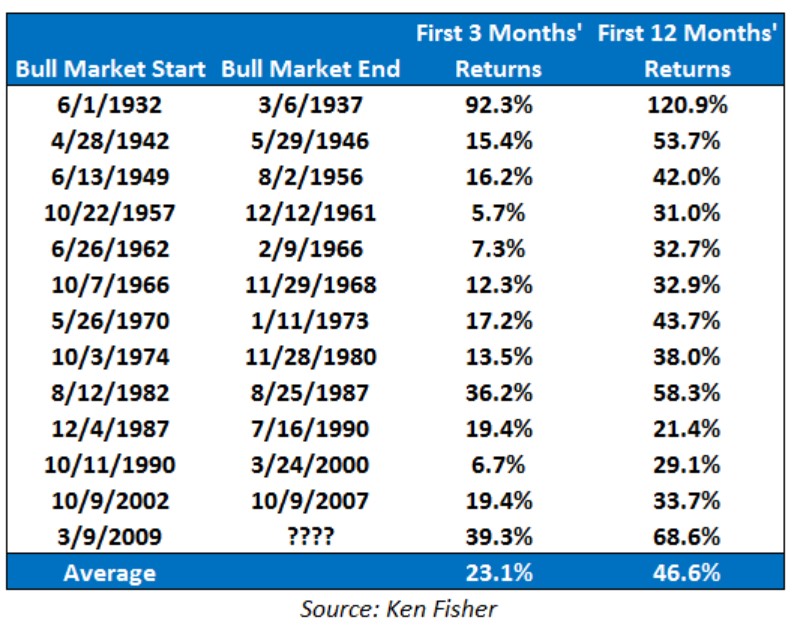

Here’s a table with data from Ken Fisher that shows how important the first 3 months and 12 months are in a bull market. These are the returns for various bull markets in the S&P 500 going all the way back to the 1930s. As you can see, the performance is very front-loaded:

If you are trying to time the market means that you’ll probably feel much safer in cash when stocks are going down and completely miss these large initial gains. It’s nearly impossible to pick when the market will turn on a dime.

BOB AND WEAVE

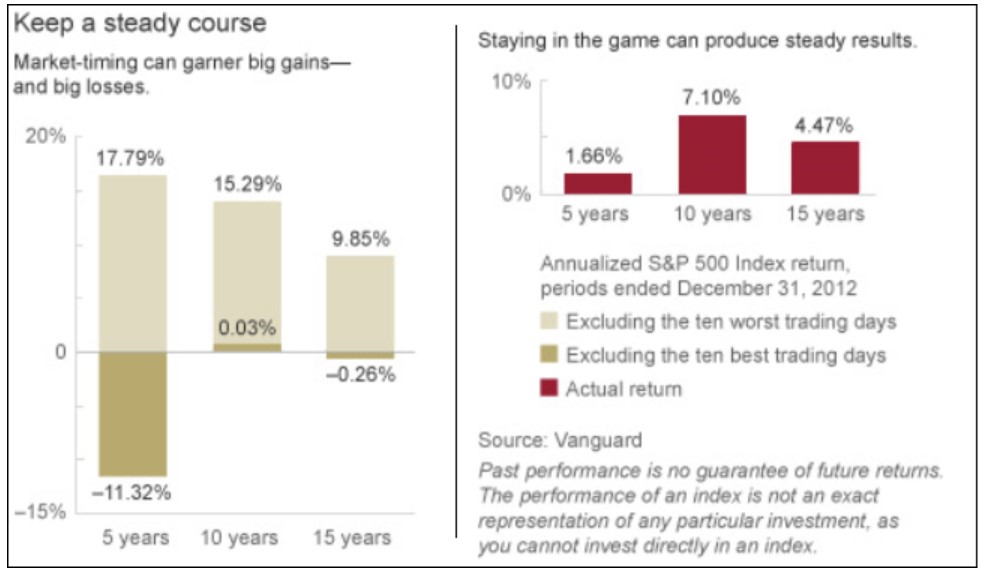

It would be great if we were all able to pick and choose when we’re in and out of the markets with precision. If we could only sidestep the large losses and just take part in the gains. Here’s a nice chart from Vanguard showing how stocks look excluding the 10 best and 10 worst trading days over 5, 10 and 15 years:

Wouldn’t it be great to earn just the top half of those returns in the column on the left and miss out on all of the gains?

One more anecdote, this one from John Bogle:

From 1926 to 2006, the S&P 500 rose from 17 to 1,540. Take away the best 40 days and the return drops by 70% to 276. Take away the worst 40 days, and the S&P would have been at 11,235 or seven times higher.

You can see why certain investors would like to try to jump in and out of the market.

The reality is that no one can do this on a consistent basis. You have to not only be right about the direction of the market, but also the timing of the move in the market.

Another problem with the statistics provided in these graphs is the fact that most of the time the biggest gains and losses are clustered together in the same weeks and months. Trying to go all in or all out can leave you whipsawed back and forth, up and down. Good luck with that.

DON’T MAKE WHOLESALE CHANGES

If you are really that worried about missing out on huge gains or huge losses, try letting your exposure to stocks drift up or down by 10% or so from your target weights. There’s a big difference between risk management and market timing.

I’d rather have you stick to your plan, but this is much better than making wholesale shifts. Just don’t try to call the top and bottom of the market on a consistent basis.

You can’t do it. I can’t do it. If someone can do it, they won’t let you in on their secret.

If you’ve done this in the past and it’s worked, good for you. You dodged a bullet. If you are on the wrong side of a market timing decision, learn from your mistakes and stick to an approach that’s based on a disciplined rules-based process that considers your risk tolerance and time horizon, not how you feel about the market at any particular time.

I always like to hear Warren Buffett’s common sense wisdom on subjects such as these. He has always done a great job of taking complex issues and making them easy to understand. I will leave you with his take on market timing:

Since the basic game is so favorable, Charlie and I believe it’s a terrible mistake to try to dance in and out of it based upon the turn of tarot cards, the predictions of “experts,” or the ebb and flow of business activity. The risks of being out of the game are huge compared to the risks of being in it.

Sources:

Vanguard

The Little Book of Market Myths

Don’t Count On it

Where Have All the Cowboys Gone? (The Reformed Broker)

Thanks for the link to my post which is how I came to visit your excellent blog. This is my first visit but not my last, excellent content!

Thanks Roger! I appreciate you stopping by. I just came across your blog recently and have really been enjoying your content as well. Nice to find another blogger from the midwest.

[…] timing might not be perfect on my rebalancing, but timing the market is not the point. You’ll never get a surefire signal that now is the time to switch from one […]

[…] lucrative as long as you don’t make common mistakes like buying high and selling low, trying to time the market, chasing the hottest performing investment or changing your investment plan because you’re […]